Wells Fargo 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Asset/Liability Management (continued)

securities are recognized in net income when realized and

periodically include OTTI charges.

Changes in equity market prices may also indirectly affect

our net income by affecting (1) the value of third party assets

under management and, hence, fee income, (2) particular

borrowers, whose ability to repay principal and/or interest may

be affected by the stock market, or (3) brokerage activity,

related commission income and other business activities. Each

business line monitors and manages these indirect risks.

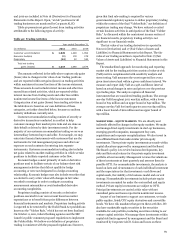

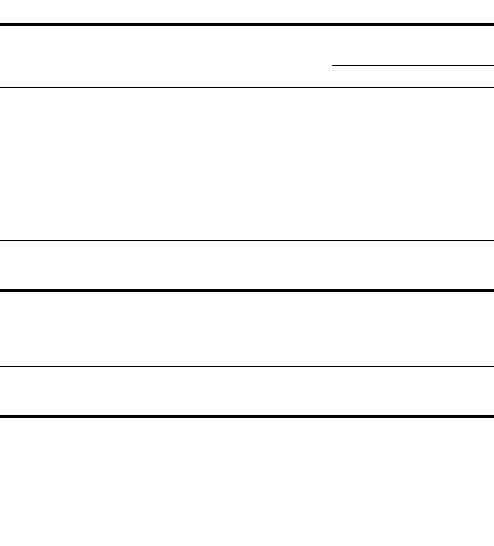

Table 41 provides information regarding our marketable

and nonmarketable equity investments.

Table 41: Nonmarketable and Marketable Equity Investments

December 31,

(in millions)

2011

2010

Nonmarketable equity investments:

Private equity investments:

Cost method

$

3,444

3,240

LIHTC investments - equity method (1)

4,077

3,611

All other equity method

4,434

4,013

Federal bank stock

4,617

5,254

Principal investments

236

305

Total nonmarketable

equity investments (2)

$

16,808

16,423

Marketable equity securities:

Cost

$

2,929

4,258

Net unrealized gains

488

931

Total marketable

equity securities (3)

$

3,417

5,189

(1)

Represents low income housing tax credit investments

(2)

Included in other assets on the balance sheet. See Note 7 (Premises, Equipment,

Lease Commitments and Other Assets) to Financial Statements in this Report for

additional information.

(3)

Included in securities available for sale. See Note 5 (Securities Available for Sale)

to Financial Statements in this Report for additional information.

LIQUIDITY AND FUNDING

The objective of effective liquidity

management is to ensure that we can meet customer loan

requests, customer deposit maturities/withdrawals and other

cash commitments efficiently under both normal operating

conditions and under unpredictable circumstances of industry

or market stress. To achieve this objective, the Corporate ALCO

establishes and monitors liquidity guidelines that require

sufficient asset-based liquidity to cover potential funding

requirements and to avoid over-dependence on volatile, less

reliable funding markets. We set these guidelines for both the

consolidated balance sheet and for the Parent to ensure that

the Parent is a source of strength for its regulated, deposit-

taking banking subsidiaries.

Unencumbered debt and equity securities in the securities

available-for-sale portfolio provide asset liquidity, in addition

to the immediately liquid resources of cash and due from banks

and federal funds sold, securities purchased under resale

agreements and other short-term investments. The weighted-

average expected remaining maturity of the debt securities

within this portfolio was 4.9 years at December 31, 2011. Of the

$212.6 billion (cost basis) of debt securities in this portfolio at

December 31, 2011, $38.5 billion (18%) is expected to mature

or be prepaid in 2012 and an additional $34.8 billion (16%) in

2013. Asset liquidity is further enhanced by our ability to sell or

securitize loans in secondary markets and to pledge loans to

access secured borrowing facilities through the Federal Home

Loan Banks (FHLB) and the FRB. In 2011, we sold or

securitized mortgage loans of $353 billion. The amount of

mortgage loans and other consumer loans available to be sold,

securitized or pledged was approximately $222 billion at

December 31, 2011.

Core customer deposits have historically provided a sizeable

source of relatively stable and low-cost funds. At December

31, 2011, core deposits funded 113% of total loans compared

with 105% a year ago. Additional funding is provided by long-

term debt (including trust preferred securities), other foreign

deposits, and short-term borrowings. Long-term debt averaged

$141.1 billion in 2011 and $185.4 billion in 2010. Short-term

borrowings averaged $51.8 billion in 2011 and $46.8 billion in

2010.

We anticipate making capital expenditures of

approximately $930 million in 2012 for our stores, relocation

and remodeling of our facilities, and routine replacement of

furniture, equipment and servers. We fund expenditures from

various sources, including funds from operations and

borrowings.

In mid-2009, we froze the Wells Fargo & Company Cash

Balance Plan. As a result, pension funding is not a material

consideration in our liquidity management. See Note 20

(Employee Benefits and Other Expenses) to Financial

Statements in this Report for additional information on

pension and postretirement plans.

We access domestic and international capital markets for

long-term funding through issuances of registered debt

securities, private placements and asset-backed secured

funding. Investors in the long-term capital markets generally

will consider, among other factors, a company’s debt rating in

making investment decisions. Rating agencies base their

ratings on many quantitative and qualitative factors, including

capital adequacy, liquidity, asset quality, business mix, the level

and quality of earnings, and rating agency assumptions

regarding the probability and extent of Federal financial

assistance or support for certain large financial institutions.

Adverse changes in these factors could result in a reduction of

our credit rating; however, a reduction in credit rating would

not cause us to violate any of our debt covenants.

In September 2011, Moody’s Investors Service, Inc.

(Moody’s) downgraded the long-term senior debt ratings of the

Parent and Wells Fargo Bank, N.A., the Parent’s significant

banking subsidiary, one notch to A2 and Aa3, respectively,

based on its determination that, as a result of the Dodd-Frank

Act, the U.S. government is less likely to support systemically

important financial institutions, if needed, in the future.

Moody’s outlook on the Parent’s and Wells Fargo Bank, N.A.’s

long-term senior debt ratings is negative based on the

possibility that Moody’s may further reduce its assumptions

about the likelihood of government support for systemically

important financial institutions. In November 2011, S&P

lowered the long-term senior debt ratings of the Parent and

Wells Fargo Bank, N.A. one notch to A+ and AA-, respectively,

following changes in S&P’s ratings criteria for the global

82