PNC Bank 2014 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

prior to recovery of its amortized cost basis. In this situation,

the amount of loss recognized in income is equal to the

difference between the fair value and the amortized cost basis

of the security. Even if we do not expect to sell the security,

we must evaluate the expected cash flows to be received to

determine if we believe a credit loss has occurred. In the event

of a credit loss, only the amount of impairment associated

with the credit loss is recognized in income. The portion of the

unrealized loss relating to other factors, such as liquidity

conditions in the market or changes in market interest rates, is

recorded in accumulated other comprehensive income (loss).

The security-level assessment is performed on each security,

regardless of the classification of the security as available for

sale or held to maturity. Our assessment considers the security

structure, recent security collateral performance metrics if

applicable, external credit ratings, failure of the issuer to make

scheduled interest or principal payments, our judgment and

expectations of future performance, and relevant independent

industry research, analysis and forecasts. Results of the

periodic assessment are reviewed by a cross-functional senior

management team representing Asset & Liability

Management, Finance, and Market Risk Management. The

senior management team considers the results of the

assessments, as well as other factors, in determining whether

the impairment is other-than-temporary.

Substantially all of the credit impairment we have recognized

relates to non-agency residential mortgage-backed securities and

asset-backed securities collateralized by first-lien and second-

lien non-agency residential mortgage loans. Potential credit

losses on these securities are evaluated on a security-by-security

basis. Collateral performance assumptions are developed for

each security after reviewing collateral composition and

collateral performance statistics. This includes analyzing recent

delinquency roll rates, loss severities, voluntary prepayments

and various other collateral and performance metrics. This

information is then combined with general expectations on the

housing market, employment and other macroeconomic factors

to develop estimates of future performance.

Security level assumptions for prepayments, loan defaults and

loss given default are applied to each non-agency residential

mortgage-backed security and asset-backed security

collateralized by first-lien and second-lien non-agency residential

mortgage loans using a third-party cash flow model. The third-

party cash flow model then generates projected cash flows

according to the structure of each security. Based on the results of

the cash flow analysis, we determine whether we expect that we

will recover the amortized cost basis of our security.

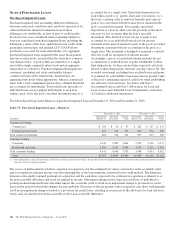

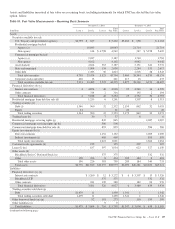

The following table provides detail on the significant assumptions

used to determine credit impairment for non-agency residential

mortgage-backed and asset-backed securities collateralized by

first-lien and second-lien non-agency residential mortgage loans.

Table 77: Credit Impairment Assessment Assumptions –

Non-Agency Residential Mortgage-Backed and Asset-

Backed Securities

December 31, 2014 Range

Weighted-

average (a)

Long-term prepayment rate (annual CPR)

Prime 7 – 20% 13%

Alt-A 5 – 12 6

Option ARM 3 – 6 3

Remaining collateral expected to default

Prime 0 – 32% 13%

Alt-A 6 – 50 27

Option ARM 11 –53 36

Loss severity

Prime 20 – 70% 41%

Alt-A 30 – 83 60

Option ARM 45 – 71 62

(a) Calculated by weighting the relevant assumption for each individual security by the

current outstanding cost basis of the security.

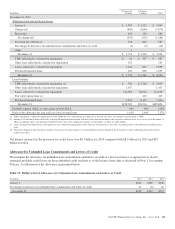

The following table presents a rollforward of the cumulative

OTTI credit losses recognized in earnings for all debt

securities for which a portion of an OTTI loss was recognized

in Accumulated other comprehensive income (loss).

Table 78: Rollforward of Cumulative OTTI Credit Losses

Recognized in Earnings

Year ended December 31

In millions 2014 2013

Balance at beginning of period $(1,160) $(1,201)

Loss where impairment was not previously

recognized (6)

Additional loss where credit impairment was

previously recognized (5) (16)

Reduction due to credit impaired securities

sold or matured 7 57

Balance at end of period $(1,164) $(1,160)

The PNC Financial Services Group, Inc. – Form 10-K 149