Wells Fargo 2011 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

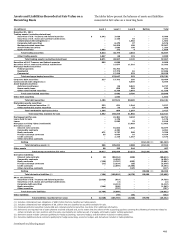

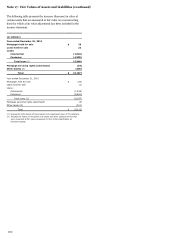

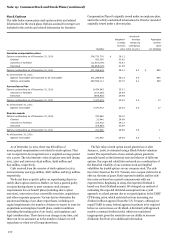

Alternative Investments

The following table summarizes our investments in various types

of funds, which are included in trading assets, securities

available for sale and other assets. We use the funds’ net asset

values (NAVs) per share as a practical expedient to measure fair

value on recurring and nonrecurring bases. The fair values

presented in the table are based upon the funds’ NAVs or an

equivalent measure.

Redemption

Fair

Unfunded

Redemption

notice

(in millions)

value

commitments

frequency

period

December 31, 2011

Offshore funds

$

352

-

Daily - Annually

1 - 180 days

Funds of funds

1

-

Quarterly

90 days

Hedge funds

22

-

Daily - Annually

5 - 95 days

Private equity funds

976

240

N/A

N/A

Venture capital funds

83

28

N/A

N/A

Total

$

1,434

268

December 31, 2010

Offshore funds

$

1,665

-

Daily - Annually

1 - 180 days

Funds of funds

63

-

Monthly - Quarterly

10 - 90 days

Hedge funds

23

-

Monthly - Annually

30 - 120 days

Private equity funds

1,830

669

N/A

N/A

Venture capital funds

88

36

N/A

N/A

Total

$

3,669

705

N/A - Not applicable

Offshore funds primarily invest in investment grade

European fixed-income securities. Redemption restrictions are

in place for investments with a fair value of $200 million and

$74 million at December 31, 2011 and 2010, respectively, due to

lock-up provisions that will remain in effect until October 2015.

Private equity funds invest in equity and debt securities

issued by private and publicly-held companies in connection

with leveraged buyouts, recapitalizations and expansion

opportunities. Substantially all of these investments do not allow

redemptions. Alternatively, we receive distributions as the

underlying assets of the funds liquidate, which we expect to

occur over the next nine years.

Venture capital funds invest in domestic and foreign

companies in a variety of industries, including information

technology, financial services and healthcare. These investments

can never be redeemed with the funds. Instead, we receive

distributions as the underlying assets of the fund liquidate,

which we expect to occur over the next six years.

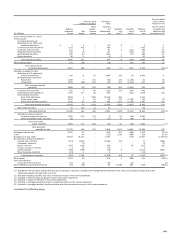

Fair Value Option

We measure MHFS at fair value for prime MHFS originations

for which an active secondary market and readily available

market prices exist to reliably support fair value pricing models

used for these loans. Loan origination fees on these loans are

recognized when earned, and related direct loan origination

costs are recognized when incurred. We also measure at fair

value certain of our other interests held related to residential

loan sales and securitizations. We believe fair value

measurement for prime MHFS and other interests held, which

we hedge with free-standing derivatives (economic hedges)

along with our MSRs, measured at fair value, reduces certain

timing differences and better matches changes in the value of

these assets with changes in the value of derivatives used as

economic hedges for these assets.

Upon the acquisition of Wachovia, we elected to measure at

fair value certain portfolios of LHFS that may be economically

hedged with derivative instruments. In addition, we elected to

measure at fair value certain letters of credit that are hedged

with derivative instruments to better reflect the economics of the

transactions. These letters of credit are included in trading

account assets or liabilities.

Upon the adoption of new consolidation guidance on January

1, 2010, we elected to measure at fair value the eligible assets

(loans) and liabilities (long-term debt) of certain nonconforming

mortgage loan securitization VIEs. We elected the fair value

option for such newly consolidated VIEs to continue fair value

accounting as our interests prior to consolidation were

predominantly carried at fair value with changes in fair value

recognized in earnings. Upon clarifying guidance from the SEC

during fourth quarter 2011, we consolidated reverse mortgage

loans previously sold under a GNMA securitization program. We

had initially elected fair value option on these loans prior to sale,

and, as such, they were consolidated under fair value option.

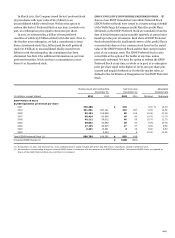

The following table reflects the differences between fair value

carrying amount of certain assets and liabilities for which we

have elected the fair value option and the contractual aggregate

unpaid principal amount at maturity.

203