Wells Fargo 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings Performance (continued)

Operating Segment Results

We are organized for management reporting purposes into three

operating segments: Community Banking; Wholesale Banking;

and Wealth, Brokerage and Retirement. These segments are

defined by product type and customer segment and their results

are based on our management accounting process, for which

there is no comprehensive, authoritative financial accounting

guidance equivalent to generally accepted accounting principles

(GAAP). In fourth quarter 2010, we aligned certain lending

businesses into Wholesale Banking from Community Banking to

reflect our previously announced restructuring of Wells Fargo

Financial.

In first quarter 2011, we realigned a private equity

business into Wholesale Banking from Community Banking.

Prior

periods have been revised to reflect these changes. Table 9

and the following discussion present our results by operating

segment. For a more complete description of our operating

segments, including additional financial information and the

underlying management accounting process, see Note 24

(Operating Segments) to Financial Statements in this Report.

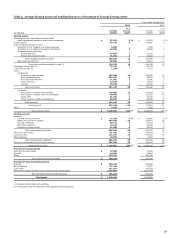

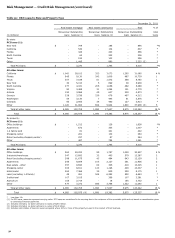

Table 9: Operating Segment Results – Highlights

Year ended December 31,

Wealth, Brokerage

(in billions)

Community Banking

Wholesale Banking

and Retirement

2011

2010

2011

2010

2011

2010

Revenue

$

50.7

54.5

21.7

22.4

12.2

11.7

Net income

9.1

7.0

7.0

5.9

1.3

1.0

Average loans

498.1

530.1

249.1

230.5

43.0

43.0

Average core deposits

556.2

536.4

202.1

170.0

130.4

121.2

Community Banking offers a complete line of diversified

financial products and services for consumers and small

businesses including investment, insurance and trust services in

39 states and D.C., and mortgage and home equity loans in all

50 states and D.C. through its Regional Banking and Wells Fargo

Home Mortgage business units.

Community Banking reported net income of $9.1 billion and

revenue of $50.7 billion in 2011. Revenue decreased $3.8 billion,

or 7%, from 2010 due to reduced mortgage banking income,

lower yields on investment securities and expected reductions in

the non-strategic and liquidating loan portfolios, partially offset

by long-term debt run-off and lower deposit costs. Net interest

income decreased $2.3 billion, or 7%, from 2010, mostly due to

lower average loans (down $32.0 billion from 2010) as a result

of planned run-off in the non-strategic and liquidating loan

portfolios (including home equity and Pick-A-Pay), loan

repricing at lower rates, and lower yields on our investment

securities. This decline in interest income was mitigated by long-

term debt run-off and continued low funding costs. Average core

deposits increased $19.8 billion, or 4%, from 2010, as growth in

liquid deposits more than offset maturities of higher yielding

certificates of deposit. The number of consumer checking

accounts grew 3.2% from December 31, 2010. Noninterest

income decreased $1.5 billion, or 7%, from 2010, mainly due to

lower volume-related mortgage banking income and lower

deposit service charges as a result of the third quarter 2010

implementation of Regulation E, partially offset by lower other

than temporary impairments. Noninterest expense decreased

$837 million, or 3%, from 2010, due to reduced expenses across

most categories, as well as a 2010 charitable donation expense of

$400 million. The provision for credit losses decreased

$5.8 billion from 2010 as credit quality in most of our consumer

and business loan portfolios continued to improve. Charge-offs

decreased $4.8 billion from 2010, reflecting improvement

primarily in the home equity, credit card, and small business

lending portfolios. Additionally, we released $2.4 billion of

allowance for credit losses in 2011, compared with $1.4 billion

released in 2010.

Wholesale Banking provides financial solutions across the

U.S. and globally to middle market and large corporate

customers with annual revenue generally in excess of

$20 million. Products and businesses include commercial

banking, investment banking and capital markets, securities

investment, government and institutional banking, corporate

banking, commercial real estate, treasury management, capital

finance, international, insurance, real estate capital markets,

commercial mortgage servicing, corporate trust, equipment

finance, asset backed finance, and asset management.

Wholesale Banking reported net income of $7.0 billion in

2011, up $1.1 billion, or 19%, from $5.9 billion in 2010. Average

loans of $249.1 billion increased $18.6 billion, or 8%, driven by

strong demand from both our domestic and international

customers. Average core deposits of $202.1 billion in 2011

increased $32.1 billion, or 19%, from 2010 reflecting continued

strong customer liquidity.

The year over year increase in net income was the result of a

decrease in the provision for credit losses and noninterest

expenses, which more than offset a decrease in revenue.

Revenue decreased $759 million, or 3%, from 2010, as broad-

based growth among many businesses, including strong loan

and deposit growth, was offset by lower PCI resolutions revenue,

lower sales and trading revenue, and lower crop insurance

revenue.

Total noninterest expense in 2011 decreased $75 million

compared with 2010 as lower operating losses and foreclosed

asset expenses were partially offset by higher personnel expense.

The provision for credit losses declined $2.0 billion from 2010,

and reflected a $1.6 billion improvement in net credit losses

along with a $950 million allowance release (compared with a

$561 million release in 2010).

Wholesale Banking’s 2011 financial results benefited from

loan portfolio acquisitions and strong borrowing demand across

40