Wells Fargo 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

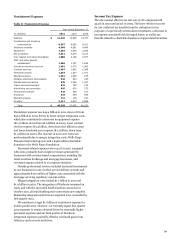

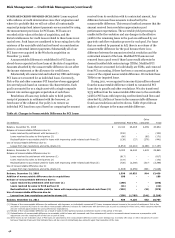

Noninterest Expense

Table 8: Noninterest Expense

Year ended December 31,

(in millions)

2011

2010

2009

Salaries

$

14,462

13,869

13,757

Commission and incentive

compensation

8,857

8,692

8,021

Employee benefits

4,348

4,651

4,689

Equipment

2,283

2,636

2,506

Net occupancy

3,011

3,030

3,127

Core deposit and other intangibles

1,880

2,199

2,577

FDIC and other deposit

assessments

1,266

1,197

1,849

Outside professional services

2,692

2,370

1,982

Contract services

1,407

1,642

1,088

Foreclosed assets

1,354

1,537

1,071

Operating losses

1,261

1,258

875

Postage, stationery and supplies

942

944

933

Outside data processing

935

1,046

1,027

Travel and entertainment

821

783

575

Advertising and promotion

607

630

572

Telecommunications

523

596

610

Insurance

515

464

845

Operating leases

112

109

227

All other

2,117

2,803

2,689

Total

$

49,393

50,456

49,020

Noninterest expense was $49.4 billion in 2011, down 2% from

$50.5 billion in 2010, driven by lower merger integration costs,

which also contributed to decreases in equipment expense

($2.3 billion, down from $2.6 billion in 2010), lower contract

services expense ($1.4 billion, down from $1.6 billion in 2010)

and lower foreclosed asset expense ($1.4 billion, down from

$1.5 billion in 2010). The increase in 2010 over 2009 was

predominantly due to merger integration costs, Wells Fargo

Financial restructuring costs and a $400 million charitable

donation to the Wells Fargo Foundation.

Personnel-related expenses were up 2% in 2011 compared

with 2010, primarily due to higher revenues generated by

businesses with revenue-based compensation, including the

retail securities brokerage and mortgage businesses, and

severance expense related to our expense initiative.

Outside professional services included increased investments

by our businesses in 2011 in their service delivery systems and

approximately $100 million of higher costs associated with the

mortgage servicing regulatory consent orders.

Merger integration costs totaled $1.7 billion in 2011 and

$1.9 billion in 2010. The integration of Wachovia remained on

track, and with the successful North Carolina conversion in

October 2011, all retail banking store conversions are complete.

Remaining integration activities are expected to be concluded by

first quarter 2012.

We continue to target $11 billion of noninterest expense for

fourth quarter 2012. However, we currently expect first quarter

2012 expenses to remain elevated driven by seasonally higher

personnel expenses and our final quarter of Wachovia

integration expenses, partially offset by continued gains from

efficiency and cost save initiatives.

Income Tax Expense

The 2011 annual effective tax rate was 31.9% compared with

33.9% in 2010 and 30.3% in 2009. The lower effective tax rate

for 2011 reflected tax benefits from the realization for tax

purposes of a previously written down investment, a decrease in

tax expense associated with leveraged leases, as well as tax

benefits related to charitable donations of appreciated securities.

39