PNC Bank 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

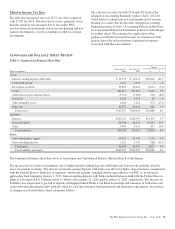

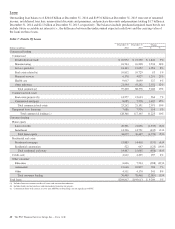

Average interest-earning deposits with banks, which are

primarily maintained with the Federal Reserve Bank,

increased significantly in the comparison to the prior year

period as we continued to enhance our liquidity position.

Average noninterest-earning assets decreased in 2014

compared with 2013, primarily reflecting lower unsettled

securities sales, partially offset by higher investment securities

valuation adjustments, both of which are included in

noninterest-earning assets for average balance sheet purposes.

Average total deposits increased $10.8 billion in 2014

compared with the prior year, driven by an increase of $12.1

billion in average transaction deposits, which grew to $189

billion in 2014. Higher average money market deposits,

average noninterest-bearing deposits, and average interest-

bearing demand deposits drove the increase in both

commercial and consumer average transaction deposits. These

increases were partially offset by a decrease of $2.6 billion in

average retail certificates of deposit attributable to runoff of

maturing accounts. Total deposits at December 31, 2014 were

$232.2 billion compared with $220.9 billion at December 31,

2013 and are further discussed within the Consolidated

Balance Sheet Review section of this Item 7.

Average total deposits represented 68% of average total assets

for 2014 and 69% for 2013.

Average borrowed funds increased in 2014 compared with

2013 primarily due to increases in average Federal Home

Loan Bank (FHLB) borrowings, average bank notes and

senior debt, and average subordinated debt, in part to enhance

our liquidity position. These increases were partially offset by

a decline in average commercial paper. Total borrowed funds

at December 31, 2014 were $56.8 billion compared with $46.1

billion at December 31, 2013 and are further discussed within

the Consolidated Balance Sheet Review section of this Item 7.

The Liquidity Risk Management portion of the Risk

Management section of this Item 7 includes additional

information regarding our borrowed funds.

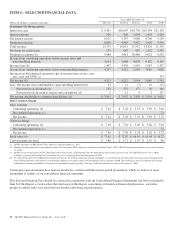

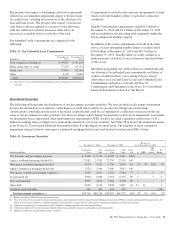

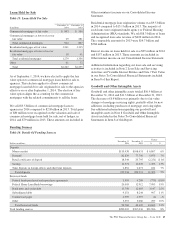

Business Segment Highlights

Total business segment earnings were $3.9 billion in 2014 and $4.0 billion in 2013. The Business Segments Review section of this

Item 7 includes further analysis of our business segment results during 2014 and 2013, including presentation differences from

Note 24 Segment Reporting in our Notes To Consolidated Financial Statements in Item 8 of this Report. Note 24 Segment

Reporting presents results of businesses for 2014, 2013 and 2012.

We provide a reconciliation of total business segment earnings to PNC total consolidated net income as reported on a GAAP basis

in Note 24 Segment Reporting in our Notes To Consolidated Financial Statements in Item 8 of this Report.

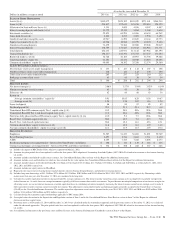

Table 3: Results Of Businesses – Summary

(Unaudited)

Year ended December 31 Net Income (a) Revenue Average Assets (a) (b)

In millions 2014 2013 2014 2013 2014 2013

Retail Banking $ 728 $ 550 $ 6,049 $ 6,100 $ 75,046 $ 74,971

Corporate & Institutional Banking 2,106 2,264 5,476 5,506 122,927 112,970

Asset Management Group 181 162 1,107 1,040 7,745 7,366

Residential Mortgage Banking 35 148 800 1,100 7,857 9,896

BlackRock 530 469 703 621 6,640 6,272

Non-Strategic Assets Portfolio 367 379 587 742 8,338 9,987

Total business segments 3,947 3,972 14,722 15,109 228,553 221,462

Other (c) (d) (e) 260 240 653 903 99,300 84,202

Total $4,207 $4,212 $15,375 $16,012 $327,853 $305,664

(a) Amounts for 2013 period have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits.

(b) Period-end balances for BlackRock.

(c) “Other” average assets include investment securities associated with asset and liability management activities.

(d) “Other” includes differences between the total business segment financial results and our total consolidated net income. Additional detail is included in Note 24 Segment Reporting in

the Notes To Consolidated Financial Statements in Item 8 of this Report.

(e) Net income for “Other” in 2014 increased slightly compared to 2013 as lower noninterest expense due to a reduction in benefits costs was mostly offset by lower interest income from

investment securities.

36 The PNC Financial Services Group, Inc. – Form 10-K