Wells Fargo 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

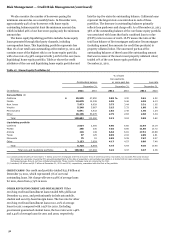

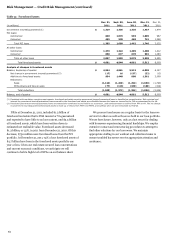

LOANS 90 DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans 90 days or more past due as to interest or principal are

still accruing if they are (1) well-secured and in the process of

collection or (2) real estate 1-4 family mortgage loans or

consumer loans exempt under regulatory rules from being

classified as nonaccrual until later delinquency, usually 120 days

past due. PCI loans of $8.7 billion, $11.6 billion and $16.1 billion

at December 31, 2011, 2010 and 2009, respectively, are excluded

from this disclosure even though they are 90 days or more

contractually past due. These PCI loans are considered to be

accruing due to the existence of the accretable yield and not

based on consideration given to contractual interest payments.

Excluding insured/guaranteed loans, loans 90 days or more

past due and still accruing at December 31, 2011, were down

$601 million, or 23%, from December 31, 2010. The decline was

due to loss mitigation activities including modifications and

increased collection capacity/process improvements, charge-

offs, lower early stage delinquency levels and credit stabilization.

Loans 90 days or more past due and still accruing whose

repayments are insured by the Federal Housing Administration

(FHA) or predominantly guaranteed by the Department of

Veterans Affairs (VA) for mortgages and the U.S. Department of

Education for student loans under the Federal Family Education

Loan Program were $20.5 billion at December 31, 2011, up from

$15.8 billion at December 31, 2010, due primarily to growth in

the FHA/VA portfolio over the past two years and the

subsequent seasoning of those loans.

Table 34 reflects non-PCI loans 90 days or more past due and

still accruing by class for loans not government

insured/guaranteed. For additional information on

delinquencies by loan class, see Note 6 (Loans and Allowance for

Credit Losses) to Financial Statements in this Report.

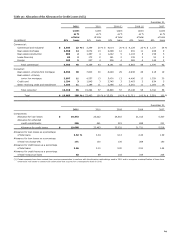

Table 34: Loans 90 Days or More Past Due and Still Accruing

December 31,

(in millions)

2011

2010

2009

2008

2007

Loans 90 days or more past due and still accruing:

Total (excluding PCI)

$

22,569

18,488

22,188

11,831

6,393

Less: FHA Insured/VA guaranteed (1)

19,240

14,733

15,336

8,185

4,834

Less: Student loans guaranteed under the FFELP (2)

1,281

1,106

994

765

333

Total, not government insured/guaranteed

$

2,048

2,649

5,858

2,881

1,226

By segment and class, not government insured/guaranteed:

Commercial:

Commercial and industrial

$

153

308

590

218

32

Real estate mortgage

256

104

1,014

70

10

Real estate construction

89

193

909

250

24

Foreign

6

22

73

34

52

Total commercial

504

627

2,586

572

118

Consumer:

Real estate 1-4 family first mortgage (3)

781

941

1,623

883

286

Real estate 1-4 family junior lien mortgage (3)

279

366

515

457

201

Credit card

346

516

795

687

402

Other revolving credit and installment

138

199

339

282

219

Total consumer

1,544

2,022

3,272

2,309

1,108

Total, not government insured/guaranteed

$

2,048

2,649

5,858

2,881

1,226

(1)

Represents loans whose repayments are insured by the FHA or guaranteed by the VA.

(2)

Represents loans whose repayments are predominantly guaranteed by agencies on behalf of the U.S. Department of Education under the Federal Family Education Loan

Program (FFELP).

(3)

Includes mortgages held for sale 90 days or more past due and still accruing.

65