Wells Fargo 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

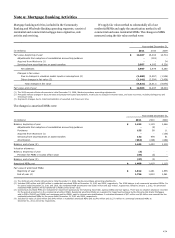

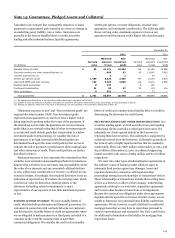

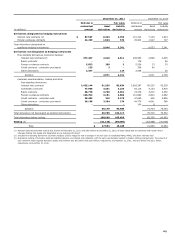

Note 14: Guarantees, Pledged Assets and Collateral

Guarantees are contracts that contingently require us to make

payments to a guaranteed party based on an event or a change in

an underlying asset, liability, rate or index. Guarantees are

generally in the form of standby letters of credit, securities

lending and other indemnifications, liquidity agreements,

written put options, recourse obligations, residual value

guarantees, and contingent consideration. The following table

shows carrying value, maximum exposure to loss on our

guarantees and the amount with a higher risk of performance.

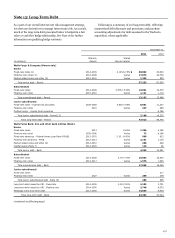

December 31,

2011

2010

Maximum

Non-

Maximum

Non-

Carrying

exposure

investment

Carrying

exposure

investment

(in millions)

value

to loss

grade

value

to loss

grade

Standby letters of credit

$

85

41,171

22,259

142

42,159

19,596

Securities lending and other indemnifications (1)

-

669

62

45

13,645

3,993

Liquidity agreements (2)

-

2

2

-

49

1

Written put options (2)(3)

1,469

8,224

2,466

747

8,134

2,615

Loans and MHFS sold with recourse

102

5,784

3,850

119

5,474

3,564

Residual value guarantees

8

197

-

8

197

-

Contingent consideration

31

98

97

23

118

116

Other guarantees

6

552

4

-

73

-

Total guarantees

$

1,701

56,697

28,740

1,084

69,849

29,885

(1) We commenced divestiture of our securities lending business in the latter half of 2011.

(2) Certain of these agreements included in this table are related to off-balance sheet entities and, accordingly, are also disclosed in Note 8.

(3) Written put options, which are in the form of derivatives, are also included in the derivative disclosures in Note 16.

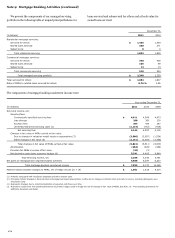

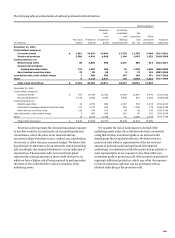

“Maximum exposure to loss” and “Non-investment grade” are

required disclosures under GAAP. Non-investment grade

represents those guarantees on which we have a higher risk of

being required to perform under the terms of the guarantee. If

the underlying assets under the guarantee are non-investment

grade (that is, an external rating that is below investment grade

or an internal credit default grade that is equivalent to a below

investment grade external rating), we consider the risk of

performance to be high. Internal credit default grades are

determined based upon the same credit policies that we use to

evaluate the risk of payment or performance when making loans

and other extensions of credit. These credit policies are further

described in Note 6.

Maximum exposure to loss represents the estimated loss that

would be incurred under an assumed hypothetical circumstance,

despite what we believe is its extremely remote possibility, where

the value of our interests and any associated collateral declines

to zero, without any consideration of recovery or offset from any

economic hedges. Accordingly, this required disclosure is not an

indication of expected loss. We believe the carrying value, which

is either fair value for derivative related products or the

allowance for lending related commitments, is more

representative of our exposure to loss than maximum exposure

to loss.

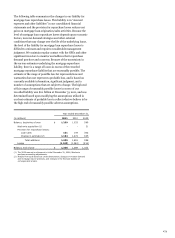

STANDBY LETTERS OF CREDIT

We issue standby letters of

credit, which include performance and financial guarantees, for

customers in connection with contracts between our customers

and third parties. Standby letters of credit are agreements where

we are obligated to make payment to a third party on behalf of a

customer in the event the customer fails to meet their

contractual obligations. We consider the credit risk in standby

letters of credit and commercial and similar letters of credit in

determining the allowance for credit losses.

SECURITIES LENDING AND OTHER INDEMNIFICATIONS

As a

securities lending agent, we lend securities from participating

institutional clients’ portfolios to third-party borrowers. We

indemnify our clients against default by the borrower in

returning these lent securities. This indemnity is supported by

collateral received from the borrowers. Collateral is generally in

the form of cash or highly liquid securities that are marked to

market daily. There was $687 million at December 31, 2011, and

$14.0 billion at December 31, 2010, in collateral supporting

loaned securities with values of $669 million and $13.6 billion,

respectively.

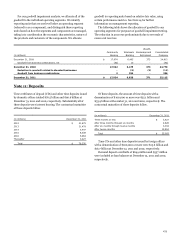

We enter into other types of indemnification agreements in

the ordinary course of business under which we agree to

indemnify third parties against any damages, losses and

expenses incurred in connection with legal and other

proceedings arising from relationships or transactions with us.

These relationships or transactions include those arising from

service as a director or officer of the Company, underwriting

agreements relating to our securities, acquisition agreements

and various other business transactions or arrangements.

Because the extent of our obligations under these agreements

depends entirely upon the occurrence of future events, we are

unable to determine our potential future liability under these

agreements. We do, however, record a liability for residential

mortgage loans that we may have to repurchase pursuant to

various representations and warranties. See Note 1 and Note 9

for additional information on the liability for mortgage loan

repurchase losses.

179