Wells Fargo 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 3: Cash, Loan and Dividend Restrictions

Federal Reserve Board (FRB) regulations require that each of

our subsidiary banks maintain reserve balances on deposit with

the Federal Reserve Banks. The average required reserve balance

was $7.0 billion in 2011 and $6.0 billion in 2010.

Federal law restricts the amount and the terms of both credit

and non-credit transactions between a bank and its nonbank

affiliates. These transaction amounts may not exceed 10% of the

bank's capital and surplus, which for this purpose represents

total capital, as calculated under the risk-based capital (RBC)

guidelines, plus the balance of the allowance for credit losses in

excess of the amount included in total capital with any single

nonbank affiliate and 20% of the bank's capital and surplus with

all its nonbank affiliates. Transactions that are extensions of

credit may require collateral to be held to provide added security

to the bank. For further discussion of RBC, see Note 26.

Dividends paid by our subsidiary banks are subject to various

federal and state regulatory limitations. Dividends that may be

paid by a national bank without the express approval of the

Office of the Comptroller of the Currency (OCC) are limited to

that bank's retained net profits for the preceding two calendar

years plus retained net profits up to the date of any dividend

declaration in the current calendar year. Retained net profits, as

defined by the OCC, consist of net income less dividends

declared during the period.

We also have state-chartered subsidiary banks that are

subject to state regulations that limit dividends. Under those

provisions, our national and state-chartered subsidiary banks

could have declared additional dividends of $0.6 billion at

December 31, 2011, without obtaining prior regulatory approval.

Our nonbank subsidiaries are also limited by certain federal and

state statutory provisions and regulations covering the amount

of dividends that may be paid in any given year. Based on

retained earnings at December 31, 2011, our nonbank

subsidiaries could have declared additional dividends of

$5.7 billion at December 31, 2011, without obtaining prior

approval.

The FRB published clarifying supervisory guidance in 2009,

SR 09-4 Applying Supervisory Guidance and Regulations on

the Payment of Dividends, Stock Redemptions, and Stock

Repurchases at Bank Holding Companies, pertaining to FRB's

criteria, assessment and approval process for reductions in

capital including the redemption of Troubled Asset Relief

Program (TARP) and the payment of dividends. The effect of this

guidance is to require the approval of the FRB for the Company

to repurchase or redeem common or perpetual preferred stock

as well as to increase the per share dividend from its current

level of $0.12 per share. In November 2010, the FRB updated the

SR 09-4 guidance to require the original 19 Supervisory Capital

Assessment Program (SCAP) banks to submit a Capital Plan

Review to the FRB no later than January 7, 2011. In

December 2011, the FRB finalized rules under 12 CFR Part 225,

Regulation Y requiring large bank holding companies (BHCs) to

submit capital plans annually and to obtain regulatory approval

before making capital distributions including share dividend

increases or share repurchases. The rule requires updates to

capital plans in the event of material changes in a BHC’s risk

profile, including as a result of any significant acquisitions. The

Company submitted its board-approved 2012 capital plan to the

FRB on January 6, 2012.

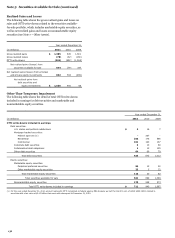

Note 4: Federal Funds Sold, Securities Purchased under Resale Agreements

and Other Short-Term Investments

The following table provides the detail of federal funds sold,

securities purchased under resale agreements, and other short-

term investments.

December 31,

(in millions)

2011

2010

Federal funds sold and securities

purchased under resale agreements

$

24,255

24,880

Interest-earning deposits

18,917

53,433

Other short-term investments

1,195

2,324

Total

$

44,367

80,637

We receive collateral from other entities under resale

agreements and securities borrowings. For additional

information, see Note 14.

132