Wells Fargo 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

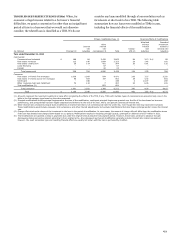

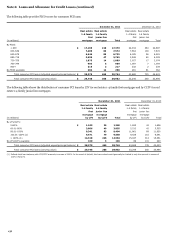

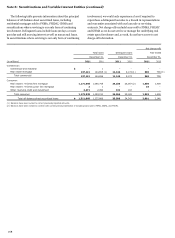

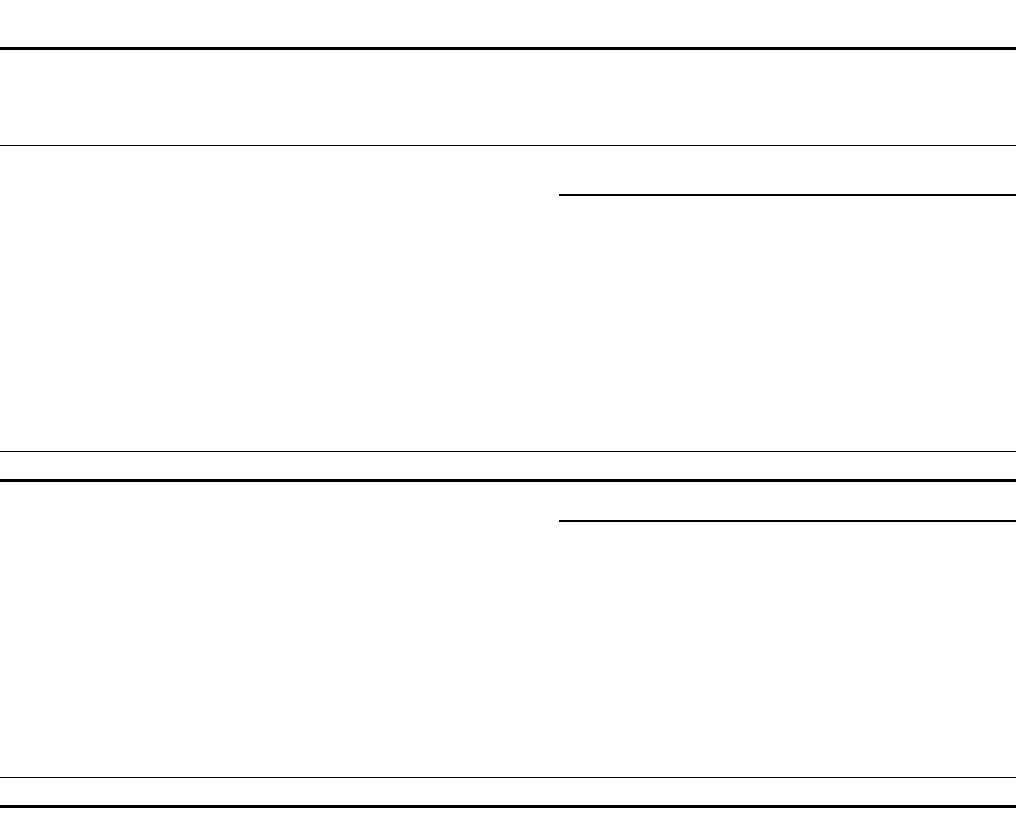

(continued from previous page)

Other

Total

Debt and

commitments

VIE

equity

Servicing

and

Net

(in millions)

assets

interests (1)

assets

Derivatives

guarantees

assets

December 31, 2010

Carrying value - asset (liability)

Residential mortgage loan securitizations:

Conforming

$

1,068,737

5,527

12,115

-

(928)

16,714

Other/nonconforming

76,304

2,997

495

6

(107)

3,391

Commercial mortgage loan securitizations

190,377

5,506

608

261

-

6,375

Collateralized debt obligations:

Debt securities

20,046

1,436

-

844

-

2,280

Loans (2)

9,970

9,689

-

-

-

9,689

Asset-based finance structures

12,055

6,556

-

(118)

-

6,438

Tax credit structures

20,981

3,614

-

-

(1,129)

2,485

Collateralized loan obligations

13,196

2,804

-

56

-

2,860

Investment funds

10,522

1,416

-

-

-

1,416

Other (3)

20,031

3,221

43

377

(6)

3,635

Total

$

1,442,219

42,766

13,261

1,426

(2,170)

55,283

Maximum exposure to loss

Residential mortgage loan securitizations:

Conforming

$

5,527

12,115

-

4,248

21,890

Other/nonconforming

2,997

495

6

233

3,731

Commercial mortgage loan securitizations

5,506

608

488

-

6,602

Collateralized debt obligations:

Debt securities

1,436

-

2,850

7

4,293

Loans (2)

9,689

-

-

-

9,689

Asset-based finance structures

6,556

-

118

2,175

8,849

Tax credit structures

3,614

-

-

1

3,615

Collateralized loan obligations

2,804

-

56

519

3,379

Investment funds

1,416

-

-

87

1,503

Other (3)

3,221

43

916

162

4,342

Total

$

42,766

13,261

4,434

7,432

67,893

(1) Includes total equity interests of $460 million and $316 million at December 31, 2011, and December 31, 2010, respectively. Also includes debt interests in the form of both

loans and securities. Excludes certain debt securities held related to loans serviced for FNMA, FHLMC and GNMA.

(2) Represents senior loans to trusts that are collateralized by asset-backed securities. The trusts invest primarily in senior tranches from a diversified pool of primarily U.S.

asset securitizations, of which all are current, and over 88% were rated as investment grade by the primary rating agencies at December 31, 2011. These senior loans were

acquired in the Wachovia business combination and are accounted for at amortized cost as initially determined under purchase accounting and are subject to the Company’s

allowance and credit charge-off policies.

(3) Includes structured financing, student loan securitizations, auto loan and lease securitizations and credit-linked note structures. Also contains investments in auction rate

securities (ARS) issued by VIEs that we do not sponsor and, accordingly, are unable to obtain the total assets of the entity.

163