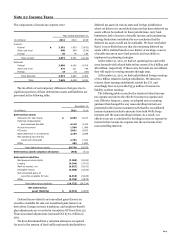

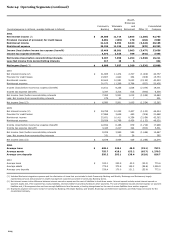

Wells Fargo 2011 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

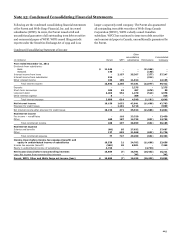

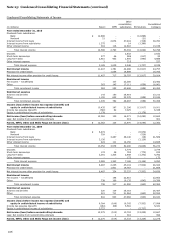

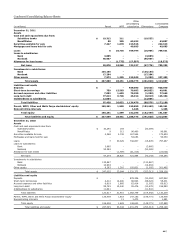

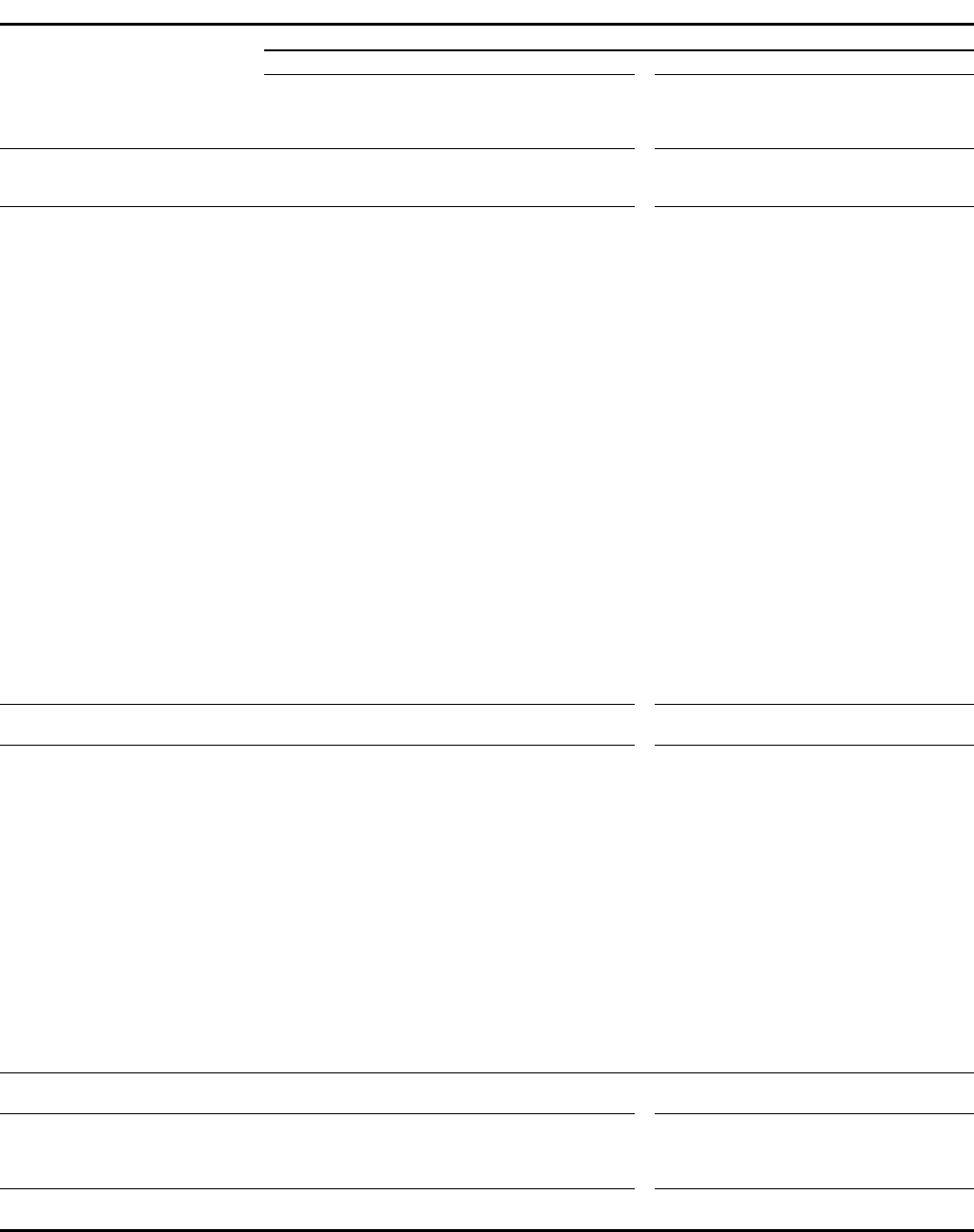

Note 25: Condensed Consolidating Financial Statements (continued)

Condensed Consolidating Statements of Cash Flows

Year ended December 31,

2011

2010

Other

Other

consolidating

consolidating

subsidiaries/

Consolidated

subsidiaries/

Consolidated

(in millions)

Parent

WFFI

eliminations

Company

Parent

WFFI

eliminations

Company

Cash flows from operating activities:

Net cash provided (used)

by operating activities

$

15,049

1,563

(2,947)

13,665

14,180

1,774

2,818

18,772

Cash flows from investing activities:

Securities available for sale:

Sales proceeds

11,459

1,946

9,657

23,062

2,441

796

5,431

8,668

Prepayments and maturities

-

294

52,324

52,618

-

229

47,690

47,919

Purchases

(16,487)

(1,086)

(103,662)

(121,235)

(119)

(1,037)

(52,310)

(53,466)

Loans:

Loans originated by banking

subsidiaries, net of principal

collected

-

(596)

(35,090)

(35,686)

-

(206)

16,075

15,869

Proceeds from sales (including

participations) of loans

originated for investment by

banking subsidiaries

-

-

6,555

6,555

-

-

6,517

6,517

Purchases (including participations)

of loans by banking

subsidiaries

-

-

(8,878)

(8,878)

-

-

(2,297)

(2,297)

Principal collected on nonbank

entities' loans

-

9,984

(202)

9,782

-

10,829

4,731

15,560

Loans originated by nonbank entities

-

(7,520)

(2)

(7,522)

-

(6,336)

(4,500)

(10,836)

Net repayments from

(advances to) subsidiaries

1,318

(81)

(1,237)

-

(5,485)

(842)

6,327

-

Capital notes and term loans

made to subsidiaries

(1,340)

-

1,340

-

-

-

-

-

Principal collected on notes/loans

made to subsidiaries

5,779

-

(5,779)

-

11,282

-

(11,282)

-

Net decrease (increase) in

investment in subsidiaries

(610)

-

610

-

1,198

-

(1,198)

-

Net cash paid for acquisitions

-

-

(353)

(353)

-

-

(36)

(36)

Other, net

230

210

46,173

46,613

15

64

(31,652)

(31,573)

Net cash provided (used)

by investing activities

349

3,151

(38,544)

(35,044)

9,332

3,497

(16,504)

(3,675)

Cash flows from financing activities:

Net change in:

Deposits

-

-

72,128

72,128

-

-

23,924

23,924

Short-term borrowings

(242)

1,013

(7,002)

(6,231)

1,860

4,118

5,330

11,308

Long-term debt:

Proceeds from issuance

7,058

513

4,116

11,687

1,789

-

1,700

3,489

Repayment

(31,198)

(6,029)

(13,328)

(50,555)

(23,281)

(9,478)

(30,558)

(63,317)

Preferred stock:

Proceeds from issuance

2,501

-

-

2,501

-

-

-

-

Cash dividends paid

(844)

-

-

(844)

(737)

-

-

(737)

Common stock warrants repurchased

(2)

-

-

(2)

(545)

-

-

(545)

Common stock:

Proceeds from issuance

1,296

-

-

1,296

1,375

-

-

1,375

Repurchased

(2,416)

-

-

(2,416)

(91)

-

-

(91)

Cash dividends paid

(2,537)

-

-

(2,537)

(1,045)

-

-

(1,045)

Excess tax benefits related to

stock option payments

79

-

-

79

98

-

-

98

Net change in noncontrolling interests:

Other

-

(11)

(320)

(331)

-

1

(593)

(592)

Net cash provided (used) by

financing activities

(26,305)

(4,514)

55,594

24,775

(20,577)

(5,359)

(197)

(26,133)

Net change in cash and

due from banks

(10,907)

200

14,103

3,396

2,935

(88)

(13,883)

(11,036)

Cash and due from banks

at beginning of year

30,249

366

(14,571)

16,044

27,314

454

(688)

27,080

Cash and due from banks

at end of year

$

19,342

566

(468)

19,440

30,249

366

(14,571)

16,044

228