Wells Fargo 2011 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

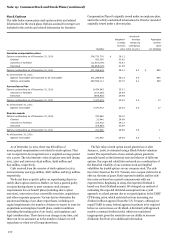

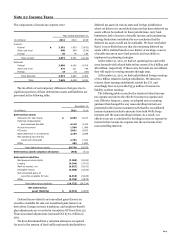

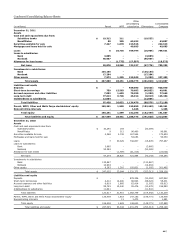

Note 21: Income Taxes (continued)

December 31,

2011

2010

2009

(in millions)

Amount

Rate

Amount

Rate

Amount

Rate

Statutory federal income tax expense and rate

$

8,160

35.0

%

$

6,545

35.0

%

$

6,162

35.0

%

Change in tax rate resulting from:

State and local taxes on income, net of

federal income tax benefit

730

3.1

586

3.1

468

2.7

Tax-exempt interest

(334)

(1.4)

(283)

(1.5)

(260)

(1.5)

Excludable dividends

(247)

(1.1)

(258)

(1.3)

(253)

(1.4)

Tax credits

(735)

(3.2)

(577)

(3.1)

(533)

(3.0)

Life insurance

(222)

(1.0)

(223)

(1.2)

(257)

(1.5)

Leveraged lease tax expense

272

1.2

461

2.5

400

2.3

Other (1)

(179)

(0.7)

87

0.4

(396)

(2.3)

Effective income tax expense and rate

$

7,445

31.9

%

$

6,338

33.9

%

$

5,331

30.3

%

(1) Includes other deductible dividends of $(57) million for 2011, $(33) million for 2010, and $(29) million for 2009.

The effective tax rate for 2011 decreased primarily due to tax

benefits from the realization for tax purposes of a previously

written down investment, a decrease in tax expense associated

with leveraged leases, as well as tax benefits related to charitable

donations of appreciated securities.

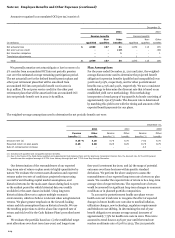

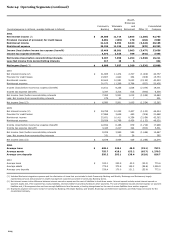

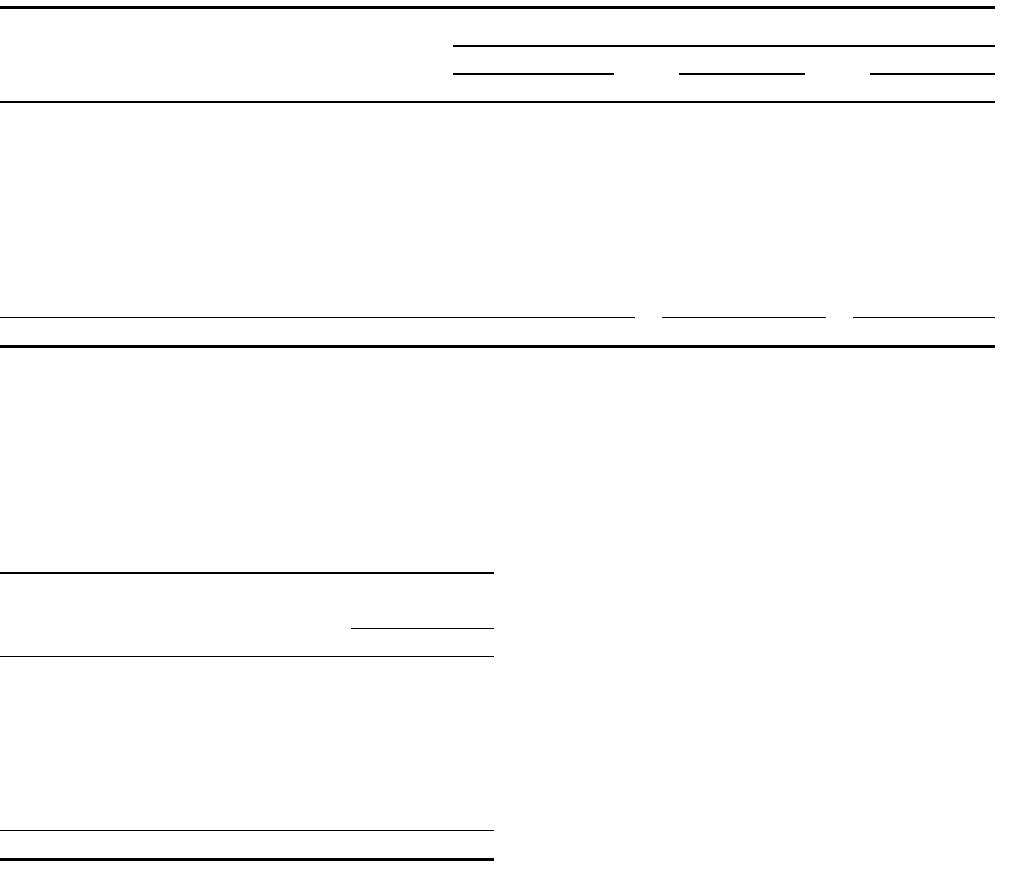

The change in unrecognized tax benefits follows:

Year ended

December 31,

(in millions)

2011

2010

Balance at beginning of year

$

5,500

4,921

Additions:

For tax positions related to the current year

279

579

For tax positions related to prior years

255

301

Reductions:

For tax positions related to prior years

(358)

(111)

Lapse of statute of limitations

(75)

(148)

Settlements with tax authorities

(596)

(42)

Balance at end of year

$

5,005

5,500

Of the $5.0 billion of unrecognized tax benefits at

December 31, 2011, approximately $3.3 billion would, if

recognized, affect the effective tax rate. The remaining

$1.7 billion of unrecognized tax benefits relates to income tax

positions on temporary differences.

We recognize interest and penalties as a component of

income tax expense. As of December 31, 2011 and 2010, we have

accrued approximately $871 million and $870 million for the

payment of interest and penalties, respectively. We recognized in

income tax expense in 2011 and 2010, interest and penalties of

$32 million and $45 million, respectively.

We are subject to U.S. federal income tax as well as income

tax in numerous state and foreign jurisdictions. With few

exceptions, Wells Fargo and its subsidiaries are not subject to

federal, state, local and foreign income tax examinations for

taxable years prior to 2007; and Wachovia Corporation and its

subsidiaries are not subject to federal, state, local and foreign

income tax examinations for taxable years prior to 2006.

We are routinely examined by tax authorities in various

jurisdictions. The IRS is currently examining the 2007 through

2010 consolidated federal income tax returns of Wells Fargo &

Company and its subsidiaries. We are also litigating or appealing

various issues related to our prior IRS examinations for the

periods 1999 and 2003 through 2006. For Wachovia’s 2003

through 2008 tax years, we are appealing various issues related

to their IRS examinations. We have paid the IRS the contested

income tax associated with these issues and refund claims have

been filed for the respective years. In addition, we are currently

subject to examination by various state, local and foreign taxing

authorities. While it is possible that one or more of these

examinations may be resolved within the next twelve months, we

do not anticipate that there will be a significant impact to our

unrecognized tax benefits as a result of these examinations.

During 2010, we filed a Notice of Appeal to the U.S. Court of

Appeals for the Federal Circuit in connection with the adverse

judgment of the U.S. Court of Federal Claims related to certain

leveraged lease transactions that we entered into between 1997

and 2002. On April 15, 2011, the Federal Circuit affirmed the

decision of the Court of Federal Claims. There was no adverse

financial statement impact resulting from the Federal Circuit’s

decision.

On September 30, 2011, we received an adverse decision from

the U.S. District Court for the District of Minnesota in WFC

Holdings Corp. v. United States, a case involving a lease

restructuring transaction. There was no adverse financial

statement impact from the decision. On December 1, 2011, we

filed a Notice of Appeal to the U.S. Court of Appeals for the

Eighth Circuit.

We estimate that our unrecognized tax benefits will not

change significantly during the next 12 months.

220