Wells Fargo 2011 Annual Report Download - page 70

Download and view the complete annual report

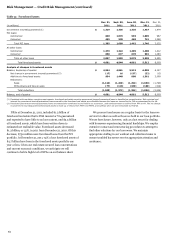

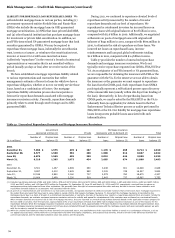

Please find page 70 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management — Credit Risk Management (continued)

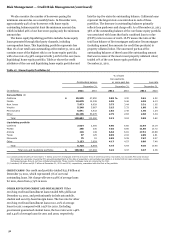

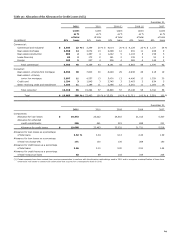

The $3.7 billion decline in the allowance for loan losses in

2011 reflected the release of allowance due to lower levels of

inherent credit loss in the portfolio compared with prior year-

end levels. Total provision for credit losses was $7.9 billion in

2011, $15.8 billion in 2010 and $21.7 billion in 2009. The 2011

provision was $3.4 billion less than net charge-offs. Primary

drivers of the 2011 provision reduction were decreased net

charge-offs and continued improvement in the credit quality of

the commercial and consumer portfolios and related loss

estimates as seen in declining delinquency and nonperforming

loan levels. Absent significant deterioration in the economy, we

expect future allowance releases in 2012, although at more

modest levels.

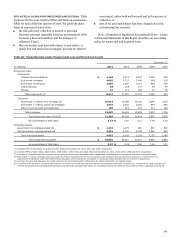

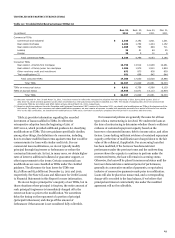

In 2010, the provision of $15.8 billion was $2.0 billion less

than net charge-offs. The reduction in the provision was

primarily due to continued improvement in the consumer

portfolios and related loss estimates and improvement in

economic conditions. These drivers were partially offset by an

increase in impaired loans and related allowance primarily

associated with increased consumer loan modification efforts

and a $693 million addition to the allowance due to adoption of

consolidation accounting guidance on January 1, 2010.

In 2009, the provision of $21.7 billion was $3.5 billion

greater than net charge-offs. Primary drivers of the 2009

provision were deterioration in economic conditions that

increased the projected losses in our commercial portfolios,

additional allowance associated with loan modification

programs designed to keep qualifying borrowers in their homes,

and the establishment of additional allowance for PCI loans.

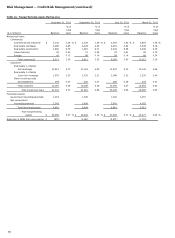

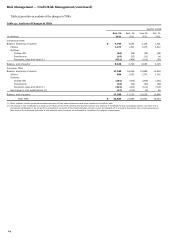

In determining the appropriate allowance attributable to our

residential real estate portfolios, the loss rates used in our

analysis include the impact of our established loan modification

programs. When modifications occur or are probable to occur,

our allowance considers the impact of these modifications,

taking into consideration the associated credit cost, including re-

defaults of modified loans and projected loss severity. The loss

content associated with existing and probable loan modifications

has been considered in our allowance reserving methodology.

Changes in the allowance reflect changes in statistically

derived loss estimates, historical loss experience, current trends

in borrower risk and/or general economic activity on portfolio

performance, and management’s estimate for imprecision and

uncertainty, including ongoing discussions with regulatory and

government agencies regarding mortgage foreclosure-related

matters.

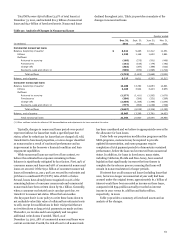

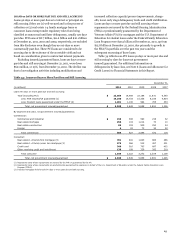

Table 36 presents an analysis of the allowance for credit

losses by loan segments and classes for the last five years.

68