Wells Fargo 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

student loans, personal loans, and lines of credit.

This can help our customers resolve past-due

accounts quickly and discreetly, and also reduce

our collectionwork.

We’re also putting the global needs of

our business customers first. This year we

relocated our branch in Shanghai, one of the

world’s most dynamic cities. This expanded

oce will play a critical role in supporting the

increasing number of WellsFargo customers

doing business in China and a growing number

of Chinese companies that want to grow their

business in the U.S. This is just one way we’re

positioned to continue to grow our international

business and serve our customers with an

expanded range of products and services.

2. Growing revenue

From WellsFargo’s Vision & Values:

“We can’t control the economy, interest

rates, the markets, or world events. We focus

on what we can control and what we can

sustain long term: our core performance,

ourrevenuegrowth.”

When we put customers first and help

them succeed financially, we strengthen

relationships, build loyalty, and earn trust.

Asaresult, our customers bring us more

business, we create more opportunities

for our team members, and we earn more

revenue to support our operations, growing

our earnings and shareholder return.

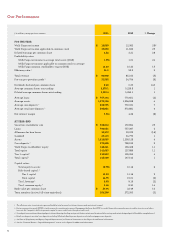

In 2011, WellsFargo grew its Tier1

common equity 1 (a bank’s core equity capital)

by $13.8billion, up 17percent. This was the

greatest increase among the four largest U.S.

banks, based on assets.

We grew revenue in many of our businesses

within Community Banking; Wealth, Brokerage

and Retirement; Consumer Lending; and

Wholesale Banking, including Commercial

Banking. However, our total revenue declined

during the year, reflecting lower interest rates,

new regulations, and the sluggish economy.

We’re confident we can grow revenue if

we stay true to our vision and attract new

customers through organic growth and

disciplinedacquisitions.

We have a huge opportunity to earn

more business from our current customers.

Our average retail bank household cross-sell

reached a record 5.92 products in 2011, up

from 5.70 in the fourth quarter of 2010. In our

Western markets it was a record 6.29, in the

East 5.43, and our top region had 7.38. The

opportunities, therefore, are immense. Even

if we get to eight products per retail bank

household, we still have room to grow. We

believe the average American household has

between 14 and 16 financial services products.

In Wholesale Banking, we’re building on

strong relationships with existing customers

and developing relationships with new

customers. Our loans in this important segment

grew 8percent in 2011. Our Commercial

Banking business has increased loans for

17straight months.

We also bought commercial portfolios

with favorable risk-reward characteristics

in 2011, including approximately $4billion

of U.S.-based commercial real estate loans,

and made a number of other acquisitions,

expanding our product lines. Weserve the

treasury management, investment banking,

and international needs of more than 28,000

relationships with middle-market and large

corporate businesses, governments, and

institutions worldwide.

We see huge growth opportunities in our

Wealth, Brokerage and Retirement segment.

Only one of about every 10 of our banking

households has an investment relationship

with us. More than 5million auent banking

households don’t have investment products

with us, but they have nearly $2trillion in

investable assets. Increasing cross-sell only

5percent with these customers could generate

$600million in annual revenue. Our more

than 15,000 financial advisors have their work

cut out for them. They’re eager to earn all our

customers’ business. If you’re a WellsFargo

customer with investable assets, we look

forward to talking toyousoon.

Growing revenue comes down to how well

our team can help our customers succeed, one

customer at a time. In Scottsdale, Ariz., for

example, our financial advisors and private

bankers worked together to help a customer

open a $1million line of credit to help his

business meet its short-term capital needs.

1Please see the “Financial Review – Capital Management” section

in this Report for more information.