Wells Fargo 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.servicing rights (MSRs) valuation and increased our estimate of

losses for repurchases of serviced loans.

Wells Fargo net income was $15.9 billion and diluted

earnings per common share were $2.82 for 2011, both up 28%

from 2010. Our net income growth from 2010 was primarily

driven by a lower provision for credit losses and lower

noninterest expense, which more than offset lower revenues. Net

income growth from 2010 included contributions from each of

our three business segments: Community Banking (up 30%);

Wholesale Banking (up 19%); and Wealth, Brokerage and

Retirement (up 28%). Return on average assets was 1.25% for

2011, compared with 1.01% for 2010. Our return on equity was

11.93% in 2011, up from 10.33% in 2010.

On a year-over-year basis, revenue was down 5% in 2011,

predominantly reflecting decreased interest income on securities

available for sale and loans due to lower yields as market rates

declined. The decline in revenue was also affected by lower

mortgage banking noninterest income as a result of lower

originations and higher servicing-related costs caused by the

regulatory consent orders and other mortgage-related regulatory

matters as well as lower net gains from trading activities. These

decreases in revenue were partially offset by increased interest

income on trading assets and decreased interest expense.

Noninterest expense was down 2% from 2010 reflecting the

benefit of reduced merger integration costs and lower foreclosed

asset expense.

We believe loan and deposit growth have positioned us for

continued improvement in financial performance. Total loans

were $769.6 billion at December 31, 2011, up from $757.3 billion

at December 31, 2010, and averaged $757.1 billion for 2011

compared with $770.6 billion for 2010. The net growth in loans

from December 31, 2010, included the consolidation of

$5.6 billion of reverse mortgage loans previously sold as well as

the purchases with a period end balance of $3.6 billion of U.S.-

based commercial real estate (CRE), offset by a $21.0 billion

decrease in our non-strategic and liquidating loan portfolios.

Our core deposits totaled $872.6 billion at December 31, 2011,

up 9% from December 31, 2010, and our average core deposits

grew 7% from 2010 to $826.7 billion for 2011. Average core

deposits were 109% of average loans for 2011, up from 100% for

2010. We continued to attract high quality core deposits in the

form of checking and savings deposits, which on average totaled

$757.0 billion, up 11% from 2010 as we added new customers

and deepened our relationships with existing customers. Average

core checking and savings deposits were 92% of average core

deposits, up from 89% for 2010.

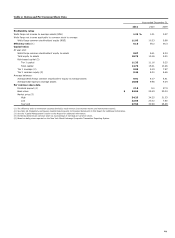

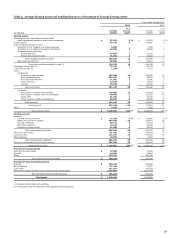

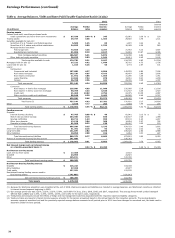

Table 1 provides a six-year summary of selected financial

data and Table 2 presents key ratios and per common share data.

Credit Quality

As in 2010, we again experienced credit improvement during

2011 in our loan portfolios with lower net charge-offs and

improved or stable delinquency trends. The rate of improvement

moderated in some portfolios during the latter half of 2011,

consistent with our expectations at this point in the credit cycle.

The improvement in our credit portfolio was due in part to the

continued decline in balances in our non-strategic and

liquidating loan portfolios (primarily from the Wachovia

acquisition), which decreased $21.0 billion during 2011, and

$78.5 billion in total since the beginning of 2009, to

$112.3 billion at December 31, 2011.

Reflecting the continued improved credit performance in our

loan portfolios, the $7.9 billion provision for credit losses for

2011 was $7.9 billion less than a year ago. The 2011 provision for

credit losses was $3.4 billion less than net charge-offs, compared

with $2.0 billion less for 2010. Absent significant deterioration

in the economy, we expect future allowance releases in 2012,

although at more modest levels. Since first quarter 2010 net

charge-offs have decreased every quarter until fourth quarter

2011 when they were essentially flat compared with third quarter

2011. Nonperforming assets (NPAs) have decreased every

quarter since their peak in third quarter 2010. Net charge-offs

totaled $11.3 billion for 2011, compared with $17.8 billion for

2010. NPAs decreased to $26.0 billion at December 31, 2011,

from $32.3 billion at December 31, 2010. Loans 90 days or more

past due and still accruing (excluding government

insured/guaranteed loans) decreased to $2.0 billion at

December 31, 2011, from $2.6 billion at December 31, 2010. In

addition, our portfolio of purchased credit-impaired (PCI) loans

continued to perform better than expected at the time of

acquisition.

Capital

We continued to build capital in 2011, with total equity up

$13.8 billion to $141.7 billion from December 31, 2010. Our Tier

1 common equity ratio grew 116 basis points during 2011 to

9.46% of risk-weighted assets under Basel I, reflecting strong

internal capital generation. Based on our interpretation of

current Basel III capital proposals, we estimate that our Tier 1

common equity ratio was 7.50% at the end of 2011. Our other

regulatory capital ratios remained strong with a Tier 1 capital

ratio of 11.33% and Tier 1 leverage ratio of 9.03% at

December 31, 2011. See the “Capital Management” section in this

Report for more information regarding our capital, including

Tier 1 common equity.

During 2011 we redeemed $9.2 billion of trust preferred

securities that carried a higher cost than other funding sources

available to us, repurchased approximately 80 million shares of

our common stock and entered into two separate $150 million

private forward repurchase transactions. The first transaction

settled in fourth quarter 2011 for approximately 6 million shares

of common stock and the second transaction settled in first

quarter 2012 for approximately 6 million shares of common

stock. We also paid common stock dividends of $0.12 per share

each quarter in 2011.

27