PNC Bank 2014 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

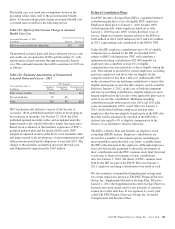

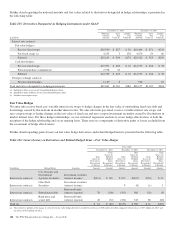

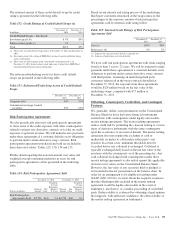

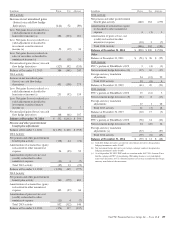

The notional amount of these credit default swaps by credit

rating is presented in the following table:

Table 132: Credit Ratings of Credit Default Swaps (a)

In millions

December 31,

2014

December 31,

2013

Credit Default Swaps – Purchased

Investment grade (b) $ 95 $95

Subinvestment grade (c) 15

Total $110 $95

(a) There were no credit default swaps sold as of December 31, 2014 and December 31,

2013.

(b) Investment grade with a rating of BBB-/Baa3 or above based on published rating

agency information.

(c) There were no subinvestment grade credit default swaps purchased as of

December 31, 2013. Subinvestment grade represents a rating below BBB-/Baa3

based on published rating agency information.

The referenced/underlying assets for these credit default

swaps are presented in the following table:

Table 133: Referenced/Underlying Assets of Credit Default

Swaps

December 31,

2014

December 31,

2013

Corporate debt 45% 37%

Commercial mortgage-backed

securities 55% 63%

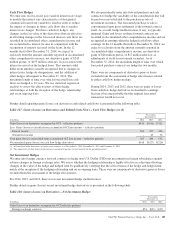

Risk Participation Agreements

We also periodically enter into risk participation agreements

to share some of the credit exposure with other counterparties

related to interest rate derivative contracts or to take on credit

exposure to generate revenue. We will make/receive payments

under these agreements if a customer defaults on its obligation

to perform under certain derivative swap contracts. Risk

participation agreements purchased and sold are included in

these derivative tables: Tables 129, 130, 134 and 135.

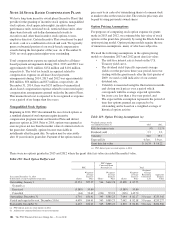

Further detail regarding the notional amount, fair value and

weighted-average remaining maturities in years for risk

participation agreements sold is presented in the following

table:

Table 134: Risk Participation Agreements Sold

December 31, 2014 December 31, 2013

Dollars in millions

Notional

Amount

Fair

Value

Weighted-

Average

Remaining

Maturity

In Years

Notional

Amount

Fair

Value

Weighted-

Average

Remaining

Maturity

In Years

Risk Participation

Agreements Sold $2,796 $(4) 5.4 $2,770 $(4) 6.1

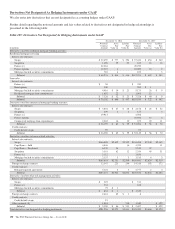

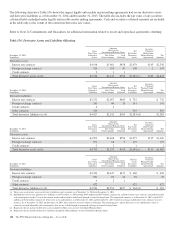

Based on our internal risk rating process of the underlying

third party customers referenced in the swap contracts, the

percentages of the exposure amount of risk participation

agreements sold by internal credit rating follow:

Table 135: Internal Credit Ratings of Risk Participation

Agreements Sold

December 31,

2014

December 31,

2013

Pass (a) 100% 98%

Below pass (b) 0% 2%

(a) Indicates the expected risk of default is currently low.

(b) Indicates a higher degree of risk of default.

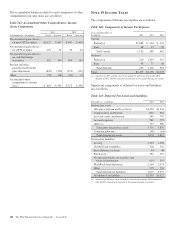

We have sold risk participation agreements with terms ranging

from less than 1 year to 22 years. We will be required to make

payments under these agreements if a customer defaults on its

obligation to perform under certain derivative swap contracts

with third parties. Assuming all underlying third party

customers referenced in the swap contracts defaulted at

December 31, 2014, the exposure from these agreements

would be $124 million based on the fair value of the

underlying swaps, compared with $77 million at

December 31, 2013.

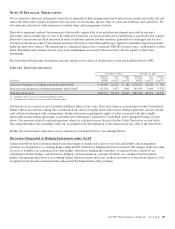

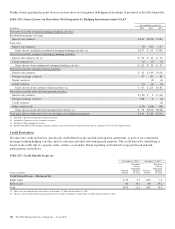

Offsetting, Counterparty Credit Risk, and Contingent

Features

We, generally, utilize a net presentation on the Consolidated

Balance Sheet for those derivative financial instruments

entered into with counterparties under legally enforceable

master netting agreements. The master netting agreements

reduce credit risk by permitting the closeout netting of various

types of derivative instruments with the same counterparty

upon the occurrence of an event of default. The master netting

agreement also may require the exchange of cash or

marketable securities to collateralize either party’s net

position. In certain cases, minimum thresholds must be

exceeded before any collateral is exchanged. Collateral is

typically exchanged daily based on the net fair value of the

positions with the counterparty as of the preceding day. Any

cash collateral exchanged with counterparties under these

master netting agreements is also netted against the applicable

derivative fair values on the Consolidated Balance Sheet.

However, the fair value of any securities held or pledged is

not included in the net presentation on the balance sheet. In

order for an arrangement to be eligible for netting under

GAAP (ASC 210-20), we must obtain the requisite assurance

that the offsetting rights included in the master netting

agreement would be legally enforceable in the event of

bankruptcy, insolvency, or a similar proceeding of such third

party. Enforceability is evidenced by obtaining a legal opinion

that supports, with sufficient confidence, the enforceability of

the master netting agreement in bankruptcy.

The PNC Financial Services Group, Inc. – Form 10-K 193