Wells Fargo 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

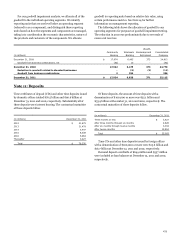

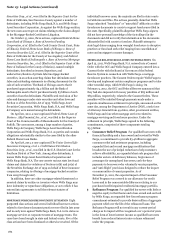

Note 15: Legal Actions

Wells Fargo and certain of our subsidiaries are involved in a

number of judicial, regulatory and arbitration proceedings

concerning matters arising from the conduct of our business

activities. These proceedings include actions brought against

Wells Fargo and/or our subsidiaries with respect to corporate

related matters and transactions in which Wells Fargo and/or

our subsidiaries were involved. In addition, Wells Fargo and our

subsidiaries may be requested to provide information or

otherwise cooperate with government authorities in the conduct

of investigations of other persons or industry groups.

Although there can be no assurance as to the ultimate

outcome, Wells Fargo and/or our subsidiaries have generally

denied, or believe we have a meritorious defense and will deny,

liability in all significant litigation pending against us, including

the matters described below, and we intend to defend

vigorously each case, other than matters we describe as having

settled. Reserves are established for legal claims when

payments associated with the claims become probable and the

costs can be reasonably estimated. The actual costs of resolving

legal claims may be substantially higher or lower than the

amounts reserved for those claims.

ILLINOIS ATTORNEY GENERAL LITIGATION

On July 31, 2009, the

Attorney General for the State of Illinois filed a civil lawsuit

against Wells Fargo & Company, Wells Fargo Bank, N.A. and

Wells Fargo Financial Illinois, Inc. in the Circuit Court for Cook

County, Illinois. The Illinois Attorney General alleges that the

Wells Fargo defendants engaged in illegal discrimination by

“reverse redlining” and by steering African-American and Latino

customers into high cost, subprime mortgage loans while other

borrowers with similar incomes received lower cost mortgages.

Illinois also alleges that Wells Fargo Financial Illinois, Inc.

misled Illinois customers about the terms of mortgage loans.

Illinois’ complaint against all Wells Fargo defendants is based on

alleged violation of the Illinois Human Rights Act and the

Illinois Fairness in Lending Act. The complaint also alleges that

Wells Fargo Financial Illinois, Inc. violated the Illinois

Consumer Fraud and Deceptive Business Practices Act and the

Illinois Uniform Deceptive Trade Practices Act. Illinois’

complaint seeks an injunction against the defendants’ alleged

violation of these Illinois statutes, restitution to consumers and

civil money penalties. On October 26, 2011, the Illinois Court

issued an order granting, in part, and denying, in part, Wells

Fargo’s motion to dismiss. The Court dismissed Wells Fargo &

Company as a party and dismissed Count III of the complaint,

which alleged violations of the Illinois Fair Lending Act. The

Court denied the remainder of the motion to dismiss.

INTERCHANGE LITIGATION

Wells Fargo Bank, N.A., Wells

Fargo & Company, Wachovia Bank, N.A. and Wachovia

Corporation are named as defendants, separately or in

combination, in putative class actions filed on behalf of a

plaintiff class of merchants and in individual actions brought by

individual merchants with regard to the interchange fees

associated with Visa and MasterCard payment card transactions.

These actions have been consolidated in the United States

District Court for the Eastern District of New York. Visa,

MasterCard and several banks and bank holding companies are

named as defendants in various of these actions. The amended

and consolidated complaint asserts claims against defendants

based on alleged violations of federal and state antitrust laws

and seeks damages, as well as injunctive relief. Plaintiff

merchants allege that Visa, MasterCard and payment card

issuing banks unlawfully colluded to set interchange rates.

Plaintiffs also allege that enforcement of certain Visa and

MasterCard rules and alleged tying and bundling of services

offered to merchants are anticompetitive. Wells Fargo and

Wachovia, along with other defendants and entities, are parties

to Loss and Judgment Sharing Agreements, which provide that

they, along with other entities, will share, based on a formula, in

any losses from the Interchange Litigation.

MEDICAL CAPITAL CORPORATION LITIGATION

Wells Fargo

Bank, N.A. served as indenture trustee for debt issued by

affiliates of Medical Capital Corporation, which was placed in

receivership at the request of the Securities and Exchange

Commission (SEC) in August 2009. Since September 2009,

Wells Fargo has been named as a defendant in various class and

mass actions brought by holders of Medical Capital

Corporation’s debt, alleging that Wells Fargo breached

contractual and other legal obligations owed to them and seeking

unspecified damages. The actions have been consolidated in the

United States District Court for the Central District of California.

On July 26, 2011, the District Court certified a class consisting of

holders of notes issued by affiliates of Medical Capital

Corporation and, on October 18, 2011, the Ninth Circuit Court of

Appeals denied a petition seeking to appeal the class certification

order.

MORTGAGE-BACKED CERTIFICATES LITIGATION

Several

securities law based putative class actions were consolidated in

the U.S. District Court for the Northern District of California on

July 16, 2009, under the caption In re Wells Fargo Mortgage-

Backed Certificates Litigation. The case asserted claims against

several Wells Fargo mortgage backed securities trusts, Wells

Fargo Bank, N.A. and other affiliated entities, individual

employee defendants, along with various underwriters and

rating agencies. The plaintiffs alleged that the offering

documents contain untrue statements of material fact, or omit to

state material facts necessary to make the registration

statements and accompanying prospectuses not misleading. The

parties agreed to settle the case on May 27, 2011, for

$125 million. Final approval of the settlement was entered on

November 14, 2011. Some class members opted out of the

settlement, with the most significant being the Federal National

Mortgage Association (Fannie Mae), the Federal Home Loan

Mortgage Corporation (Freddie Mac) and American

International Group, Inc.

On June 29, 2010, and on July 15, 2010, two complaints, the

first captioned The Charles Schwab Corporation vs. Merrill

Lynch, Pierce, Fenner & Smith, Inc., et al., and the second

captioned The Charles Schwab Corporation v. BNP Paribas

181