Wells Fargo 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

forgiveness of forbearance amounts on existing loan

modifications – 40% credit;

earned forgiveness over no more than a 3 year period:

85% credit for LTV less than or equal to 175%; 45% credit for

forgiveness over 175% LTV;

second lien principal forgiveness: 90% credit for loans

90 days or less delinquent; 50% credit for loans greater than

90 but less than 180 days delinquent; 10% credit for loans

180 days more delinquent. Subject to a number of

requirements, servicers participating in the settlement will be

obligated to implement second lien principal forgiveness on

second mortgages it owns when another participating

servicer reduces principal on a first mortgage via its

proprietary non-HAMP modification programs (must

constitute at least 60% of the Consumer Relief Program

credits when combined with the first lien principal

forgiveness credits);

deficiency balance waivers on first and second lien loans:

10% credit;

short sale deficiency balance waivers on first and second lien

loans: 20% to 100% credit depending on whether the

servicer, servicer/lien holder or investor incurs the loss;

payment arrearages forgiveness for unemployed borrowers:

100% credit;

transitional funds paid to homeowners in connection with a

short sale or deed-in-lieu of foreclosure for payments in

excess of $1,500: 45% credit if a non-GSE investor bears the

cost or 100% if the servicer bears the cost;

anti-blight – forgiveness of principal associated with

properties where foreclosure is not pursued: 50% credit;

anti-blight – cash costs paid by servicer for property

demolition – 100% credit; and

anti-blight – donation of real estate owned properties to

qualifying recipients such as non-profit organizations:

100% credit.

Additionally, the Consumer Relief Program limits the total

amount of credits that may be applied toward the $3.4 billion

commitment from certain activities such as:

credits from deficiency balance waivers are limited to 10% of

credits under the Consumer Relief Program;

credits for forgiveness of forbearance are limited to 12.5% of

credits under the Consumer Relief Program; and

anti-blight provisions are limited to 12% of credits under the

Consumer Relief Program.

We will begin to receive credit towards satisfaction of the

requirements of the Consumer Relief Program for any activities

taken on or after March 1, 2012. We can also receive an

additional 25% credit for any first or second lien principal

reduction taken within one year from March 1, 2012. Because we

will not receive dollar-for-dollar credit for the relief provided in

some circumstances, the actual relief we provide to borrowers

will likely exceed our commitment. The terms also require that

we satisfy 75% of the commitments under the Consumer Relief

Program within two years from March 1, 2012. If we do not meet

this two-year requirement and also do not meet the entire

commitment within three years, we are required to pay an

amount equal to 140% of the unmet commitment amount. If we

meet the two-year commitment target, but do not meet the

entire commitment amount within the three years, we are

required to pay an amount equal to 125% of the unmet

commitment amount. We expect that we will be able to meet our

commitment (and state-level sub-commitments) on the

Consumer Relief Program within the required timeframes.

We expect to be able to meet our Consumer Relief Program

commitment primarily through our first and second lien

modification and short sale and other deficiency balance waiver

programs. We have evaluated our commitment along with the

menu of credits and believe that fulfilling our commitment

under the Consumer Relief Program has been appropriately

considered in our estimation for the allowance for loan losses as

well as our cash flow projections to evaluate the nonaccretable

difference for our PCI portfolios at December 31, 2011.

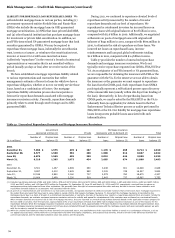

Refinance Program

The Refinance Program is intended for borrowers in good

standing who are not experiencing financial difficulty, but are

not able to take advantage of refinancing at lower rates to lower

their payments because they have little or negative equity in

their home. The terms of the pending settlement for the

Refinance Program require that we provide notification to

eligible borrowers indicating that they may refinance under the

program. The minimum eligibility criteria for the program are as

follows:

must be Wells Fargo owned first lien mortgage loan on

property that is occupied;

loan must be current with no delinquencies in the last

12 months;

must be fixed rate, adjustable rate, or interest-only

mortgages with an initial period of five years or more;

current LTV is greater than 100%;

loans originated prior to January 1, 2009;

loans must have a current interest rate of at least 5.25% or

100 basis points above the Freddie Mac current primary

mortgage market survey rate, whichever is greater;

the minimum difference between the current interest rate

and the offered interest rate under the Refinance Program

must be at least 25 basis points or there must be at least a

$100 reduction in monthly payment; and

the maximum unpaid principal balance must be below the

GSE lending limit applicable to the respective state where the

property is located.

Additionally, there are defined exclusions from the eligibility

criteria such as FHA/VA loans, properties outside the 50 states,

the District of Columbia and Puerto Rico, and loans for

borrowers who have been in bankruptcy or foreclosure anytime

in the prior 24 months. We are also permitted to extend the

Refinance Program to borrowers beyond the minimum eligible

population detailed above provided they have an LTV over 80%

and would not have qualified for a refinance under our other

offered refinance programs in existence as of

September 30, 2011. The structure of the refinanced loans can

vary to include interest rate reductions for the entire life of the

loan or, depending on current interest rates, a minimum of

75