Wells Fargo 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

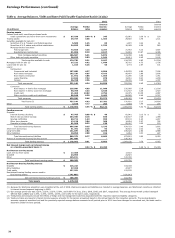

Earnings Performance (continued)

Table 6 allocates the changes in net interest income on a

taxable-equivalent basis to changes in either average balances or

average rates for both interest-earning assets and

interest-bearing liabilities. Because of the numerous

simultaneous volume and rate changes during any period, it is

not possible to precisely allocate such changes between volume

and rate. For this table, changes that are not solely due to either

volume or rate are allocated to these categories in proportion to

the percentage changes in average volume and average rate.

Table 6: Analysis of Changes in Net Interest Income

Year ended December 31,

2011 over 2010

2010 over 2009

(in millions)

Volume

Rate

Total

Volume

Rate

Total

Increase (decrease) in interest income:

Federal funds sold, securities purchased under resale

agreements and other short-term investments

$

89

26

115

148

(68)

80

Trading assets

363

(21)

342

349

(172)

177

Debt securities available for sale (1):

Securities of U.S. Treasury and federal agencies

62

(54)

8

(2)

(6)

(8)

Securities of U.S. states and political subdivisions

424

(181)

243

338

(198)

140

Mortgage-backed securities:

Federal agencies

135

(575)

(440)

(114)

(780)

(894)

Residential and commercial

9

(788)

(779)

(176)

(578)

(754)

Total mortgage-backed securities

144

(1,363)

(1,219)

(290)

(1,358)

(1,648)

Other debt securities

349

(510)

(161)

79

(268)

(189)

Total debt securities available for sale

979

(2,108)

(1,129)

125

(1,830)

(1,705)

Mortgages held for sale

24

(116)

(92)

(35)

(159)

(194)

Loans held for sale

(100)

57

(43)

(69)

(13)

(82)

Loans:

Commercial:

Commercial and industrial

373

(665)

(292)

(1,425)

968

(457)

Real estate mortgage

147

180

327

81

390

471

Real estate construction

(385)

389

4

(306)

167

(139)

Lease financing

(45)

(218)

(263)

(120)

(16)

(136)

Foreign

215

(311)

(96)

(36)

(139)

(175)

Total commercial

305

(625)

(320)

(1,806)

1,370

(436)

Consumer:

Real estate 1-4 family first mortgage

(440)

(676)

(1,116)

(150)

(636)

(786)

Real estate 1-4 family junior lien mortgage

(473)

(120)

(593)

(249)

(321)

(570)

Credit card

(120)

(73)

(193)

(123)

269

146

Other revolving credit and installment

(111)

(173)

(284)

(140)

(65)

(205)

Total consumer

(1,144)

(1,042)

(2,186)

(662)

(753)

(1,415)

Total loans

(839)

(1,667)

(2,506)

(2,468)

617

(1,851)

Other

(35)

31

(4)

(8)

29

21

Total increase (decrease) in interest income

481

(3,798)

(3,317)

(1,958)

(1,596)

(3,554)

Increase (decrease) in interest expense:

Deposits:

Interest-bearing checking

(13)

(19)

(32)

(13)

(15)

(28)

Market rate and other savings

112

(364)

(252)

224

(511)

(287)

Savings certificates

(252)

-

(252)

(729)

238

(491)

Other time deposits

(30)

(4)

(34)

(121)

8

(113)

Deposits in foreign offices

13

-

13

5

(28)

(23)

Total interest-bearing deposits

(170)

(387)

(557)

(634)

(308)

(942)

Short-term borrowings

9

(21)

(12)

(21)

(104)

(125)

Long-term debt

(1,227)

317

(910)

(1,209)

311

(898)

Other liabilities

122

(33)

89

65

(10)

55

Total increase (decrease) in interest expense

(1,266)

(124)

(1,390)

(1,799)

(111)

(1,910)

Increase (decrease) in net interest income

on a taxable-equivalent basis

$

1,747

(3,674)

(1,927)

(159)

(1,485)

(1,644)

(1)

Volume and rate amounts for 2010 over 2009 have been revised to reflect the use of amortized cost as the basis for calculating the change between periods.

36