Wells Fargo 2011 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

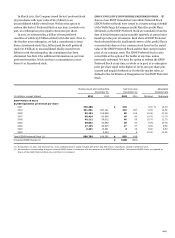

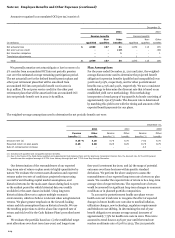

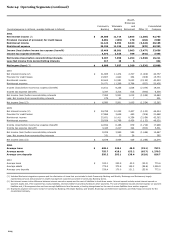

Note 20: Employee Benefits and Other Expenses (continued)

Amounts recognized in accumulated OCI (pre tax) consist of:

December 31,

2011

2010

Pension benefits

Pension benefits

Non-

Other

Non-

Other

(in millions)

Qualified

qualified

benefits

Qualified

qualified

benefits

Net actuarial loss

$

2,699

137

61

1,672

113

135

Net prior service credit

-

-

(27)

-

-

(30)

Net transition obligation

-

-

1

-

-

1

Translation adjustments

-

-

-

1

-

-

Total

$

2,699

137

35

1,673

113

106

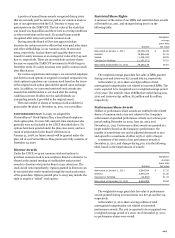

We generally amortize net actuarial gain or loss in excess of a

5% corridor from accumulated OCI into net periodic pension

cost over the estimated average remaining participation period.

The net actuarial loss for the defined benefit pension plans and

other post retirement plans that will be amortized from

accumulated OCI into net periodic benefit cost in 2012 is

$141 million. The net prior service credit for the other post

retirement plans that will be amortized from accumulated OCI

into net periodic benefit cost in 2012 is $2 million.

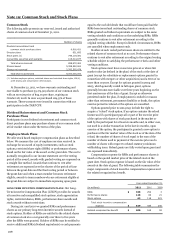

Plan Assumptions

For the years ended December 31, 2011 and 2010, the weighted-

average discount rate used to determine the projected benefit

obligation for pension benefits (qualified and nonqualified) was

5.00% and 5.25%, respectively, and for other postretirement

benefits was 4.75% and 5.25%, respectively. We use a consistent

methodology to determine the discount rate that is based on an

established yield curve methodology. This methodology

incorporates a broad group of top quartile Aa bonds consisting of

approximately 250-275 bonds. The discount rate is determined

by matching this yield curve with the timing and amounts of the

expected benefit payments for our plans.

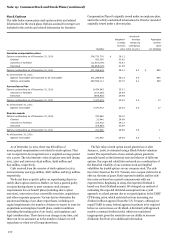

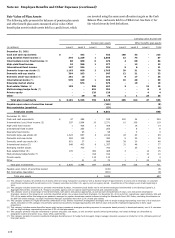

The weighted-average assumptions used to determine the net periodic benefit cost were:

December 31,

2011

2010

2009

Pension

Other

Pension

Other

Pension

Other

benefits (1)

benefits

benefits (1)

benefits

benefits (1)

benefits

Discount rate (2)

5.25

%

5.25

5.75

5.75

7.42

6.75

Expected return on plan assets

8.25

6.00

8.25

8.25

8.75

8.75

Rate of compensation increase

-

-

-

-

4.0

-

(1) Includes both qualified and nonqualified pension benefits.

(2) Due to the freeze of the Wells Fargo qualified and supplemental Cash Balance Plans and the Wachovia Corporation Pension Plan, the discount rate for the 2009 pension

benefits was the weighted average of 6.75% from January through April and 7.75% from May through December.

Our determination of the reasonableness of our expected

long-term rate of return on plan assets is highly quantitative by

nature. We evaluate the current asset allocations and expected

returns under two sets of conditions: projected returns using

several forward-looking capital market assumptions, and

historical returns for the main asset classes dating back to 1970

or the earliest period for which historical data was readily

available for the asset classes included. Using long term

historical data allows us to capture multiple economic

environments, which we believe is relevant when using historical

returns. We place greater emphasis on the forward-looking

return and risk assumptions than on historical results. We use

the resulting projections to derive a base line expected rate of

return and risk level for the Cash Balance Plans' prescribed asset

mix.

We evaluate the portfolio based on: (1) the established target

asset allocations over short term (one-year) and longer term

(ten-year) investment horizons, and (2) the range of potential

outcomes over these horizons within specific standard

deviations. We perform the above analyses to assess the

reasonableness of our expected long-term rate of return on plan

assets. We consider the expected rate of return to be a long-term

average view of expected returns. The expected rate of return

would be assessed for significant long-term changes in economic

conditions or in planned portfolio composition.

To account for postretirement health care plans we use

health care cost trend rates to recognize the effect of expected

changes in future health care costs due to medical inflation,

utilization changes, new technology, regulatory requirements

and Medicare cost shifting. In determining the end of year

benefit obligation we assume average annual increases of

approximately 7.75% for health care costs in 2012. This rate is

assumed to trend down 0.25% per year until the trend rate

reaches an ultimate rate of 5.0% in 2023. The 2011 periodic

214