Wells Fargo 2011 Annual Report Download - page 172

Download and view the complete annual report

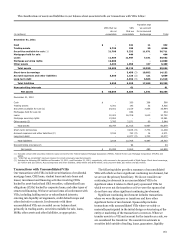

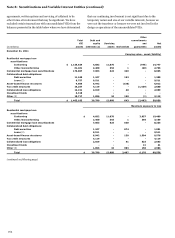

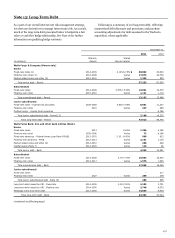

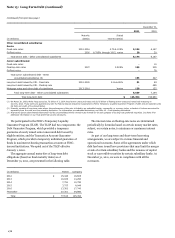

Please find page 172 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 8: Securitizations and Variable Interest Entities (continued)

investors. Other than this limited contractual support, the assets

of the VIEs are the sole source of repayment of the securities

held by third parties. The liquidity support we provide to the

multi-seller commercial paper conduit ensures timely repayment

of commercial paper issued by the conduit and is described

further below.

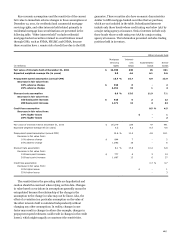

NONCONFORMING RESIDENTIAL MORTGAGE LOAN

SECURITIZATIONS

We have consolidated certain of our

nonconforming residential mortgage loan securitizations in

accordance with consolidation accounting guidance. We have

determined we are the primary beneficiary of these

securitizations because we have the power to direct the most

significant activities of the entity through our role as primary

servicer and also hold variable interests that we have determined

to be significant. The nature of our variable interests in these

entities may include beneficial interests issued by the VIE,

mortgage servicing rights and recourse or repurchase reserve

liabilities. The beneficial interests issued by the VIE that we hold

include either subordinate or senior securities held in an amount

that we consider potentially significant.

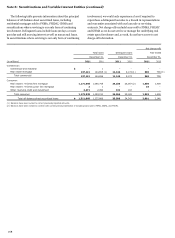

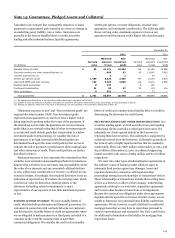

MULTI-SELLER COMMERCIAL PAPER CONDUIT

We administer

a multi-seller asset-based commercial paper conduit that

finances certain client transactions. This conduit is a bankruptcy

remote entity that makes loans to, or purchases certificated

interests, generally from SPEs, established by our clients

(sellers) and which are secured by pools of financial assets. The

conduit funds itself through the issuance of highly rated

commercial paper to third party investors. The primary source of

repayment of the commercial paper is the cash flows from the

conduit’s assets or the re-issuance of commercial paper upon

maturity. The conduit’s assets are structured with deal-specific

credit enhancements generally in the form of

overcollateralization provided by the seller, but may also include

subordinated interests, cash reserve accounts, third party credit

support facilities and excess spread capture. The timely

repayment of the commercial paper is further supported by

asset-specific liquidity facilities in the form of liquidity asset

purchase agreements that we provide. Each facility is equal to

102% of the conduit’s funding commitment to a client. The

aggregate amount of liquidity must be equal to or greater than

all the commercial paper issued by the conduit. At the discretion

of the administrator, we may be required to purchase assets

from the conduit at par value plus accrued interest or discount

on the related commercial paper, including situations where the

conduit is unable to issue commercial paper. Par value may be

different from fair value.

We receive fees in connection with our role as administrator

and liquidity provider. We may also receive fees related to the

structuring of the conduit’s transactions. In 2010, the conduit

terminated its subordinated note to a third party investor and

repaid all amounts due under the terms of the note agreement.

We are the primary beneficiary of the conduit because we have

power over the significant activities of the conduit and have a

significant variable interest due to our liquidity arrangement.

INVESTMENT FUNDS

We have consolidated certain of our

investment funds where we manage the assets of the fund and

our interests absorb a majority of the funds’ variability. In 2011,

we redeemed our interest in an unconsolidated investment fund

and placed the assets received upon redemption into new VIEs.

We consolidate these VIEs because we have discretion over the

management of the assets and are the sole investor in these

funds.

170