PNC Bank 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The PNC Financial Services Group

2014 Annual Report

Delivering a Superior

Banking Experience

for Every Customer

Market Leadership Sophisticated Capabilities Experience & AccountabilityInnovative Products

Table of contents

-

Page 1

Delivering a Superior Banking Experience for Every Customer Innovative Products Sophisticated Capabilities Market Leadership Experience & Accountability The PNC Financial Services Group 2014 Annual Report -

Page 2

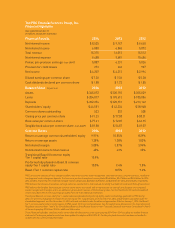

... per common share Book value per common share Tangible book value per common share $ 59.88 Selected Ratios Return on average common shareholders' equity Return on average assets Net interest margin Noninterest income to total revenue Transitional Basel III common equity Tier 1 capital ratio Pro... -

Page 3

... reported net income of $4.2 billion, or $7.30 per diluted common share. Our return on average assets was 1.28 percent. We added customers, grew loans by $9.2 billion and increased deposits by $11.3 billion. Additionally, we reduced expenses by nearly $200 million, strengthened our capital position... -

Page 4

... are at the heart of our business model. By and large, we live and work where our customers live and work. We understand their ï¬nancial goals. Whether they are saving for retirement, looking to buy a new home, building a small business or growing a large company, we are there to help. When... -

Page 5

...' pension funds. PNC has been in the asset management business for a long time, and we have established our company as one of the largest bank asset managers in the United States. In recent years, we have worked to make investing and retirement a part of every client conversation, and our employees... -

Page 6

...by customers' evolving preferences; year over year we continue to see signiï¬cant increases in the number of nonbranch transactions we process and the number of customers who want to bank primarily through digital channels. PNC's new branch model integrates enhanced technologies, from deposit-ready... -

Page 7

... and apply for home lending products, track the status of their applications throughout the origination process, and manage their accounts across digital platforms. These new tools are part of a longterm plan to improve the ease and convenience of home buying. PNC's mortgage origination volume was... -

Page 8

... time, across every channel. To that end, in 2014 we named PNC Executive Vice President and Chief Marketing Ofï¬cer Karen Larrimer to serve as the company's ï¬rst Chief Customer Ofï¬cer and to lead PNC's new Ofï¬ce of the Customer. Under Karen's leadership, the Ofï¬ce of the Customer is working... -

Page 9

... tower when it opens in the fall of 2015. And our net-zero-energy branch in southern Florida achieved LEED Platinum certiï¬cation. Additionally, as you can read in our 2014 Corporate Responsibility Report, available at PNC.com, our businesses implemented a number of important changes to make health... -

Page 10

... customers and non-teller deposit transactions, see Item 5 and the Retail Banking section of Item 7, respectively, of the accompanying 2014 Annual Report on Form 10-K. And for additional information on PNC's tangible book value and fee income, see the inside front cover that precedes this letter... -

Page 11

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2014 Commission file number 001-09718 FORM 10-K THE PNC FINANCIAL SERVICES GROUP, INC. (Exact name of ... -

Page 12

...Fair Value Measurements Business Segments Review Critical Accounting Estimates And Judgments Status Of Qualified Defined Benefit Pension Plan Recourse And Repurchase Obligations Risk Management 2013 Versus 2012 Glossary Of Terms Cautionary Statement Regarding Forward-Looking Information Item 7A Item... -

Page 13

... Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services. Exhibits, Financial Statement... -

Page 14

... Loans Net Unfunded Loan Commitments Investment Securities Loans Held For Sale Details Of Funding Sources Shareholders' Equity Basel III Capital Fair Value Measurements - Summary Retail Banking Table Corporate & Institutional Banking Table Asset Management Group Table Residential Mortgage Banking... -

Page 15

... Interest Income Sensitivity to Alternative Rate Scenarios (Fourth Quarter 2014) Alternate Interest Rate Scenarios: One Year Forward Enterprise-Wide Gains/Losses Versus Value-at-Risk Customer-Related Trading Revenue Equity Investments Summary Financial Derivatives Summary 79 80 81 87 88 88 89 90 90... -

Page 16

... Activities Principal Balance, Delinquent Loans, and Net Charge-offs Related to Serviced Loans Consolidated VIEs - Carrying Value Non-Consolidated VIEs Analysis of Loan Portfolio Nonperforming Assets Commercial Lending Asset Quality Indicators Home Equity and Residential Real Estate Balances Home... -

Page 17

... Trust Securities Reconciliation of Changes in Projected Benefit Obligation and Change in Plan Assets Asset Strategy Allocations Pension Plan Assets - Fair Value Hierarchy Rollforward of Pension Plan Level 3 Assets Estimated Cash Flows Components of Net Periodic Benefit Cost Net Periodic Costs... -

Page 18

... and Effective Tax Rates Net Operating Loss Carryforwards and Tax Credit Carryforwards Change in Unrecognized Tax Benefits Basel Regulatory Capital Credit Commitments Internal Credit Ratings Related to Net Outstanding Standby Letters of Credit Analysis of Commercial Mortgage Recourse Obligations... -

Page 19

... cash and investment management, receivables management, disbursement services, funds transfer services, information reporting and global trade services. Capital markets-related products and services include foreign exchange, derivatives, securities, loan syndications, mergers and acquisitions... -

Page 20

... its business is available in its filings with the Securities and Exchange Commission (SEC). Non-Strategic Assets Portfolio includes a consumer portfolio of mainly residential mortgage and brokered home equity loans and lines of credit and a small commercial/commercial real estate loan and lease... -

Page 21

... For Loan And Lease Losses Average Amount And Average Rate Paid On Deposits Time Deposits Of $100,000 Or More Selected Consolidated Financial Data Short-term borrowings - not included as average balances during 2014, 2013, and 2012 were less than 30% of total shareholders' equity at the end of... -

Page 22

... of trust preferred securities as Tier 1 regulatory capital; required that deposit insurance assessments be calculated based on an insured depository institution's assets rather than its insured deposits; raised the minimum Designated Reserve Ratio (the balance in the Deposit Insurance Fund divided... -

Page 23

... both available for sale securities and pension and other post-retirement plans as a component of common equity Tier 1 capital. The Basel III capital rule became effective on January 1, 2014 for PNC and PNC Bank, although many provisions are phased-in over a period of years, with the rules generally... -

Page 24

... common equity Tier 1 capital and Basel I Tier 1 common capital, see the Capital section of the Consolidated Balance Sheet Review section of Item 7 of this Report. Under the regulatory capital rules, a banking organization's risk-based capital ratios are calculated by allocating assets and specified... -

Page 25

...to a variety of enforcement remedies available to the federal bank regulatory agencies, including a limitation on the ability to pay dividends or repurchase shares, the issuance of a capital directive to increase capital and, in severe cases, the termination of deposit insurance by the FDIC, and the... -

Page 26

... the Capital portion of the Consolidated Balance Sheet Review section and the Liquidity Risk Management portion of the Risk Management section of Item 7 of this Report. The NSFR is designed to promote a stable maturity structure of assets and liabilities of banking organizations over a oneyear time... -

Page 27

... expects capital plans submitted in 2015 to reflect conservative dividend payout ratios and net share repurchase programs, and that requests that imply common dividend payout ratios above 30% of projected after-tax net income available to common shareholders will receive particularly close scrutiny... -

Page 28

... agencies possess broad powers to take corrective action as deemed appropriate for an insured depository institution and its holding company. Laws and regulations limit the scope of our permitted activities and investments. National banks (such as PNC Bank) and their operating subsidiaries generally... -

Page 29

...CFPB authority to examine PNC and PNC Bank for compliance with a broad range of federal consumer financial laws and regulations, including the laws and regulations that relate to credit card, deposit, mortgage, automobile loans and other consumer financial products and services we offer. In addition... -

Page 30

... registered investment companies. Certain of these advisers are registered as investment advisers to private equity funds under rules adopted under Dodd-Frank. Broker-dealer subsidiaries are subject to the requirements of the Securities Exchange Act of 1934 and related regulations. The Financial... -

Page 31

...PNC Bank competes for deposits with: • Other commercial banks, • Savings banks, • Savings and loan associations, • Credit unions, • Treasury management service companies, • Insurance companies, and • Issuers of commercial paper and other securities, including mutual funds. SEC Reports... -

Page 32

...its products and services are available on the internet at www.pnc.com. We provide information for investors on our corporate website under "About Us - Investor Relations," such as Investor Events, SEC Filings, Financial Information (including Quarterly Earnings, Annual Reports, Proxy Statements and... -

Page 33

... to customers, purchasing securities, and entering into financial derivative transactions and certain guarantee contracts. Credit risk is one of our most significant risks, particularly given the high percentage of our assets represented directly or indirectly by loans and the importance of lending... -

Page 34

..., our cost of funding. We cannot predict the nature or timing of future changes in monetary, tax and other policies or the effects that they may have on our activities and financial results. The current very low interest rate environment has had a negative impact on our ability to increase our net... -

Page 35

..., customers may be less willing to maintain balances in noninterest bearing or low interest bank accounts, which could result in a loss of deposits or a relatively higher cost of funds to PNC. This could also result in a loss of fee income. In our asset management business, investment performance... -

Page 36

... ordinary course of business and, thus, to some extent, may limit the ability of PNC to most effectively hedge its risks, manage its balance sheet or provide products or services to its customers. • In addition, as of December 31, 2014, PNC held interests in private equity and hedge funds that are -

Page 37

... participants (including PNC) adjust to the new rules. On the indirect impact side, PNC originates loans of a variety of types, including residential and commercial mortgages, credit card, auto, and student, that historically have commonly been securitized, and PNC is also a significant servicer... -

Page 38

...'s new liquidity risk management requirements for bank holding companies with $50 billion or more in consolidated total assets (like PNC) also became effective on January 1, 2015. The new rules require covered BHCs to, among other things, conduct internal liquidity stress tests over a range of time... -

Page 39

banking agencies have been taking into account expectations regarding the ability of banks to meet these new requirements, including under stressed conditions, in approving actions that represent uses of capital, such as dividend increases, share repurchases and acquisitions. Moreover, PNC, as a BHC... -

Page 40

... on customers' card accounts, as well as for other costs related to data security compromise events, such as replacing cards associated with compromised card accounts. In addition, PNC provides card transaction processing services to some merchant customers under agreements we have with payment... -

Page 41

... in our business. PNC relies on quantitative models to measure risks and to estimate certain financial values. Models may be used in such processes as determining the pricing of various products, grading loans and extending credit, measuring interest rate and other market risks, predicting losses... -

Page 42

.... Investors in mortgage loans and 24 The PNC Financial Services Group, Inc. - Form 10-K other assets that we sell are more likely to seek indemnification from us against losses or otherwise seek to have us share in such losses. The CFPB has issued new rules for mortgage origination and mortgage... -

Page 43

... of an acquisition or otherwise, could impact the timing or realization of anticipated benefits to PNC. Note 21 Legal Proceedings in the Notes To Consolidated Financial Statements in Item 8 of this Report describes several legal proceedings related to preacquisition activities of companies we have... -

Page 44

... Hall ITEM 2 - PROPERTIES Our executive and primary administrative offices are currently located at One PNC Plaza, Pittsburgh, Pennsylvania. The 30story structure is owned by PNC Bank, National Association. We own or lease numerous other premises for use in conducting business activities, including... -

Page 45

... to PNC's retail and small business customers, directed branch banking, business banking, community development and PNC Investments. Michael J. Hannon has served as Executive Vice President since February 2009, prior to which he served as Senior Vice President. He has served as Chief Credit Officer... -

Page 46

...Corp. (real estate development company) (2014) • William S. Demchak, 52, Chairman, Chief Executive Officer and President of PNC (2013) • Andrew T. Feldstein, 50, Chief Executive Officer and Co-Chief Investment Officer of BlueMountain Capital Management, LLC (asset management firm) (2013) • Kay... -

Page 47

...Notes To Consolidated Financial Statements in Item 8 of this Report include additional information regarding our employee benefit and equity compensation plans that use PNC common stock. (b) On October 4, 2007, our Board of Directors authorized the repurchase of up to 25 million shares of PNC common... -

Page 48

... reflect the first quarter 2014 adoption of Accounting Standards Update (ASU) 2014-01 related to investments in low income housing tax credits. (c) Includes results of operations for PNC Global Investment Servicing Inc. (GIS) through June 30, 2010 and the related after-tax gain on sale. We sold GIS... -

Page 49

... SELECTED RATIOS Net interest margin (i) Noninterest income to total revenue Efficiency (b) Return on Average common shareholders' equity (b) Average assets (b) Loans to deposits Dividend payout (b) Transitional Basel III common equity Tier 1 capital ratio (j) (k) Transitional Basel III Tier 1 risk... -

Page 50

... net of dividend payments and share repurchases. PNC has increased its liquidity positions at both PNC and PNC Bank, National Association (PNC Bank). For more detail, see the Capital and Liquidity Actions portion of this Executive Summary, the Capital portion of the Consolidated Balance Sheet Review... -

Page 51

... Item 7. • Net interest income of $8.5 billion for 2014 decreased 7% compared with 2013, as lower yields on loans and investment securities, a decline in investment securities balances and a reduction in purchase accounting accretion were partially offset by commercial and commercial real estate... -

Page 52

... month end. The estimated pro forma ratio at December 31, 2014 exceeded 100% and 95% for PNC and PNC Bank, respectively. PNC's well-positioned balance sheet remained core funded with a loans to deposits ratio of 88% at December 31, 2014. The Transitional Basel III common equity Tier 1 capital ratio... -

Page 53

...largely driven by purchases to enhance our liquidity position. Total investment securities comprised 20% of average interest-earning assets in 2014 and 22% in 2013. Average loans grew in 2014, driven by increases in average commercial loans of $6.4 billion and average commercial real estate loans of... -

Page 54

... To Consolidated Financial Statements in Item 8 of this Report. Table 3: Results Of Businesses - Summary (Unaudited) Year ended December 31 In millions Net Income (a) 2014 2013 Revenue 2014 2013 Average Assets (a) (b) 2014 2013 Retail Banking Corporate & Institutional Banking Asset Management Group... -

Page 55

...compared with 2013 reflecting the ongoing low rate environment. Lower yields on loans and investment securities, a decline in investment securities balances and a reduction in purchase accounting accretion were partially offset by commercial and commercial real estate loan growth. Lower net interest... -

Page 56

... Risk Management - Equity And Other Investment Risk section, and further details regarding gains or losses related to our equity investment in BlackRock are included in the Business Segments Review section of this Item 7. 38 The PNC Financial Services Group, Inc. - Form 10-K In the first quarter... -

Page 57

... these investments. CONSOLIDATED BALANCE SHEET REVIEW Table 6: Summarized Balance Sheet Data December 31 2014 December 31 2013 Change $ % Dollars in millions Assets Interest-earning deposits with banks Loans held for sale Investment securities Loans Allowance for loan and lease losses Goodwill... -

Page 58

... estate related (a) Financial services Health care Other industries Total commercial Commercial real estate Real estate projects (b) Commercial mortgage Total commercial real estate Equipment lease financing Total commercial lending (c) Consumer lending Home equity Lines of credit Installment Total... -

Page 59

... the Risk Management section of this Item 7 and Note 1 Accounting Policies, Note 3 Asset Quality and Note 5 Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit in our Notes To Consolidated Financial Statements included in Item 8 of this Report. (a) Approximately... -

Page 60

... and commercial real estate loans: Outstanding balance (a) Recorded investment Allowance for loan losses Net investment/Carrying value Consumer and residential mortgage loans: Outstanding balance (a) Recorded investment Allowance for loan losses Net investment/Carrying value Total purchased impaired... -

Page 61

...of this Report. Total commercial lending (a) Home equity lines of credit Credit card Other Total $ 99,837 17,839 17,833 4,178 $139,687 $ 90,104 18,754 16,746 4,266 $129,870 (a) Less than 5% of net unfunded loan commitments relate to commercial real estate at each date. Investment Securities The... -

Page 62

.... Securities classified as available for sale are carried at fair value with net unrealized gains and losses, representing the difference between amortized cost and fair value, included in Shareholders' equity as Accumulated other comprehensive income or loss, net of tax, on our Consolidated Balance... -

Page 63

...Notes To Consolidated Financial Statements in Item 8 of this Report. Funding Sources Table 16: Details Of Funding Sources December 31 2014 December 31 2013 Change $ % Dollars in millions Deposits Money market Demand Retail certificates of deposit Savings Time deposits in foreign offices and other... -

Page 64

... Home Loan Bank borrowings and issuances of bank notes and senior debt and subordinated debt were partially offset by a decline in federal funds purchased and repurchase agreements. Capital Table 17: Shareholders' Equity Dollars in millions December 31 2014 December 31 2013 Change $ % Shareholders... -

Page 65

... and lease losses of up to 1.25% of credit risk related risk-weighted assets and dividing by estimated Basel III standardized approach risk-weighted assets. (n) Leverage ratio is calculated based on Tier 1 capital divided by Average quarterly adjusted total assets. The PNC Financial Services Group... -

Page 66

... related to securities currently and previously held as available for sale, as well as pension and other postretirement plans, whereas under Basel III these items are a component of PNC's capital. The Basel III final rules also eliminate the Tier 1 treatment of trust preferred securities for bank... -

Page 67

... Exchange Agreement with PNC Preferred Funding Trust II. See Note 12 Capital Securities of a Subsidiary Trust and Perpetual Trust Securities in the Notes To Consolidated Financial Statements in Item 8 of this Report for additional information on contractual limitations on dividend payments resulting... -

Page 68

...Note 7 Fair Value in the Notes To Consolidated Financial Statements in Item 8 of this Report. BUSINESS SEGMENTS REVIEW We have six reportable business segments: • Retail Banking • Corporate & Institutional Banking • Asset Management Group • Residential Mortgage Banking • BlackRock • Non... -

Page 69

... Income taxes Earnings AVERAGE BALANCE SHEET Loans Consumer Home equity Indirect auto Indirect other Education Credit cards Other Total consumer Commercial and commercial real estate Floor plan Residential mortgage Total loans Goodwill and other intangible assets Other assets Total assets Deposits... -

Page 70

... for credit losses, and increased noninterest income due to strong fee income growth. These increases in earnings were partially offset by lower net interest income driven by lower yields on loans, interest rate spread compression on the value of deposits, and lower purchase accounting accretion... -

Page 71

... than 2013. Increases in technology investments, customer transaction-related costs, and non-credit losses were offset by reduced branch network expenses as a result of transaction migration to lower cost digital and ATM channels. Growing core checking deposits is key to Retail Banking's growth... -

Page 72

...264 Average Loans (by C&IB business) Corporate Banking Real Estate Business Credit Equipment Finance Other Total average loans Total loans (g) Net carrying amount of commercial mortgage servicing rights (g) Credit-related statistics: Nonperforming assets (g) (h) Purchased impaired loans (g) (i) Net... -

Page 73

... 2013. Higher average deposit balances were offset by lower spreads on deposits. Capital markets revenue includes merger and acquisition advisory fees, loan syndications, derivatives, foreign exchange, asset-backed finance revenue, fixed income and equity capital markets advisory activities. Revenue... -

Page 74

... Income taxes Earnings AVERAGE BALANCE SHEET Loans Consumer Commercial and commercial real estate Residential mortgage Total loans Goodwill and other intangible assets Other assets Total assets Deposits Noninterest-bearing demand Interest-bearing demand Money market Total transaction deposits CDs... -

Page 75

... a year ago. Discretionary client assets under management were $135 billion at December 31, 2014 increased $8 billion compared with December 31, 2013. The increase was driven by higher equity markets, new sales, and positive net flows, after adjustments for cyclical client activities. Total revenue... -

Page 76

...) MSR capitalization value (in basis points) Weighted-average servicing fee (in basis points) RESIDENTIAL MORTGAGE REPURCHASE RESERVE Beginning of period (Benefit)/ Provision Agency settlements Losses - loan repurchases End of Period OTHER INFORMATION Loan origination volume (in billions) Loan sale... -

Page 77

... loan sales revenue and lower net hedging gains on residential mortgage servicing rights, partially offset by increased servicing fees and lower origination and servicing expenses. The strategic focus of the business is the acquisition of new customers through a retail loan officer sales force... -

Page 78

... earnings Income taxes Earnings AVERAGE BALANCE SHEET Commercial Lending: Commercial/Commercial real estate Lease financing Total commercial lending Consumer Lending: Home equity Residential real estate Total consumer lending Total portfolio loans Other assets (a) Total assets Deposits and other... -

Page 79

... Letters of Credit in the Notes To Consolidated Financial Statements and Allocation of Allowance for Loan and Lease Losses in the Statistical Information (Unaudited) section of Item 8 of this Report. The PNC Financial Services Group, Inc. - Form 10-K 61 Fair Value Measurements We must use estimates... -

Page 80

...in expected cash flows could increase future earnings volatility. See Note 1 Accounting Policies, Note 4 Purchased Loans, and Note 5 Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit in the Notes To Consolidated Financial Statements in Item 8 of this Report for... -

Page 81

... information. future. Residual values are reviewed for impairment at least annually. Revenue Recognition We earn net interest and noninterest income from various sources, including: • Lending, • Securities portfolio, • Asset management, • Customer deposits, • Loan sales and servicing... -

Page 82

... impairment, the commercial MSRs were stratified based on asset type, which characterizes the predominant risk of the underlying financial asset. PNC employs risk management strategies designed to protect the value of MSRs from changes in interest rates and related market factors. The values of the... -

Page 83

... Benefit Plans in the Notes To Consolidated Financial Statements in Item 8 of this Report. We calculate the expense associated with the pension plan and the assumptions and methods that we use include a policy of reflecting plan assets at their fair market value. On an annual basis, we review... -

Page 84

..., the expected long-term return on plan assets for determining net periodic pension cost for 2014 was 7.00%, down from 7.50% for 2013. After considering the views of both internal and external 66 The PNC Financial Services Group, Inc. - Form 10-K capital market advisors, particularly with regard to... -

Page 85

RECOURSE AND REPURCHASE OBLIGATIONS As discussed in Note 2 Loan Sale and Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements in Item 8 of this Report, PNC has sold commercial mortgage, residential mortgage and home equity loans directly or indirectly... -

Page 86

...Refer to Note 2 Loan Sale and Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements in Item 8 of this Report for further discussion of ROAPs. (e) Activity relates to loans sold through Non-Agency securitizations and loan sale transactions. Residential... -

Page 87

...home equity loans/lines of credit that were sold to a limited number of private investors in the financial services industry by National City prior to our acquisition of National City. PNC is no longer engaged in the brokered home equity lending business, and our exposure under these loan repurchase... -

Page 88

...Appetite and Strategy PNC manages risk in light of our risk appetite to optimize long term shareholder value while supporting our employees, customers, and communities. PNC's risk appetite represents the organization's desired enterprise risk position, set within our capital-based risk and liquidity... -

Page 89

... and the Board of Directors. These policies and procedures are organized in a multi-tiered framework and require periodic review and approval by relevant committees within the governance structure. Business Activities - Our businesses strive to enhance risk management and internal control processes... -

Page 90

... regarding our nonperforming loans and nonaccrual policies is included in Note 1 Accounting Policies in the Notes To Consolidated Financial Statements in Item 8 of this Report. The major categories of nonperforming assets are presented in Table 30. In the first quarter of 2013, we completed our... -

Page 91

...to purchased impaired loans. See Note 1 Accounting Policies and Note 5 Allowances for Loan and Lease Losses and Unfunded Loan Commitments and Letters of Credit in the Notes To Consolidated Financial Statements in Item 8 of this Report for additional information. Table 31: OREO and Foreclosed Assets... -

Page 92

... impaired loans would result in an impairment charge to the provision for credit losses in the period in which the change is deemed probable. Generally increases in the net present value of expected cash flows of purchased impaired loans would 74 The PNC Financial Services Group, Inc. - Form 10... -

Page 93

... Dollars in millions Commercial Commercial real estate Equipment lease financing Home equity Residential real estate Non government insured Government insured Credit card Other consumer Non government insured Government insured Total (a) Amounts in table represent recorded investment. $ 73 23 11... -

Page 94

... quarterly, updated LTVs semi-annually, and other credit metrics at least quarterly, including the historical performance of any mortgage loans regardless of lien position that we do or do not hold. This information is used for internal reporting and risk management. For internal reporting and risk... -

Page 95

... delinquency status of our loan modification programs to assess their effectiveness in serving our customers' needs while mitigating credit losses. Table 37 provides the number of accounts and unpaid principal balance of modified consumer real estate related loans at the end of each year presented... -

Page 96

... after modification. The data in this table represents loan modifications completed during the quarters ending June 30, 2013 through June 30, 2014 and represents a vintage look at all quarterly accounts and the number of those modified accounts (for each quarterly vintage) 60 days or more delinquent... -

Page 97

... the twelve months ended December 31, 2013 was $2.3 billion. Table 39: Summary of Troubled Debt Restructurings (a) In millions December 31 2014 December 31 2013 Consumer lending: Real estate-related Credit card Other consumer Total consumer lending Total commercial lending Total TDRs Nonperforming... -

Page 98

...in a lower ratio of net charge-offs to average loans. See Note 4 Purchased Loans in the Notes To Consolidated Financial Statements in Item 8 of this Report for additional information on net charge-offs related to these loans. We maintain an ALLL to absorb losses from the loan and lease portfolio and... -

Page 99

... To Consolidated Financial Statements in Item 8 of this Report for further information on certain key asset quality indicators that we use to evaluate our portfolios and establish the allowances. Table 41: Allowance for Loan and Lease Losses Dollars in millions 2014 2013 January 1 Total net charge... -

Page 100

...investment balance. Additional allowance is recorded when the net present value of expected cash flows is lower than the recorded investment balance. See Table 30 within this Credit Risk Management section for additional information. The ALLL balance increases or decreases across periods in relation... -

Page 101

... is a very high priority for PNC. The ever changing and complex threat landscape is closely monitored and PNC participates in proactive information sharing with intelligence sources, law enforcement, and the private sector. The cyber security program is based on a continuous improvement strategy by... -

Page 102

... of reporting insurance related activities through the governance structure that allows management to fully vet risk information. Quarterly, an enterprise operational risk report is developed to report key operational risks to senior management and the Board of Directors. The report encompasses key... -

Page 103

..., to estimate certain financial values, and to support or inform certain business decisions. Models may be used in processes such as determining the pricing of various products, grading and granting loans, measuring interest rate risks and other market risks, predicting losses, and assessing capital... -

Page 104

... including market conditions, loan and deposit growth and balance sheet management activities. Of our total liquid assets of $80.2 billion, we had $6.1 billion of securities available for sale and trading securities pledged as collateral to secure public and trust deposits, repurchase agreements and... -

Page 105

On January 16, 2014, PNC Bank established a new bank note program under which it may from time to time offer up to $25 billion aggregate principal amount at any one time outstanding of its unsecured senior and subordinated notes due more than nine months from their date of issue (in the case of ... -

Page 106

... Balance Sheet Review section in this Item 7 and the dividend increase described below. January 1 Issuances Calls and maturities December 31 $12.9 15.7 (8.6) $20.0 The FHLB-Pittsburgh also periodically provides standby letters of credit on behalf of PNC Bank to secure certain public deposits. PNC... -

Page 107

... Notes To Consolidated Financial Statements in Item 8 of this Report. Status of Credit Ratings The cost and availability of short-term and long-term funding, as well as collateral requirements for certain derivative instruments, is influenced by PNC's debt ratings. In general, rating agencies base... -

Page 108

... our Consolidated Balance Sheet, of which $140 million relate to private equity investments. The remaining $793 million of commitments were included in Other liabilities on our Consolidated Balance Sheet, of which $717 million related to tax credit investments. 90 The PNC Financial Services Group... -

Page 109

... with these limits and guidelines, and reporting significant risks in the business to the Risk Committee of the Board. Market Risk Management - Interest Rate Risk Interest rate risk results primarily from our traditional banking activities of gathering deposits and extending loans. Many factors... -

Page 110

... interest rate yield curve. We believe that we have the deposit funding base and balance sheet flexibility to adjust, where appropriate and permissible, to changing interest rates and market conditions. Market Risk Management - Customer-Related Trading Risk We engage in fixed income securities... -

Page 111

... Value in the Notes To Consolidated Financial Statements in Item 8 of this Report for additional information. Various PNC business units manage our equity and other investment activities. Our businesses are responsible for making investment decisions within the approved policy limits and associated... -

Page 112

... is presented in Note 1 Accounting Policies, Note 7 Fair Value and Note 15 Financial Derivatives in the Notes To Consolidated Financial Statements in Item 8 of this Report, which is incorporated here by reference. Not all elements of market and credit risk are addressed through the use of financial... -

Page 113

... Total derivatives used for commercial mortgage banking activities Total derivatives used for customer-related activities Total derivatives used for other risk management activities Total derivatives not designated as hedging instruments Total Derivatives (a) Represents the net fair value of assets... -

Page 114

...higher revenue associated with private equity investments and commercial mortgage loans held for sale. In addition, the increase reflected higher revenue from credit valuations for customer-related derivatives activities as higher market interest rates reduced the fair value of PNC's credit exposure... -

Page 115

... when interest rates increase and vice versa. In addition, the fair value generally decreases when credit spreads widen and vice versa. Net unrealized gains in the total investment securities portfolio decreased to $.7 billion at December 31, 2013 from $2.1 billion at December 31, 2012 due primarily... -

Page 116

.... Average total deposits represented 69% of average total assets for 2013 and 68% for 2012. Total borrowed funds increased $5.2 billion to $46.1 billion at December 31, 2013 as higher Federal Home Loan Bank borrowings and bank notes and senior debt were partially offset by a decrease in commercial... -

Page 117

... of total average quarterly (or annual) assets plus (less) unrealized losses (gains) on investment securities, less goodwill and certain other intangible assets (net of eligible deferred taxes). Annualized - Adjusted to reflect a full year of activity. Basel III common equity Tier 1 capital - Common... -

Page 118

... on a global basis. PNC's product set includes loans priced using LIBOR as a benchmark. Loan-to-value ratio (LTV) - A calculation of a loan's collateral coverage that is used both in underwriting and assessing credit risk in our lending portfolio. LTV is the sum total of loan obligations secured by... -

Page 119

...Loans accounted for at amortized cost for which we do not accrue interest income. Nonperforming loans include loans to commercial, commercial real estate, equipment lease financing, home equity, residential real estate, credit card and other consumer customers as well as TDRs which have not returned... -

Page 120

... loans to commercial customers for the construction or development of residential real estate including land, single family homes, condominiums and other residential properties. Return on average assets - Annualized net income divided by average assets. Return on average capital - Annualized net... -

Page 121

...-LOOKING INFORMATION We make statements in this Report, and we may from time to time make other statements, regarding our outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC... -

Page 122

...discussed in more detail by BlackRock in its SEC filings. We grow our business in part by acquiring from time to time other financial services companies, financial services assets and related deposits and other liabilities. Acquisition risks and uncertainties include those presented by the nature of... -

Page 123

ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of The PNC Financial Services Group, Inc. In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of ... -

Page 124

CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. In millions, except per share data Year ended December 31 2014 2013 2012 Interest Income Loans Investment securities Other Total interest income Interest Expense Deposits Borrowed funds Total interest expense Net interest income ... -

Page 125

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME THE PNC FINANCIAL SERVICES GROUP, INC. In millions Year ended December 31 2014 2013 2012 Net income (a) Other comprehensive income (loss), before tax and net of reclassifications into Net income: Net unrealized gains (losses) on non-OTTI securities Net... -

Page 126

... for 2013 period have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. Par value less than $.5 million at each date. See accompanying Notes To Consolidated Financial Statements. 108 The PNC Financial Services Group, Inc... -

Page 127

... for 2012 and 2013 periods have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. See Note 1 Accounting Policies for further detail of the adoption. (c) Net treasury stock activity totaled less than .5 million shares... -

Page 128

... tax benefits from share-based payment arrangements Net change in Trading securities and other short-term investments Loans held for sale Other assets Accrued expenses and other liabilities (a) Other (a) Net cash provided (used) by operating activities Investing Activities Sales Securities available... -

Page 129

... FINANCIAL SERVICES GROUP, INC. (continued from previous page) Year ended December 31 2014 2013 In millions 2012 Financing Activities Net change in Noninterest-bearing deposits Interest-bearing deposits Federal funds purchased and repurchase agreements Federal Home Loan Bank borrowings Commercial... -

Page 130

... markets located in Pennsylvania, Ohio, New Jersey, Michigan, Illinois, Maryland, Indiana, North Carolina, Florida, Kentucky, Washington, D.C., Delaware, Virginia, Alabama, Missouri, Georgia, Wisconsin and South Carolina. PNC also provides certain products and services internationally. Use... -

Page 131

...and foreign exchange customer-related trading, as well as securities underwriting activities, as these transactions occur or as services are provided. We generally recognize gains from the sale of loans upon receipt of cash. Mortgage revenue recognized is reported net of mortgage repurchase reserves... -

Page 132

... (loss) on our Consolidated Balance Sheet. 114 The PNC Financial Services Group, Inc. - Form 10-K We include all interest on debt securities, including amortization of premiums and accretion of discounts on investment securities, in net interest income using the constant effective yield method... -

Page 133

... on a purchased impaired loan (or pool of loans) over its carrying value represents the accretable yield which is recognized into The PNC Financial Services Group, Inc. - Form 10-K 115 Private Equity Investments We report private equity investments, which include direct investments in companies... -

Page 134

...the trust. The senior classes of the asset-backed securities typically receive investment grade credit ratings at the time of issuance. These ratings are generally achieved through the creation of lower-rated subordinated 116 The PNC Financial Services Group, Inc. - Form 10-K Loans Held For Sale We... -

Page 135

... card balances are placed on nonaccrual status when they become 90 days or more past due. Such loans are charged-off at 180 days past due. Consumer Loans A consumer loan is considered well-secured when the collateral in the form of liens on (or pledges of) real or The PNC Financial Services Group... -

Page 136

personal property, including marketable securities, has a realizable value sufficient to discharge the debt in full, including accrued interest. Home equity installment loans and lines of credit, whether well-secured or not, are classified as nonaccrual at 90 days past due. Well-secured residential ... -

Page 137

...data and market data. PD is influenced by such factors as liquidity, industry, obligor financial structure, access to capital and cash flow. LGD is influenced by collateral type, original and/or updated loan-to-value ratio (LTV) and guarantees by related parties. Allowance for Loan and Lease Losses... -

Page 138

... risk characteristics of the loan. Our cash flow models use loan data including, but not limited to, delinquency status of the loan, updated borrower FICO credit scores, geographic information, historical loss experience, and updated LTVs, as well as best estimates for changes in unemployment rates... -

Page 139

...prepayment rates, discount rates, servicing costs, and other economic factors which are determined based on current market conditions. Revenue from the various loan servicing contracts for commercial, residential and other consumer loans is reported on the Consolidated Income Statement in line items... -

Page 140

... to interest rate, market and credit risk inherent in our business activities. Interest rate and total return swaps, swaptions, interest rate caps and floors, options, forwards, and futures contracts are the primary instruments we use for interest rate risk management. Financial derivatives involve... -

Page 141

... and commercial mortgage loans for sale. We also enter into commitments to purchase or sell commercial and residential real estate loans. These commitments are accounted for as free-standing derivatives which are recorded at fair value in Other assets or Other liabilities on the Consolidated Balance... -

Page 142

... be presented in the statement of financial position as a reduction to a deferred tax asset for a net operating loss (NOL) carryforward, similar tax loss, or a tax credit carryforward except when an NOL carryforward, similar tax loss, or tax credit carryforward is not available under the tax law of... -

Page 143

... Commercial Mortgages (a) $3,833 31 29 $4,321(h) 11 22 Home Equity Loans/Lines (b) CASH FLOWS - Year ended December 31, 2014 Sales of loans (i) Repurchases of previously transferred loans (j) Servicing fees (k) Servicing advances recovered/(funded), net Cash flows on mortgage-backed securities... -

Page 144

... Net Charge-offs Related to Serviced Loans In millions Residential Mortgages Commercial Mortgages (a) Home Equity Loans/Lines (b) Table 58: Consolidated VIEs - Carrying Value (a) (b) December 31, 2014 In millions Credit Card and Other Securitization Trusts Tax Credit Investments Total Assets Cash... -

Page 145

... liabilities on our Consolidated Balance Sheet. (h) PNC Risk of Loss and Carrying Value of Assets Owned by PNC have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. Credit Card Securitization Trust We were the sponsor... -

Page 146

... that to a large extent provided returns in the form of tax credits. The outstanding financings and operating lease assets are reflected as Loans and Other assets, respectively, on our Consolidated Balance Sheet, whereas related liabilities are reported in Deposits and Other liabilities. ultimately... -

Page 147

... Loans Fair Value Option Nonaccrual Loans (c) Purchased Impaired Loans Total Loans (d) (e) Dollars in millions December 31, 2014 Commercial Lending Commercial Commercial real estate Equipment lease financing Total commercial lending Consumer Lending Home equity Residential real estate (f) Credit... -

Page 148

... concentration of credit risk would include a high original or updated LTV ratio, terms that may expose the borrower to future increases in repayments above increases in market interest rates, and interest-only loans, among others. We also originate home equity and residential real estate loans that... -

Page 149

... than on an annual basis, we review PD rates related to each rating grade based upon internal historical data. These rates are updated as needed and augmented by market data as deemed necessary. For small balance homogenous pools of commercial loans, mortgages and leases, we apply statistical... -

Page 150

... and/or ongoing liquidation, capital availability, business operations and payment patterns. We attempt to proactively manage these factors by using various procedures that are customized to the risk of a given loan. These procedures include a review by our Special Asset Committee (SAC), ongoing... -

Page 151

... an updated LTV ratio. For open-end credit lines secured by real estate in regions experiencing significant declines in property values, more frequent valuations may occur. We examine LTV migration and stratify LTV into categories to monitor the risk in the loan classes. Table 63: Home Equity and... -

Page 152

... loans. (b) Amounts shown represent recorded investment. (c) Based upon updated LTV (inclusive of combined loan-to-value (CLTV) for first and subordinate lien positions). Updated LTV is estimated using modeled property values. These ratios are updated at least semi-annually. The related estimates... -

Page 153

...: New Jersey 13%, Illinois 12%, Pennsylvania 12%, Ohio 11%, Florida 9%, Maryland 5%, Michigan 5%, and California 4%. The remainder of the states had lower than 4% of the high risk loans individually, and collectively they represent approximately 29% of the higher risk loans. Table 65: Home Equity... -

Page 154

... ratios are updated at least semi-annually. The related estimates and inputs are based upon an approach that uses a combination of third-party automated valuation models (AVMs), broker price opinions (BPOs), HPI indices, property location, internal and external balance information, origination data... -

Page 155

... to high net worth individuals. Other internal credit metrics may include delinquency status, geography or other factors. (c) Credit card loans and other consumer loans with no FICO score available or required generally refers to new accounts issued to borrowers with limited credit history, accounts... -

Page 156

... Chapter 7 bankruptcy and have not formally reaffirmed their loan obligations to PNC and loans to borrowers not currently obligated to make both principal and interest payments under the restructured terms are not returned to accrual status. 138 The PNC Financial Services Group, Inc. - Form 10-K -

Page 157

... Number of Loans Pre-TDR Recorded Investment (b) Post-TDR Recorded Investment (c) Principal Rate Forgiveness Reduction Other Total Commercial lending Commercial Commercial real estate Total commercial lending (d) Consumer lending Home equity Residential real estate Credit card Other consumer Total... -

Page 158

... quarter of 2013. Number of Contracts Recorded Investment Commercial lending Commercial Commercial real estate Total commercial lending (a) Consumer lending Home equity Residential real estate Credit card Other consumer Total consumer lending Total TDRs During the year ended December 31, 2013... -

Page 159

... Principal Balance Recorded Investment (a) Associated Allowance (b) Average Recorded Investment (c) In millions December 31, 2014 Impaired loans with an associated allowance Commercial Commercial real estate Home equity Residential real estate Credit card Other consumer Total impaired loans with... -

Page 160

... net present value of expected cash flows will generally result in an impairment charge recorded as a provision for credit losses, resulting in an increase to the allowance for loan and lease losses, and a reclassification from accretable yield to non-accretable difference. 142 The PNC Financial... -

Page 161

...net present value of expected cash flows equaled or exceeded the recorded investment. As of December 31, 2013, the allowance for loan and lease losses related to purchased impaired loans was $1.0 billion. If any allowance for loan losses is recognized on a purchased impaired pool, which is accounted... -

Page 162

... evaluated for impairment (b) Fair value option loans (c) Purchased impaired loans December 31 Portfolio segment ALLL as a percentage of total ALLL Ratio of the allowance for loan and lease losses to total loans 144 The PNC Financial Services Group, Inc. - Form 10-K $ $ $ 1,547 $ 2,062 $ 3,609... -

Page 163

... losses on these unfunded credit facilities as of the balance sheet date as discussed in Note 1 Accounting Policies. A rollforward of the allowance is presented below. Table 74: Rollforward of Allowance for Unfunded Loan Commitments and Letters of Credit In millions 2014 2013 2012 January 1 Net... -

Page 164

...: Investment Securities Summary In millions Amortized Cost Unrealized Gains Losses Fair Value December 31, 2014 SECURITIES AVAILABLE FOR SALE Debt securities U.S. Treasury and government agencies Residential mortgage-backed Agency Non-agency Commercial mortgage-backed Agency Non-agency Asset-backed... -

Page 165

... to commercial mortgage-backed agency securities. The fair value of investment securities is impacted by interest rates, credit spreads, market volatility and liquidity conditions. Net unrealized gains and losses in the securities available for sale portfolio are included in Shareholders' equity as... -

Page 166

... securities transferred to held to maturity from available for sale, the unrealized loss for purposes of this analysis is determined by comparing the security's original amortized cost to its current estimated fair value. 148 The PNC Financial Services Group, Inc. - Form 10-K Evaluating Investment... -

Page 167

...relating to other factors, such as liquidity conditions in the market or changes in market interest rates, is recorded in accumulated other comprehensive income (loss). The security-level assessment is performed on each security, regardless of the classification of the security as available for sale... -

Page 168

...Gross Losses Net Gains Tax Expense For the year ended December 31 2014 2013 2012 $4,480 8,178 9,441 $ 33 146 214 $(29) $ 4 (47) 99 (10) 204 $ 1 35 71 The following table presents, by remaining contractual maturity, the amortized cost, fair value and weighted-average yield of debt securities at... -

Page 169

.... Level 1 assets and liabilities may include debt securities, equity securities and listed derivative contracts that are traded in an active exchange market and certain U.S. Treasury securities that are actively traded in over-the-counter markets. Level 2 Fair value is estimated using inputs other... -

Page 170

... Treasury securities and exchange-traded equities. When a quoted price in an active market for the identical security is not available, fair value is estimated using either an alternative market approach, such as a recent trade or matrix pricing, or an income approach, such as a discounted cash flow... -

Page 171

... risk participation agreements, swaps related to the sale of certain Visa Class B common shares and other types of contracts. The fair values of residential mortgage loan commitment assets as of December 31, 2014 and 2013 are included in the Insignificant Level 3 assets, net of liabilities line item... -

Page 172

... fair value. Residential mortgage loans are valued based on quoted market prices, where available, prices for other traded mortgage loans with similar characteristics, and purchase commitments and bid information received from market participants. The prices 154 The PNC Financial Services Group, Inc... -

Page 173

... quarterly basis and oversight is provided by senior management of the business. We value indirect investments in private equity funds based on net asset value as provided in the financial statements that we receive from their managers. Due to the time lag in our receipt of the financial information... -

Page 174

... savings plan participants may also invest based on fixed income and equity-based funds. PNC utilizes a Rabbi Trust to hedge the returns by purchasing similar funds on which the participant returns are based. The Rabbi Trust balances are recorded in Other Assets at fair value using the quoted market... -

Page 175

... (e) Debt (f) Equity Total trading securities Trading loans (b) Residential mortgage servicing rights (g) Commercial mortgage servicing rights (g) (h) Commercial mortgage loans held for sale (d) Equity investments (b) (i) Direct investments Indirect investments (j) Total equity investments Customer... -

Page 176

... of Government National Mortgage Association (GNMA) securities collateralized by project loans. $1.1 billion was previously reported as residential mortgage-backed agency securities and was reclassified to commercial mortgage-backed agency securities. (b) Included in Other assets on our Consolidated... -

Page 177

... sale Trading securities - Debt Trading loans Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale Equity investments Direct investments Indirect investments Total equity investments Loans Other assets BlackRock Series C Preferred Stock... -

Page 178

... mortgage loans held for sale Trading securities - Debt Residential mortgage servicing rights Commercial mortgage loans held for sale Equity investments Direct investments Indirect investments Total equity investments Loans (h) Other assets BlackRock Series C Preferred Stock Other Total other assets... -

Page 179

... (transfer) of assets or liabilities between hierarchy levels. PNC's policy is to recognize transfers in and transfers out as of the end of the reporting period. During 2014, there were transfers of one available for sale residential mortgage-backed non-agency security and one debt trading security... -

Page 180

... Trading securities - Debt Residential mortgage servicing rights Commercial mortgage servicing rights Commercial mortgage loans held for sale Equity investments - Direct investments Equity investments - Indirect (d) Loans - Residential real estate 1,152 Multiple of adjusted earnings 469 Net asset... -

Page 181

... securities Trading securities - Debt Residential mortgage servicing rights Commercial mortgage loans held for sale Equity investments - Direct investments Equity investments - Indirect (d) Loans - Residential real estate 2.0%-100% (80.0%) 0%-100% (48.4%) 12.0%-13.0% (12.2%) 8.0% weighted average... -

Page 182

... by an internal person independent of the asset manager. PNC has a real estate valuation services group whose sole function is to manage the real estate appraisal solicitation and evaluation process for commercial loans. All third-party appraisals are reviewed by this group, including consideration... -

Page 183

Equity Investments Equity investments represent the carrying value of Low Income Housing Tax Credit (LIHTC) investments held for sale calculated using a discounted cash flow model. The significant unobservable input is management's estimate of required market rate of return. The market rate of ... -

Page 184

...(c) Total Assets December 31, 2013 Assets Nonaccrual loans (a) Loans held for sale (d) Equity investments Commercial mortgage servicing rights (f) Other (c) Total Assets $ 21 224 6 543 246 $1,040 LGD percentage (b) Discounted cash flow Discounted cash flow Discounted cash flow Fair value of property... -

Page 185

... - Changes in Fair Value (a) Year ended December 31 In millions Gains (Losses) 2014 2013 2012 Assets Customer resale agreements Residential mortgage-backed agency securities with embedded derivatives (b) Trading loans Commercial mortgage loans held for sale Residential mortgage loans held for sale... -

Page 186

... funds December 31, 2013 Assets Customer resale agreements Trading loans Residential mortgage loans held for sale Performing loans Accruing loans 90 days or more past due Nonaccrual loans Total Commercial mortgage loans held for sale (a) Performing loans Nonaccrual loans Total Residential mortgage... -

Page 187

...Loans held for sale Net loans (excludes leases) Other assets Total Assets Liabilities Demand, savings and money market deposits Time deposits Borrowed funds Unfunded loan commitments and letters of credit Total Liabilities December 31, 2013 Assets Cash and due from banks Short-term assets Securities... -

Page 188

...• financial instruments recorded at fair value on a recurring basis, • real and personal property, • lease financing, • loan customer relationships, • deposit customer intangibles, • mortgage servicing rights, • retail branch networks, • fee-based businesses, such as asset management... -

Page 189

... amortized on a straight-line basis. For customer-related and other intangibles, the estimated remaining useful lives range from less than 1 year to 10 years, with a weighted-average remaining useful life of 7 years. Changes in customer-related intangible assets during 2014 and 2013 follow: Table 94... -

Page 190

... increases). The fair value of residential MSRs is estimated by using a discounted cash flow valuation model which calculates the present value of estimated future net servicing cash flows, taking into consideration actual and expected mortgage loan prepayment rates, discount rates, servicing costs... -

Page 191

...activities provided to others for which we do not have an associated servicing asset. Fees from commercial and residential MSRs are reported on our Consolidated Income Statement in the line items Corporate services and Residential mortgage, respectively. The PNC Financial Services Group, Inc. - Form... -

Page 192

... and Subordinated Debt December 31, 2014 - Dollars in millions 2014 2013 2012 Carrying Value Stated Rate Maturity Depreciation expense on premises, equipment and leasehold improvements and amortization expense, excluding intangible assets and primarily for capitalized internally developed software... -

Page 193

... tax rules, the capital securities are redeemable in whole. In accordance with GAAP, the financial statements of the Trust are not included in PNC's consolidated financial statements. At December 31, 2014, PNC's junior subordinated debt with a carrying value of $205 million represented debentures... -

Page 194

...a cash payment representing the market value of such in-kind dividend, and PNC has committed to contribute such in-kind dividend to PNC Bank. (e) Except for: (i) purchases, redemptions or other acquisitions of shares of capital stock of PNC in connection with any employment contract, benefit plan or... -

Page 195

... value of plan assets at beginning of year Actual return on plan assets Employer contribution Participant contributions Federal Medicare subsidy on benefits paid Benefits paid Settlement payments Fair value of plan assets at end of year Funded status Amounts recognized on the consolidated balance... -

Page 196

...investment strategy for pension plan assets is to: • Meet present and future benefit obligations to all participants and beneficiaries, 178 The PNC Financial Services Group, Inc. - Form 10-K Asset Category Domestic Equity International Equity Private Equity Total Equity Domestic Fixed Income High... -

Page 197

... 31, 2013 follows: • Money market and mutual funds are valued at the net asset value of the shares held by the pension plan at year end. • U.S. government and agency securities, corporate debt, common stock and preferred stock are valued at the closing price reported on the active market on... -

Page 198

...pension plan include derivative financial instruments and real estate, which are recorded at estimated fair value as determined by third-party appraisals and pricing models, and group annuity contracts, which are measured at fair value by discounting the related cash flows based on current yields of... -

Page 199

... 2014 and 2013. Table 112: Rollforward of Pension Plan Level 3 Assets Interest in Collective Funds Corporate Debt Limited Partnerships In millions January 1, 2014 Net realized gain/(loss) on sale of investments Net unrealized gain/(loss) on assets held at end of year Purchases Sales December 31... -

Page 200

... 2013 2012 Year ended December 31 - in millions Net periodic cost consists of: Service cost Interest cost Expected return on plan assets Amortization of prior service cost/(credit) Amortization of actuarial (gain)/loss Settlement (gain)/loss Net periodic cost (benefit) Other changes in plan assets... -

Page 201

...after such date. It was replaced by a new plan called The PNC Financial Services Group, Inc. Deferred Compensation and Incentive Plan. Effect on year end benefit obligation $12 (10) Unamortized actuarial gains and losses and prior service costs and credits are recognized in AOCI each December 31... -

Page 202

... of historical option activity. Table 119: Option Pricing Assumptions (a) Weighted-average for the year ended December 31 2013 2012 Nonqualified Stock Options Beginning in 2014, PNC discontinued the use of stock options as a standard element of our long-term equity incentive compensation programs... -

Page 203

... at December 31, 2014. Total shares of PNC common stock authorized for future issuance under equity compensation plans totaled 19,017,057 shares at December 31, 2014, which includes shares available for issuance under the Incentive Plans and the Employee Stock Purchase Plan (ESPP) as described below... -

Page 204

...-month offering period. Eligible participants may purchase our common stock at 95% of the fair market value on the last day of each six-month offering period. No charge to earnings is recorded with respect to the ESPP. Table 123: Employee Stock Purchase Plan - Summary Year ended December 31 Shares... -

Page 205

... interest rate, market and credit risk and reduce the effects that changes in interest rates may have on net income, the fair value of assets and liabilities, and cash flows. We also enter into derivatives with customers to facilitate their risk management activities. Derivatives represent contracts... -

Page 206

...In millions Hedged Items Location Interest rate contracts Interest rate contracts Interest rate contracts Interest rate contracts Total (a) U.S. Treasury and Government Agencies Securities Other Debt Securities Subordinated debt Bank notes and senior debt Investment securities (interest income... -

Page 207

...is presented in the following table: Table 128: Gains (Losses) on Derivatives - Net Investment Hedges Year ended December 31 2014 2013 2012 In millions Gains (losses) on derivatives recognized in OCI (effective portion) Foreign exchange contracts $54 $(21) $(27) The PNC Financial Services Group... -

Page 208

... customer-related activities: Interest rate contracts: Swaps Caps/floors - Sold Caps/floors - Purchased Swaptions Futures (c) Mortgage-backed securities commitments Subtotal Foreign exchange contracts Credit contracts: Risk participation agreements Subtotal Derivatives used for other risk management... -

Page 209

... and credit risk include forward loan sale contracts, interest rate swaps, and credit default swaps. Gains and losses on the commitments, loans and derivatives are included in Other noninterest income. Derivatives used to economically hedge the change in value of commercial mortgage servicing rights... -

Page 210

... Gains (losses) from commercial mortgage banking activities Derivatives used for customer-related activities: Interest rate contracts Foreign exchange contracts Equity contracts Credit contracts Gains (losses) from customer-related activities (c) Derivatives used for other risk management activities... -

Page 211

... the fair value of the underlying swaps, compared with $77 million at December 31, 2013. Corporate debt Commercial mortgage-backed securities 45% 55% 37% 63% Offsetting, Counterparty Credit Risk, and Contingent Features We, generally, utilize a net presentation on the Consolidated Balance Sheet... -

Page 212

... 31, 2013 In millions Gross Fair Value Derivative Assets Amounts Offset on the Consolidated Balance Sheet Fair Value Cash Offset Amount Collateral Net Fair Value Derivative Assets Net Amounts Derivative assets Interest rate contracts Foreign exchange contracts Credit contracts Total derivative... -

Page 213

... by using internal credit analysis, limits, and monitoring procedures. Collateral may also be exchanged under certain derivative agreements that are not considered master netting agreements. At December 31, 2014, we held cash, U.S. government securities and mortgage-backed securities totaling $815... -

Page 214

... Share Preferred Stock Issue Date Number of Depositary Shares Issued Dividend Dates (a) Annual Per Share Dividend Rate Optional Redemption Date (b) Series B (c) (c) N/A N/A Quarterly from March 10th Semi-annually beginning on November 21, 2008 until May 21, 2013 Quarterly beginning... -

Page 215

... Trust and Perpetual Trust Securities, the PNC Preferred Funding Trust II securities are automatically exchangeable into shares of PNC Series I preferred stock under certain conditions relating to the capitalization or the financial condition of PNC Bank and upon the direction of the Office... -

Page 216

... gains (losses) on nonOTTI securities Balance at December 31, 2012 2013 activity Increase in net unrealized gains (losses) on non-OTTI securities Less: Net gains (losses) realized as a yield adjustment reclassified to investment securities interest income Less: Net gains (losses) realized on sale of... -

Page 217

... noninterest expense Amortization of prior service cost (credit) reclassified to other noninterest expense Total 2012 activity Balance at December 31, 2012 2013 Activity Net pension and other postretirement benefit plan activity Amortization of actuarial loss (gain) reclassified to other noninterest... -

Page 218

... and benefits Loss and credit carryforward Accrued expenses Other (a) Total gross deferred tax assets Valuation allowance Total deferred tax assets Deferred tax liabilities Leasing Goodwill and intangibles Basis difference in loans Fixed assets Net unrealized gains on securities and financial... -

Page 219

...balance of unrecognized tax benefits is as follows: Table 146: Change in Unrecognized Tax Benefits In millions 2014 2013 2012 Statutory tax rate Increases (decreases) resulting from State taxes net of federal benefit Tax-exempt interest (a) Life insurance Dividend received deduction (a) Tax credits... -

Page 220

... using the Basel I regulatory capital methodology applicable to PNC during 2013. (c) Amounts for 2013 period have not been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. 202 The PNC Financial Services Group, Inc. - Form... -

Page 221

... ability of national banks to pay dividends or make other capital distributions. The amount available for dividend payments to the parent company by PNC Bank without prior regulatory approval was approximately $1.5 billion at December 31, 2014. Under federal law, a bank subsidiary generally may not... -

Page 222

... the judgment or loss sharing agreements, but it has been subject to these indemnification obligations and became responsible for National City Bank's position in the litigation and responsibilities under the agreements upon completion of the merger of National City Bank into PNC Bank, N.A. In March... -

Page 223

...Financial Services Group, Inc. - Form 10-K 205 CBNV Mortgage Litigation Between 2001 and 2003, on behalf of either individual plaintiffs or proposed classes of plaintiffs, several separate lawsuits were filed in state and federal courts against Community Bank of Northern Virginia (CBNV), a PNC Bank... -

Page 224

...overdraft policies to be unfair and unconscionable. Fulton Financial In 2009, Fulton Financial Advisors, N.A. filed lawsuits against PNC Capital Markets, LLC and NatCity Investments, Inc. in the Court of Common Pleas of Lancaster County, Pennsylvania arising out of Fulton's purchase of auction rate... -

Page 225

... all persons who obtained residential mortgage loans originated, funded or originated through correspondent lending by National City or any of its subsidiaries or affiliates between January 1, 2004 and the present and, in connection with these mortgage loans, purchased private mortgage insurance and... -

Page 226

...a result of the payment of 208 The PNC Financial Services Group, Inc. - Form 10-K commissions to PNC Bank and of reinsurance arrangements between PNC and the insurance provider. The plaintiff originally sought to certify a nationwide class and an Ohio sub-class of all persons who, during applicable... -

Page 227

...to National City Mortgage Co., NCMC Newco, Inc., and North Central Financial Corporation (Residential Funding Company, LLC v. PNC Bank, N.A., et al. (Civil No. 13-3498- JRT-JSM)). In its complaint, RFC alleges that PNC Bank (through predecessors) sold $6.5 billion worth of residential mortgage loans... -

Page 228

... under state law for payment of certain benefits under life insurance policies sold by Lincoln and Memorial, and the National Organization of Life & Health Guaranty Associations have also joined the action as plaintiffs. In addition to National City Bank and PNC Bank (added following filing of the... -

Page 229

... SBAguaranteed loans made through, a broker named Jade Capital Investments, LLC ("Jade"), as well as information regarding other PNC-originated SBA guaranteed loans made to businesses located in the State of Maryland, the Commonwealth of Virginia, The PNC Financial Services Group, Inc. - Form 10... -

Page 230

... our Consolidated Balance Sheet. NOTE 22 COMMITMENTS AND GUARANTEES Credit Extension Commitments Table 148: Credit Commitments In millions December 31 December 31 2014 2013 Net unfunded loan commitments Total commercial lending Home equity lines of credit Credit card Other Total net unfunded loan... -

Page 231

... direct investments is generally to provide for growth financing or to support acquisitions or recapitalizations. Other commitments related to equity investments at December 31, 2014 were $962 million, of which $169 million were unfunded commitments that were not recorded on our Consolidated Balance... -

Page 232

...home equity loans/lines of credit that were sold to a limited number of private investors in the financial services industry by National City prior to our acquisition of National City. PNC is no longer engaged in the brokered home equity lending business, and our exposure under these loan repurchase... -

Page 233

... and Unasserted Claims 2014 Home Equity Residential Loans/ Mortgages (a) Lines (b) 2013 Residential Mortgages (a) Home Equity Loans/ Lines (b) (c) In millions Total Total January 1 Reserve adjustments, net Losses - loan repurchases and private investor settlements Agency settlements December 31... -

Page 234

... Loss - Mortgage Insurance Quota Share Maximum Exposure to Quota Share Agreements with 100% Reinsurance $1,774 467 2,056 45 $4,342 1% 99% $ 466 $1,902 621 2,679 133 $5,335 2% 98% $ 620 (a) Reinsurance agreements exposure balances represent estimates based on availability of financial information... -

Page 235

... the structured resale agreements at fair value. Refer to Note 15 Financial Derivatives for additional information related to offsetting of financial derivatives. In millions Gross Resale Agreements Amounts Offset on the Consolidated Balance Sheet Net Resale Agreements (a) (b) Securities... -

Page 236

... quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. See Note 1 Accounting Policies for further detail of the adoption. Year ended December 31 - in millions 2014 2013 2012 $103 117 255 $ (13) 91 453 218 The PNC Financial Services Group, Inc. - Form... -

Page 237

...001 (a) Amounts for 2013 and 2012 periods have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. See Note 1 Accounting Policies for further detail of the adoption. The PNC Financial Services Group, Inc. - Form 10-K 219 -

Page 238

... cash and investment management, receivables management, disbursement services, funds transfer services, information reporting and global trade services. Capital markets-related products and services include foreign exchange, derivatives, securities, loan syndications, mergers and acquisitions... -

Page 239

... 2014-01 related to investments in low income housing tax credits. (b) Period-end balances for BlackRock. NOTE 25 SUBSEQUENT EVENTS On February 23, 2015, PNC Bank issued: • $750 million of senior notes with a maturity date of February 23, 2025. Interest is payable semi-annually at a fixed rate of... -

Page 240

...-01 related to investments in low income housing tax credits. (c) The sum of the quarterly amounts for 2014 and 2013 does not equal the respective year's amount because the quarterly calculations are based on a changing number of average shares. 222 The PNC Financial Services Group, Inc. - Form 10... -

Page 241

... available for sale Securities held to maturity Residential mortgage-backed Commercial mortgage-backed Asset-backed U.S. Treasury and government agencies State and municipal Other Total securities held to maturity Total investment securities Loans Commercial Commercial real estate Equipment lease... -

Page 242

... of Government National Mortgage Association (GNMA) securities collateralized by project loans, which were previously reported as residential mortgage-backed agency securities and have been reclassified to commercial mortgage-backed securities. 224 The PNC Financial Services Group, Inc. - Form 10... -

Page 243

... Other debt Total securities available for sale Securities held to maturity Residential mortgage-backed Commercial mortgage-backed Asset-backed State and municipal Other Total securities held to maturity Total investment securities Loans Commercial Commercial real estate Equipment lease financing... -

Page 244