Wells Fargo 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.services. There can be no assurance that continued protests and

negative publicity for the Company or large financial institutions

generally will not harm our reputation and adversely affect our

business and financial results.

Risks Relating to Legal Proceedings. Wells Fargo and some

of its subsidiaries are involved in judicial, regulatory and

arbitration proceedings or investigations concerning matters

arising from our business activities. Although we believe we have

a meritorious defense in all material significant litigation

pending against us, there can be no assurance as to the ultimate

outcome. We establish reserves for legal claims when payments

associated with the claims become probable and the costs can be

reasonably estimated. We may still incur legal costs for a matter

even if we have not established a reserve. In addition, the actual

cost of resolving a legal claim may be substantially higher than

any amounts reserved for that matter. The ultimate resolution of

a pending legal proceeding, depending on the remedy sought and

granted, could materially adversely affect our results of

operations and financial condition.

For more information, refer to Note 15 (Legal Actions) to

Financial Statements in this Report.

RISKS RELATED TO OUR INDUSTRY’S COMPETITIVE

OPERATING ENVIRONMENT

We face significant and increasing competition in the

rapidly evolving financial services industry. We compete

with other financial institutions in a highly competitive industry

that is undergoing significant changes as a result of financial

regulatory reform and increased public scrutiny stemming from

the recent financial crisis and continued challenging economic

conditions. Wells Fargo generally competes on the basis of the

quality of our customer service, the wide variety of products and

services that we can offer our customers and the ability of those

products and services to satisfy our customers’ needs, the pricing

of our products and services, the extensive distribution channels

available for our customers, our innovation, and our reputation.

Continued and increased competition in any one or all of these

areas may negatively affect our market share and results of

operations and/or cause us to increase our capital investment in

our businesses in order to remain competitive. Given the current

economic, regulatory, and political environment for large

financial institutions such as Wells Fargo, as well as increased

public protest movements and negative publicity, there is

increased competitive pressure to provide products and services

at current or lower prices. Consequently, our ability to reposition

or reprice our products and services from time to time may be

limited and could be influenced significantly by the actions of our

competitors who may or may not charge similar fees for their

products and services. Any changes in the types of products and

services that we offer our customers and/or the pricing for those

products and services could result in a loss of customers and

market share and could materially adversely affect our results of

operations.

Continued technological advances and the growth of e-

commerce have made it possible for non-depository institutions

to offer products and services that traditionally were banking

products, and for financial institutions and other companies to

provide electronic and internet-based financial solutions,

including electronic payment solutions. We may not respond

effectively to these competitive threats from existing and new

competitors and may be forced to increase our investment in our

business to modify or adapt our existing products and services or

develop new products and services to respond to our customers’

needs.

Our “cross-selling” efforts to increase the number of

products our customers buy from us and offer them all

of the financial products that fulfill their needs is a key

part of our growth strategy, and our failure to execute

this strategy effectively could have a material adverse

effect on our revenue growth and financial results.

Selling more products to our customers – “cross-selling” – is

very important to our business model and key to our ability to

grow revenue and earnings especially during the current

environment of slow economic growth and regulatory reform

initiatives. Many of our competitors also focus on cross-selling,

especially in retail banking and mortgage lending. This can limit

our ability to sell more products to our customers or influence us

to sell our products at lower prices, reducing our net interest

income and revenue from our fee-based products. It could also

affect our ability to keep existing customers. New technologies

could require us to spend more to modify or adapt our products

to attract and retain customers. Our cross-sell strategy also is

dependent on earning more business from our Wachovia

customers, and increasing our cross-sell ratio – or the average

number of products sold to existing customers – may become

more challenging and we might not attain our goal of selling an

average of eight products to each customer.

Our ability to attract and retain qualified team

members is critical to the success of our business and

failure to do so could adversely affect our business

performance, competitive position and future

prospects. The success of Wells Fargo is heavily dependent on

the talents and efforts of our team members, and in many areas

of our business, including the commercial banking, brokerage,

investment advisory, and capital markets businesses, the

competition for highly qualified personnel is intense. In order to

attract and retain highly qualified team members, we must

provide competitive compensation. As a large financial

institution we may be subject to limitations on compensation by

our regulators that may adversely affect our ability to attract and

retain these qualified team members. Some of our competitors

may not be subject to these same compensation limitations,

which may further negatively affect our ability to attract and

retain highly qualified team members.

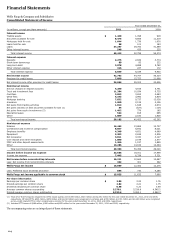

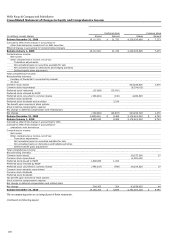

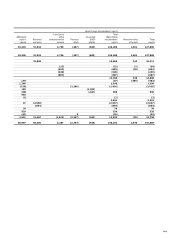

RISKS RELATED TO OUR FINANCIAL STATEMENTS

Changes in accounting policies or accounting

standards, and changes in how accounting standards

are interpreted or applied, could materially affect how

we report our financial results and condition. Our

accounting policies are fundamental to determining and

109