Wells Fargo 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

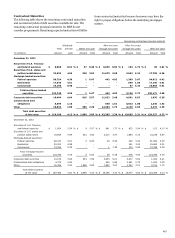

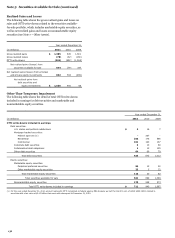

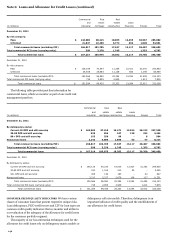

Contractual Maturities

The following table shows the remaining contractual maturities

and contractual yields of debt securities available for sale. The

remaining contractual principal maturities for MBS do not

consider prepayments. Remaining expected maturities will differ

from contractual maturities because borrowers may have the

right to prepay obligations before the underlying mortgages

mature.

Remaining contractual principal maturity

Weighted-

After one year

After five years

Total

average

Within one year

through five years

through ten years

After ten years

(in millions)

amount

yield

Amount

Yield

Amount

Yield

Amount

Yield

Amount

Yield

December 31, 2011

Securities of U.S. Treasury

and federal agencies

$

6,968

0.91

%

$

57

0.48

%

$

6,659

0.84

%

$

194

2.73

%

$

58

3.81

%

Securities of U.S. states and

political subdivisions

32,593

4.94

520

3.02

11,679

2.90

2,692

5.31

17,702

6.28

Mortgage-backed securities:

Federal agencies

96,754

4.39

1

6.47

442

4.02

1,399

3.07

94,912

4.42

Residential

17,836

4.51

-

-

-

-

640

1.88

17,196

4.61

Commercial

18,150

5.40

-

-

-

-

87

3.33

18,063

5.41

Total mortgage-backed

securities

132,740

4.55

1

6.47

442

4.02

2,126

2.72

130,171

4.58

Corporate debt securities

18,404

4.64

815

5.57

11,022

3.40

4,691

6.67

1,876

6.38

Collateralized debt

obligations

8,599

1.10

-

-

540

1.61

6,813

1.00

1,246

1.42

Other

19,892

1.89

506

2.29

12,963

1.75

3,149

2.04

3,274

2.29

Total debt securities

at fair value

$

219,196

4.12

%

$

1,899

3.85

%

$

43,305

2.36

%

$

19,665

3.31

%

$

154,327

4.72

%

December 31, 2010

Securities of U.S. Treasury

and federal agencies

$

1,604

2.54

%

$

9

5.07

%

$

641

1.72

%

$

852

2.94

%

$

102

4.15

%

Securities of U.S. states and

political subdivisions

18,654

5.99

322

3.83

3,210

3.57

1,884

6.13

13,238

6.60

Mortgage-backed securities:

Federal agencies

82,037

5.01

5

6.63

28

6.58

420

5.23

81,584

5.00

Residential

20,203

4.98

-

-

-

-

341

3.20

19,862

5.01

Commercial

13,554

5.39

-

-

1

1.38

215

5.28

13,338

5.39

Total mortgage-backed

securities

115,794

5.05

5

6.63

29

6.38

976

4.53

114,784

5.05

Corporate debt securities

10,279

5.94

545

7.82

3,853

6.01

4,817

5.62

1,064

6.21

Collateralized debt obligations

4,778

0.80

-

-

545

0.88

2,581

0.72

1,652

0.90

Other

16,356

2.53

1,588

2.89

7,887

3.00

4,367

2.01

2,514

1.72

Total debt securities

at fair value

$

167,465

4.81

%

$

2,469

4.12

%

$

16,165

3.72

%

$

15,477

3.63

%

$

133,354

5.10

%

137