Wells Fargo 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

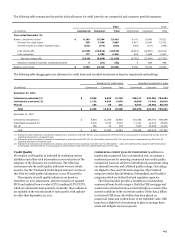

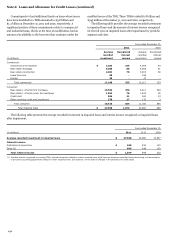

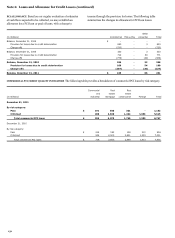

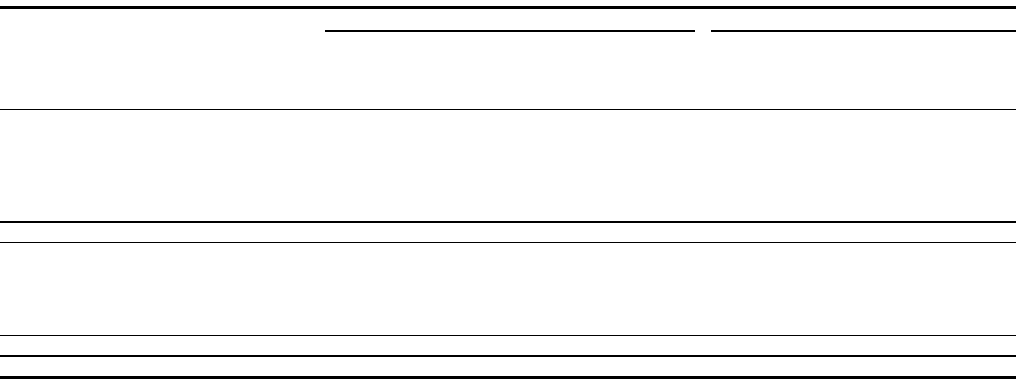

TROUBLED DEBT RESTRUCTURINGS (TDRs)

When, for

economic or legal reasons related to a borrower’s financial

difficulties, we grant a concession for other than an insignificant

period of time to a borrower that we would not otherwise

consider, the related loan is classified as a TDR. We do not

consider any loans modified through a loan resolution such as

foreclosure or short sale to be a TDR. The following table

summarizes how our loans were modified as TDRs in 2011,

including the financial effects of the modifications.

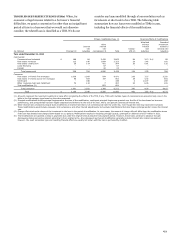

Primary modification type (1)

Financial effects of modifications

Weighted

Recorded

Other

average

investment

Interest

interest

interest

related to

rate

rate

Charge-

rate

interest rate

(in millions)

Principal (2)

reduction

concessions (3)

Total

offs (4)

reduction

reduction

Year ended December 31, 2011

Commercial:

Commercial and industrial

$

166

64

2,412

2,642

84

3.13

%

$

69

Real estate mortgage

113

146

1,894

2,153

24

1.46

160

Real estate construction

29

114

421

564

26

0.81

125

Lease financing

-

-

57

57

-

-

-

Foreign

-

-

22

22

-

-

-

Total commercial

308

324

4,806

5,438

134

1.55

354

Consumer:

Real estate 1-4 family first mortgage

1,629

1,908

934

4,471

293

3.27

3,322

Real estate 1-4 family junior lien mortgage

98

559

197

854

28

4.34

654

Credit card

-

336

-

336

2

10.77

260

Other revolving credit and installment

74

119

7

200

24

6.36

181

Trial modifications (5)

-

-

651

651

-

-

-

Total consumer

1,801

2,922

1,789

6,512

347

4.00

4,417

Total

$

2,109

3,246

6,595

11,950

481

3.82

%

$

4,771

(1) Amounts represent the recorded investment in loans after recognizing the effects of the TDR, if any. TDRs with multiple types of concessions are presented only once in the

table in the first category type based on the order presented.

(2) Principal modifications include principal forgiveness at the time of the modification, contingent principal forgiveness granted over the life of the loan based on borrower

performance, and principal that has been legally separated and deferred to the end of the loan, with a zero percent contractual interest rate.

(3) Other interest rate concessions include loans modified to an interest rate that is not commensurate with the credit risk, even though the rate may have been increased.

These modifications would include renewals, term extensions, and other interest adjustments, but exclude modifications that also forgive principal and/or reduce the interest

rate.

(4) Charge-offs include write-downs of the investment in the loan in the period of modification. In some cases, the amount of charge-offs will differ from the modification terms

if the loan has already been charged down based on our policies. Modifications resulted in forgiving principal (actual, contingent or deferred) of $577 million in 2011.

(5) Trial modifications are granted a delay in payments due under the original terms during the trial payment period. However, these loans continue to advance through

delinquency status and accrue interest according to their original terms. Any subsequent permanent modification generally includes interest rate related concessions;

however, the exact concession type and resulting financial effect are usually not known until the loan is permanently modified.

153