Wells Fargo 2011 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

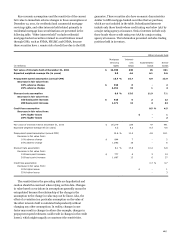

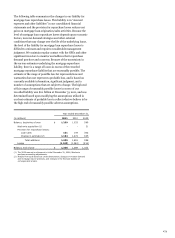

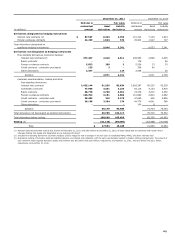

For our goodwill impairment analysis, we allocate all of the

goodwill to the individual operating segments. We identify

reporting units that are one level below an operating segment

(referred to as a component), and distinguish these reporting

units based on how the segments and components are managed,

taking into consideration the economic characteristics, nature of

the products and customers of the components. We allocate

goodwill to reporting units based on relative fair value, using

certain performance metrics. See Note 24 for further

information on management reporting.

The following table shows the allocation of goodwill to our

operating segments for purposes of goodwill impairment testing.

The reduction in 2010 was predominately due to reversals of

excess exit reserves.

Wealth,

Community

Wholesale

Brokerage and

Consolidated

(in millions)

Banking

Banking

Retirement

Company

December 31, 2009

$

17,974

6,465

373

24,812

Goodwill from business combinations, net

(52)

10

-

(42)

December 31, 2010

17,922

6,475

373

24,770

Reduction in goodwill related to divested businesses

-

(9)

(2)

(11)

Goodwill from business combinations

2

354

-

356

December 31, 2011

$

17,924

6,820

371

25,115

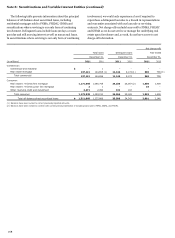

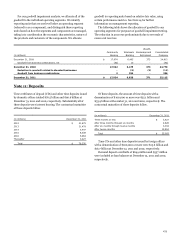

Note 11: Deposits

Time certificates of deposit (CDs) and other time deposits issued

by domestic offices totaled $76.5 billion and $90.6 billion at

December 31, 2011 and 2010, respectively. Substantially all of

these deposits were interest bearing. The contractual maturities

of these deposits follow.

(in millions)

December 31, 2011

2012

$

31,675

2013

21,479

2014

5,447

2015

8,538

2016

5,964

Thereafter

3,427

Total

$

76,530

Of these deposits, the amount of time deposits with a

denomination of $100,000 or more was $25.1 billion and

$33.9 billion at December 31, 2011 and 2010, respectively. The

contractual maturities of these deposits follow.

(in millions)

December 31, 2011

Three months or less

$

3,427

After three months through six months

2,828

After six months through twelve months

3,034

After twelve months

15,804

Total

$

25,093

Time CDs and other time deposits issued by foreign offices

with a denomination of $100,000 or more were $13.6 billion and

$16.7 billion at December 31, 2011 and 2010, respectively.

Demand deposit overdrafts of $649 million and $557 million

were included as loan balances at December 31, 2011 and 2010,

respectively.

175