Wells Fargo 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

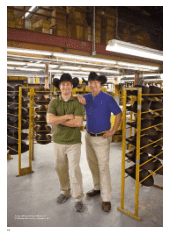

Hewas so happy with the process and our

service, he opened two more business accounts.

When he decided to expand his business, the

same team helped him finance a $3.5million

loan. When we delight our customers and help

them succeed financially, great things happen.

Another example can be found in San

Francisco’s Mission District, where many low-

income immigrant women sell food from their

homes or in the streets to help support their

families. To help these women organize and

grow their businesses, a nonprofit business

incubator called La Cocina was started in 2005.

WellsFargo provided an equity equivalent,

or EQ2 (below-market rate), loan of $500,000

to get it started. As La Cocina grew, we

helped arrange another $500,000 loan and,

later, another $300,000 loan. La Cocina is

now recognized as a national model for

moving low-income and immigrant women

entrepreneurs into the formal economy. It’s

home for several women-owned businesses,

generating $2million in annual revenue and

creating jobs in the community.

3. Reducing expenses

From WellsFargo’s Vision & Values:

“We’re making expense management a

competitive advantage — just like our people,

cross-sell, our solid capital position, our strong

balance sheet, and credit discipline.”

We have the privilege and responsibility to

use our shareholders’ capital as eciently and

eectively as possible so we can give them

asolid, long-term return on their investment.

That means managing our expenses well —

notcutting costs just for the sake of it, but

making sure everything we do is as ecient

and simple as possible. We should spend

money only on what really matters to our

customers and on things that help us grow

revenue. Weneed to cut costs, but not corners,

when it comes to doing things right and doing

therightthings.

Through our current companywide

expense initiative, we want to become more

cost-competitive and nimble by streamlining

processes and eliminating unnecessary

expense. This work is moving forward on two

fronts. First, we’re identifying cross-company

opportunities that remove complexity,

eliminate duplication, and take more of a

companywide view of how we work. Second,

each of our individual businesses is looking

closely at how they do their work. For example,

we’ve identified technology, human resources,

and marketing functions that were handled

in separate areas, and we’re bringing them

together to serve the company more eciently.

We combined our two separate automobile

finance businesses to better serve customers.

We simplified our Wealth Management

regional structure to operate seven instead of

12regions. Our businesses reduced the number

of temporary resources and contractors in

high-cost locations by 29percent in 2011.

Reducing expenses also helps us achieve

other goals. During the merger integration

with Wachovia, we converted many of our retail

banking stores to more ecient “green” signs,

saving a lot of money for the company and our

shareholders. We installed 7,000 LED signs

coast to coast, saving an estimated $1.5million

in reduced energy and maintenance costs.

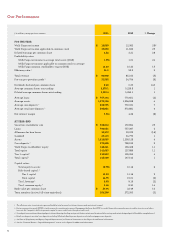

As part of our current expense initiative,

we set a target to reduce our quarterly

noninterest expenses to $11billion in the fourth

quarter of 2012. That means reducing our

quarterly noninterest expense by $1.5billion,

or 12percent, from the amount of noninterest

expenses we incurred in the second quarter of

2011, when we set our expense target. We’re on

the right track to reach that goal.

4. Living our Vision & Values

From WellsFargo’s Vision & Values: “We have

what it takes to be great. One vision. Shared

values that we live. A well-understood and

eective culture. A time-tested business model …

And most of all: great people.”

Living our Vision & Values is about trust,

personal responsibility, working together,

admitting mistakes when we make them, and

making things right for our customers. Whether

you’re a bank teller, a relationship manager,

a computer programmer, or a leader of one

of our business groups, these are the values

thatguideus.

We also value — and learn from — the

diversity of team members, customers, and

communities. We promote an environment that

embraces and values dierences, encouraging

diversity in our business practices. This

gives us multiple perspectives to respond to

5.92 products

Retail bank household cross-sell

reached a record 5.92products in

2011, up from 5.70 in the fourth

quarter of 2010.

$13.8 billion

In 2011, WellsFargo grew Tier1

common equity1 by $13.8billion,

highest among the four largest

U.S. banks by assets.

$1.5 million

We installed 7,000 LED signs

coast to coast, saving an estimated

$1.5million in reduced energy

and maintenance costs.