Wells Fargo 2011 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

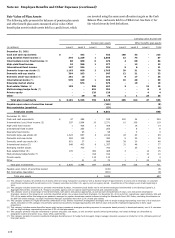

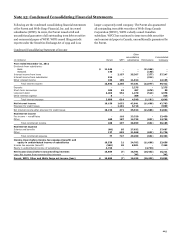

Note 20: Employee Benefits and Other Expenses (continued)

party appraisers. Market values are estimates and the actual

market price of the real estate can only be determined by

negotiation between independent third parties in a sales

transaction. Also includes investments in exchange-traded

equity securities described above.

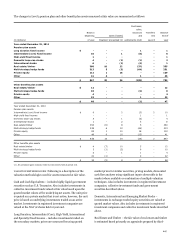

Multi-Strategy Hedge Funds and Private Equity – the fair values

of hedge funds are valued based on the proportionate share of

the underlying net assets of the investment funds that comprise

the fund, based on valuations supplied by the underlying

investment funds. Investments in private equity funds are valued

at the NAV provided by the fund sponsor. Market values are

estimates and the actual market price of the investments can

only be determined by negotiation between independent third

parties in a sales transaction.

Other – the fair values of miscellaneous investments are valued

at the NAV provided by the fund sponsor. Market values are

estimates and the actual market price of the investments can

only be determined by negotiation between independent third

parties in a sales transaction. Also includes insurance contracts

that are generally stated at cash surrender value.

The methods described above may produce a fair value

calculation that may not be indicative of net realizable value or

reflective of future fair values. While we believe our valuation

methods are appropriate and consistent with other market

participants, the use of different methodologies or assumptions

to determine the fair value of certain financial instruments could

result in a different fair value measurement at the reporting

date.

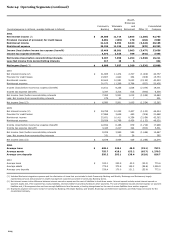

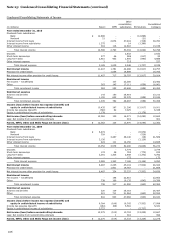

Defined Contribution Retirement Plans

We sponsor a defined contribution retirement plan named the

Wells Fargo & Company 401(k) Plan (401(k) Plan). The

Wachovia Savings Plan was acquired December 31, 2008, and

merged with the 401(k) Plan effective December 31, 2009. We

also sponsored a frozen defined contribution plan, the A.G.

Edwards, Inc. Retirement & Profit Sharing Plan (“AGE Plan”),

which resulted from a company acquired by Wachovia. The AGE

Plan merged with the 401(k) Plan on July 1, 2011. Under the

401(k) Plan, after one month of service, eligible employees may

contribute up to 50% of their certified compensation, although

there may be a lower limit for certain highly compensated

employees in order to maintain the qualified status of the 401(k)

Plan. Eligible employees who complete one year of service are

eligible for company matching contributions, which are generally

dollar for dollar up to 6% of an employee's certified

compensation. Effective January 1, 2010, previous and future

matching contributions are 100% vested for active participants.

In 2009, the 401(k) Plan was amended to permit us to make

discretionary profit sharing contributions. Based on 2011, 2010

and 2009 earnings, we committed to make a contribution in

shares of common stock to eligible employees’ 401(k) Plan

accounts equaling 2% of certified compensation for 2011 and

2010, and 1% of certified compensation for 2009, respectively,

which resulted in recognizing $311 million, $316 million and

$150 million of defined contribution retirement plan expense

recorded in 2011, 2010 and 2009, respectively. Total defined

contribution retirement plan expenses were $1,104 million,

$1,092 million and $862 million in 2011, 2010 and 2009,

respectively.

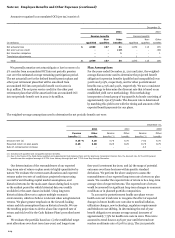

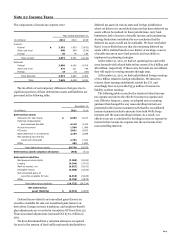

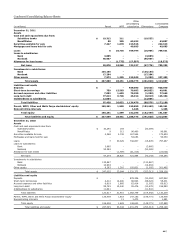

Other Expenses

Expenses exceeding 1% of total interest income and noninterest

income in any of the years presented that are not otherwise

shown separately in the financial statements or Notes to

Financial Statements were:

Year ended December 31,

(in millions)

2011

2010

2009

Outside professional services

$

2,692

2,370

1,982

Contract services

1,407

1,642

1,088

Foreclosed assets

1,354

1,537

1,071

Operating losses

1,261

1,258

875

Outside data processing

935

1,046

1,027

Postage, stationery and supplies

942

944

933

Insurance

515

464

845

218