Wells Fargo 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Since December 31, 2008, we have released $5.9 billion in

nonaccretable difference, including $4.2 billion transferred from

the nonaccretable difference to the accretable yield and

$1.7 billion released to income through loan resolutions. We

have provided $1.8 billion in the allowance for credit losses for

certain PCI loans or pools of PCI loans that have had credit-

related decreases to cash flows expected to be collected. The net

result is a $4.2 billion reduction from December 31, 2008,

through December 31, 2011, in our initial projected losses on all

PCI loans.

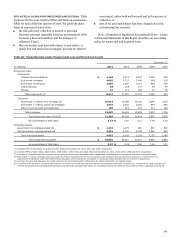

At December 31, 2011, the allowance for credit losses on

certain PCI loans was $231 million. The allowance is necessary

to absorb credit-related decreases since acquisition in cash flows

expected to be collected and primarily relates to individual PCI

loans. Table 19 analyzes the actual and projected loss results on

PCI loans since acquisition through December 31, 2011.

For additional information on PCI loans, see Note 1

(Summary of Significant Accounting Policies – Loans) and Note

6 (Loans and Allowance for Credit Losses) to Financial

Statements in this Report.

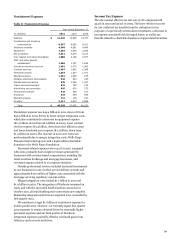

Table 19: Actual and Projected Loss Results on PCI Loans

Other

(in millions)

Commercial

Pick-a-Pay

consumer

Total

Release of nonaccretable difference due to:

Loans resolved by settlement with borrower (1)

$

1,345

-

-

1,345

Loans resolved by sales to third parties (2)

299

-

85

384

Reclassification to accretable yield for loans with improving credit-related cash flows (3)

1,216

2,383

614

4,213

Total releases of nonaccretable difference due to better than expected losses

2,860

2,383

699

5,942

Provision for losses due to credit deterioration (4)

(1,668)

-

(116)

(1,784)

Actual and projected losses on PCI loans less than originally expected

$

1,192

2,383

583

4,158

(1)

Release of the nonaccretable difference for settlement with borrower, on individually accounted PCI loans, increases interest income in the period of settlement. Pick-a-Pay

and Other consumer P

CI loans do not reflect nonaccretable difference releases for settlements with borrowers due to pool accounting for those loa

ns, which assumes that the

amount received approximates the pool performance expectations.

(2)

Release of the nonaccretable difference as a result of sales to third parties increases noninterest income in the period of the sale.

(3)

Reclassification of nonaccretable difference to accretable yield for loans with increased cash flow estimates will result in increased interest income as a prospective yield

adjustment over the remaining life of the loan or pool of loans.

(4)

Provision for additional losses recorded as a charge to income, when it is estimated that the cash flows expected to be collected for a PCI loan or pool of loans may not

support full realization of the carrying value.

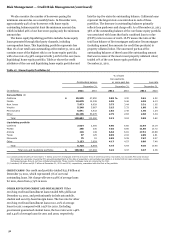

Significant Portfolio Reviews

Measuring and monitoring our

credit risk is an ongoing process that tracks delinquencies,

collateral values, FICO scores, economic trends by geographic

areas, loan-level risk grading for certain portfolios (typically

commercial) and other indications of credit risk. Our credit risk

monitoring process is designed to enable early identification of

developing risk and to support our determination of an

appropriate allowance for credit losses. The following analysis

reviews the relevant concentrations and certain credit metrics of

our significant portfolios. See Note 6 (Loans and Allowance for

Credit Losses) to Financial Statements in this Report for more

analysis and credit metric information.

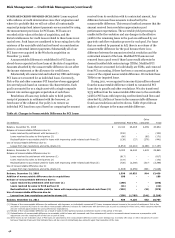

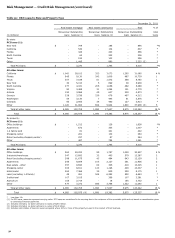

COMMERCIAL REAL ESTATE (CRE)

The CRE portfolio,

consisting of both CRE mortgage loans and CRE construction

loans, totaled $125.4 billion, or 16% of total loans, at

December 31, 2011. CRE construction loans totaled $19.4 billion

at December 31, 2011, and CRE mortgage loans totaled

$106.0 billion, of which 33% was to owner-occupants. Table 20

summarizes CRE loans by state and property type with the

related nonaccrual totals. CRE nonaccrual loans totaled 5% of

the non-PCI CRE outstanding balance at December 31, 2011, a

decline of 24% from December 31, 2010. The portfolio is

diversified both geographically and by property type. The largest

geographic concentrations of combined CRE loans are in

California and Florida, which represented 25% and 9% of the

total CRE portfolio, respectively. By property type, the largest

concentrations are office buildings at 26% and

industrial/warehouse at 11% of the portfolio. We subject

commercial loans to individual risk assessment using our

internal borrower and collateral quality ratings. Our ratings are

aligned to pass and criticized categories with our criticized

categories aligned to special mention, substandard and doubtful

categories as defined by bank regulatory agencies. At December

31, 2011, we had $22.5 billion of criticized non-PCI CRE

mortgage loans, a decrease of 13% from December 31, 2010, and

$6.8 billion of criticized non-PCI construction loans, a decrease

of 39% from December 31, 2010. Total criticized non-PCI CRE

loans remained relatively high as a result of the continued

challenging conditions in the real estate market. See Note 6

(Loans and Allowance for Credit Losses) to Financial Statements

in this Report for further detail on criticized loans.

The underwriting of CRE loans primarily focuses on cash

flows inherent in the creditworthiness of the customer, in

addition to collateral valuations. To identify and manage newly

emerging problem CRE loans, we employ a high level of

monitoring and regular customer interaction to understand and

manage the risks associated with these loans, including regular

loan reviews and appraisal updates. Management is engaged to

identify issues and dedicated workout groups are in place to

manage problem loans. At December 31, 2011, the recorded

investment in PCI CRE loans totaled $5.0 billion, down from

$12.3 billion at December 31, 2008, reflecting the reduction

resulting from principal payments, loan resolutions and write-

downs.

49