Wells Fargo 2011 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

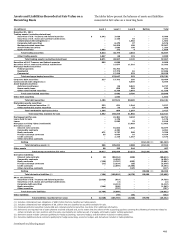

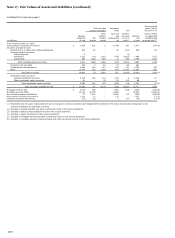

Note 17: Fair Values of Assets and Liabilities (continued)

(continued from previous page)

(in millions)

Level 1

Level 2

Level 3

Netting

Total

December 31, 2010

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies

$

1,340

3,335

-

-

4,675

Securities of U.S. states and political subdivisions

-

1,893

5

-

1,898

Collateralized debt obligations (1)

-

-

1,915

-

1,915

Corporate debt securities

-

10,164

166

-

10,330

Mortgage-backed securities

-

9,137

117

-

9,254

Asset-backed securities

-

1,811

366

-

2,177

Equity securities

2,143

625

34

-

2,802

Total trading securities

3,483

26,965

2,603

-

33,051

Other trading assets

816

987

136

-

1,939

Total trading assets (excluding derivatives)

4,299

27,952

2,739

-

34,990

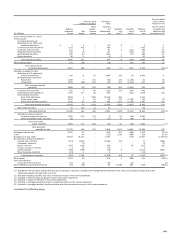

Securities of U.S. Treasury and federal agencies

938

666

-

-

1,604

Securities of U.S. states and political subdivisions

-

14,090

4,564

-

18,654

Mortgage-backed securities:

Federal agencies

-

82,037

-

-

82,037

Residential

-

20,183

20

-

20,203

Commercial

-

13,337

217

-

13,554

Total mortgage-backed securities

-

115,557

237

-

115,794

Corporate debt securities

-

9,846

433

-

10,279

Collateralized debt obligations (2)

-

-

4,778

-

4,778

Asset-backed securities:

Auto loans and leases

-

223

6,133

-

6,356

Home equity loans

-

998

112

-

1,110

Other asset-backed securities

-

5,285

3,150

-

8,435

Total asset-backed securities

-

6,506

9,395

-

15,901

Other debt securities

-

370

85

-

455

Total debt securities

938

147,035

19,492

-

167,465

Marketable equity securities:

Perpetual preferred securities (3)

721

677

2,434

-

3,832

Other marketable equity securities

1,224

101

32

-

1,357

Total marketable equity securities

1,945

778

2,466

-

5,189

Total securities available for sale

2,883

147,813

21,958

-

172,654

Mortgages held for sale

-

44,226

3,305

-

47,531

Loans held for sale

-

873

-

-

873

Loans

-

-

309

-

309

Mortgage servicing rights (residential)

-

-

14,467

-

14,467

Derivative assets:

Interest rate contracts

-

67,380

869

-

68,249

Commodity contracts

-

4,133

-

-

4,133

Equity contracts

511

2,040

721

-

3,272

Foreign exchange contracts

42

4,257

51

-

4,350

Credit contracts

-

2,148

3,198

-

5,346

Other derivative contracts

8

-

-

-

8

Netting

-

-

-

(63,469)

(4)

(63,469)

Total derivative assets (5)

561

79,958

4,839

(63,469)

21,889

Other assets

38

45

314

-

397

Total assets recorded at fair value

$

7,781

300,867

47,931

(63,469)

293,110

Derivative liabilities:

Interest rate contracts

$

(7)

(62,769)

(792)

-

(63,568)

Commodity contracts

-

(3,917)

(1)

-

(3,918)

Equity contracts

(259)

(2,291)

(946)

-

(3,496)

Foreign exchange contracts

(69)

(3,351)

(42)

-

(3,462)

Credit contracts

-

(2,199)

(4,215)

-

(6,414)

Other derivative contracts

-

-

(35)

-

(35)

Netting

-

-

-

70,009

(4)

70,009

Total derivative liabilities (6)

(335)

(74,527)

(6,031)

70,009

(10,884)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies

(2,827)

(1,129)

-

-

(3,956)

Corporate debt securities

-

(3,798)

-

-

(3,798)

Equity securities

(1,701)

(178)

-

-

(1,879)

Other securities

-

(347)

-

-

(347)

Total short sale liabilities

(4,528)

(5,452)

-

-

(9,980)

Other liabilities

-

(36)

(344)

-

(380)

Total liabilities recorded at fair value

$

(4,863)

(80,015)

(6,375)

70,009

(21,244)

(1) Includes collateralized loan obligations of $671 million that are classified as trading assets.

(2) Includes collateralized loan obligations of $4.2 billion that are classified as securities available for sale.

(3) Perpetual preferred securities include ARS and corporate preferred securities. See Note 8 for additional information.

(4) Derivatives are reported net of cash collateral received and paid and, to the extent that the criteria of the accounting guidance covering the offsetting of amounts related to

certain contracts are met, positions with the same counterparty are netted as part of a legally enforceable master netting agreement.

(5) Derivative assets include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets.

(6) Derivative liabilities include contracts qualifying for hedge accounting, economic hedges and derivatives included in trading liabilities.

196