PNC Bank 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

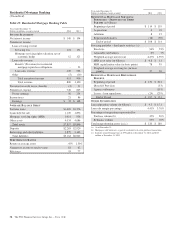

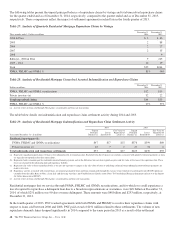

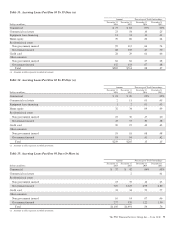

The following tables present the unpaid principal balance of repurchase claims by vintage and total unresolved repurchase claims

for the quarter ended and as of December 31, 2014, respectively, compared to the quarter ended and as of December 31, 2013,

respectively. These comparisons reflect the impact of settlement agreements reached late in the fourth quarter of 2013.

Table 27: Analysis of Quarterly Residential Mortgage Repurchase Claims by Vintage

Three months ended – Dollars in millions

December 31

2014

December 31

2013

2004 & Prior $3 $66

2005 288

2006 227

2007 235

2008 9

Subtotal – 2008 & Prior 9 225

2009 – 2014 16 19

Total $25 $244

FNMA, FHLMC and GNMA % 81% 96%

Table 28: Analysis of Residential Mortgage Unresolved Asserted Indemnification and Repurchase Claims

Dollars in millions

December 31

2014

December 31

2013

FNMA, FHLMC and GNMA securitizations $12 $13

Private investors (a) 32 22

Total unresolved claims $44 $35

FNMA, FHLMC and GNMA % 27% 37%

(a) Activity relates to loans sold through Non-Agency securitization and loan sale transactions.

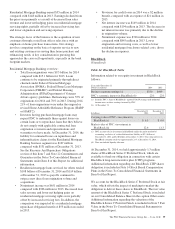

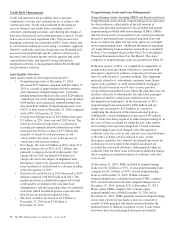

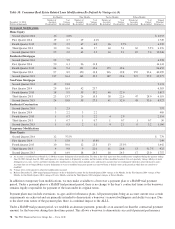

The table below details our indemnification and repurchase claim settlement activity during 2014 and 2013.

Table 29: Analysis of Residential Mortgage Indemnification and Repurchase Claim Settlement Activity

2014 2013

Year ended December 31 – In millions

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Unpaid

Principal

Balance (a)

Losses

Incurred (b)

Fair Value of

Repurchased

Loans (c)

Residential mortgages (d):

FNMA, FHLMC and GNMA securitizations $47 $17 $15 $378 $399 $89

Private investors (e) 10 7 2 47 31 6

Total indemnification and repurchase settlements $57 $24 $17 $425 $430 $95

(a) Represents unpaid principal balance of loans at the indemnification or repurchase date. Excluded from these balances are amounts associated with pooled settlement payments as loans

are typically not repurchased in these transactions.

(b) Represents both i) amounts paid for indemnification/settlement payments and ii) the difference between loan repurchase price and fair value of the loan at the repurchase date. These

losses are charged to the indemnification and repurchase liability.

(c) Represents fair value of loans repurchased only as we have no exposure to changes in the fair value of loans or underlying collateral when indemnification/settlement payments are

made to investors.

(d) Repurchase activity associated with insured loans, government-guaranteed loans and loans repurchased through the exercise of our removal of account provision (ROAP) option are

excluded from this table. Refer to Note 2 Loan Sale and Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements in Item 8 of this Report

for further discussion of ROAPs.

(e) Activity relates to loans sold through Non-Agency securitizations and loan sale transactions.

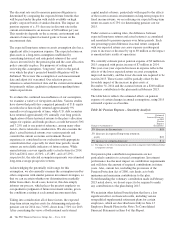

Residential mortgages that we service through FNMA, FHLMC and GNMA securitizations, and for which we could experience a

loss if required to repurchase a delinquent loan due to a breach in representations or warranties, were $49 billion at December 31,

2014, of which $251 million was 90 days or more delinquent. These amounts were $48 billion and $253 million, respectively, at

December 31, 2013.

In the fourth quarter of 2013, PNC reached agreements with both FNMA and FHLMC to resolve their repurchase claims with

respect to loans sold between 2000 and 2008. PNC paid a total of $191 million related to these settlements. The volume of new

repurchase demand claims dropped significantly in 2014 compared to the same period in 2013 as a result of the settlement

68 The PNC Financial Services Group, Inc. – Form 10-K