Wells Fargo 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

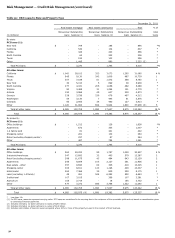

Non-Strategic and Liquidating Loan Portfolios

We

continually evaluate and modify our credit policies to address

appropriate levels of risk. We may designate certain portfolios

and loan products as non-strategic or liquidating to cease their

continued origination as we actively work to limit losses and

reduce our exposures.

Table 17 identifies our non-strategic and liquidating loan

portfolios. They consist primarily of the Pick-a-Pay mortgage

portfolio and other PCI loans acquired from Wachovia as well

as some portfolios from legacy Wells Fargo Home Equity and

Wells Fargo Financial. Effective first quarter 2011, we added

our education finance government guaranteed loan portfolio to

the non-strategic and liquidating loan portfolios as there is no

longer a U.S. Government guaranteed student loan program

available to private financial institutions pursuant to legislation

in 2010. The outstanding balances on non-strategic and

liquidating loan portfolios have decreased 41% since the

merger with Wachovia at December 31, 2008, and decreased

16% from the end of 2010.

Table 17: Non-Strategic and Liquidating Loan Portfolios

Outstanding balance

December 31,

(in millions)

2011

2010

2009

2008

Commercial:

Legacy Wachovia commercial and industrial, CRE and foreign PCI loans (1)

$

5,695

7,935

12,988

18,704

Total commercial

5,695

7,935

12,988

18,704

Consumer:

Pick-a-Pay mortgage (1)

65,652

74,815

85,238

95,315

Liquidating home equity

5,710

6,904

8,429

10,309

Legacy Wells Fargo Financial indirect auto

2,455

6,002

11,253

18,221

Legacy Wells Fargo Financial debt consolidation

16,542

19,020

22,364

25,299

Education Finance - government guaranteed (2)

15,376

17,510

21,150

20,465

Legacy Wachovia other PCI loans (1)

896

1,118

1,688

2,478

Total consumer

106,631

125,369

150,122

172,087

Total non-strategic and liquidating loan portfolios

$

112,326

133,304

163,110

190,791

(1)

Net of purchase accounting adjustments related to PCI loans.

(2)

Effective first quarter 2011, we included our education finance government guaranteed loan portfolio as there is no longer a U.S. Government guaranteed student loan

program available to private financial institutions, pursuant to legislation in 2010. Prior periods have been adjusted to reflect this change.

The Wells Fargo Financial debt consolidation portfolio

included $1.1 billion of loans at December 31, 2011, that were

considered prime based on secondary market standards,

compared with $1.2 billion at December 31, 2010. The rest is

non-prime but was originated with underwriting standards to

reduce credit risk. Wells Fargo Financial ceased originating

loans and leases through its indirect auto business channel by

the end of 2008.

The home equity liquidating portfolio was designated in

fourth quarter 2007 from loans generated through third party

channels. This portfolio is discussed in more detail in the

“Credit Risk Management – Home Equity Portfolios” section of

this Report.

Information about the liquidating PCI and Pick-a-Pay loan

portfolios is provided in the discussion of loan portfolios that

follows.

47