Wells Fargo 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.include use of option pricing models, discounted cash flow

models and similar techniques.

In the determination of the classification of financial

instruments in Level 2 or Level 3 of the fair value hierarchy, we

consider all available information, including observable market

data, indications of market liquidity and orderliness, and our

understanding of the valuation techniques and significant inputs

used. For securities in inactive markets, we use a predetermined

percentage to evaluate the impact of fair value adjustments

derived from weighting both external and internal indications of

value to determine if the instrument is classified as Level 2 or

Level 3. Based upon the specific facts and circumstances of each

instrument or instrument category, judgments are made

regarding the significance of the Level 3 inputs to the

instruments' fair value measurement in its entirety. If Level 3

inputs are considered significant, the instrument is classified as

Level 3.

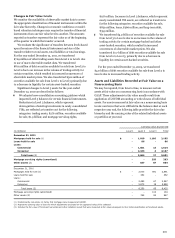

Determination of Fair Value

We base our fair values on the price that would be received to

sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement

date. We maximize the use of observable inputs and minimize

the use of unobservable inputs when developing fair value

measurements.

In instances where there is limited or no observable market

data, fair value measurements for assets and liabilities are based

primarily upon our own estimates or combination of our own

estimates and independent vendor or broker pricing, and the

measurements are often calculated based on current pricing for

products we offer or issue, the economic and competitive

environment, the characteristics of the asset or liability and

other such factors. As with any valuation technique used to

estimate fair value, changes in underlying assumptions used,

including discount rates and estimates of future cash flows,

could significantly affect the results of current or future values.

Accordingly, these fair value estimates may not be realized in an

actual sale or immediate settlement of the asset or liability.

We incorporate lack of liquidity into our fair value

measurement based on the type of asset or liability measured

and the valuation methodology used. For example, for certain

residential MHFS and certain securities where the significant

inputs have become unobservable due to illiquid markets and

vendor or broker pricing is not used, we use a discounted cash

flow technique to measure fair value. This technique

incorporates forecasting of expected cash flows (adjusted for

credit loss assumptions and estimated prepayment speeds)

discounted at an appropriate market discount rate to reflect the

lack of liquidity in the market that a market participant would

consider. For other securities where vendor or broker pricing is

used, we use either unadjusted broker quotes or vendor prices or

vendor or broker prices adjusted by weighting them with

internal discounted cash flow techniques to measure fair value.

These unadjusted vendor or broker prices inherently reflect any

lack of liquidity in the market, as the fair value measurement

represents an exit price from a market participant viewpoint.

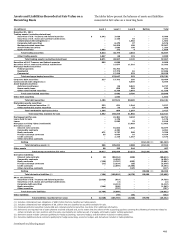

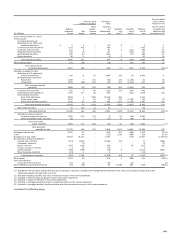

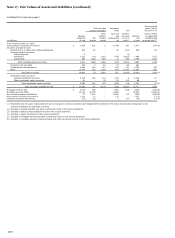

Following are descriptions of the valuation methodologies

used for assets and liabilities recorded at fair value on a

recurring or nonrecurring basis and for estimating fair value for

financial instruments not recorded at fair value.

Assets

SHORT-TERM FINANCIAL ASSETS

Short-term financial assets

include cash and due from banks, federal funds sold and

securities purchased under resale agreements and due from

customers on acceptances. These assets are carried at historical

cost. The carrying amount is a reasonable estimate of fair value

because of the relatively short time between the origination of

the instrument and its expected realization.

TRADING ASSETS (EXCLUDING DERIVATIVES) AND

SECURITIES AVAILABLE FOR SALE

Trading assets and

securities available for sale are recorded at fair value on a

recurring basis. Fair value measurement is based upon quoted

prices in active markets, if available. Such instruments are

classified within Level 1 of the fair value hierarchy. Examples

include exchange-traded equity securities and some highly liquid

government securities such as U.S. Treasuries. When

instruments are traded in secondary markets and quoted market

prices do not exist for such securities, we generally rely on

internal valuation techniques or on prices obtained from

independent pricing services or brokers (collectively, vendors) or

combination thereof.

Trading securities are mostly valued using trader prices that

are subject to internal price verification procedures. The

majority of fair values derived using internal valuation

techniques are verified against multiple pricing sources,

including prices obtained from independent vendors. Vendors

compile prices from various sources and often apply matrix

pricing for similar securities when no price is observable. We

review pricing methodologies provided by the vendors in order

to determine if observable market information is being used,

versus unobservable inputs. When we evaluate the

appropriateness of an internal trader price compared with

vendor prices, our considerations include the range and quality

of vendor prices. Vendor prices are used to ensure the

reasonableness of a trader price; however valuing financial

instruments involves judgments acquired from knowledge of a

particular market and is not perfunctory. If a trader asserts that

a vendor price is not reflective of market value, justification for

using the trader price, including recent sales activity where

possible, must be provided to and approved by the appropriate

levels of management.

Similarly, while securities available for sale traded in

secondary markets are typically valued using unadjusted vendor

prices or vendor prices adjusted by weighting them with internal

discounted cash flow techniques, these prices are reviewed and,

if deemed inappropriate by a trader who has the most knowledge

of a particular market, can be adjusted. Securities measured with

these internal valuation techniques are generally classified as

Level 2 of the hierarchy and often involve using quoted market

prices for similar securities, pricing models, discounted cash

flow analyses using significant inputs observable in the market

where available or combination of multiple valuation techniques.

Examples include certain residential and commercial MBS,

191