Wells Fargo 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

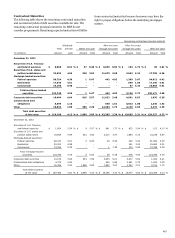

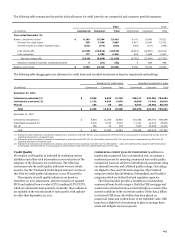

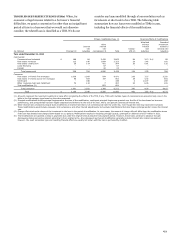

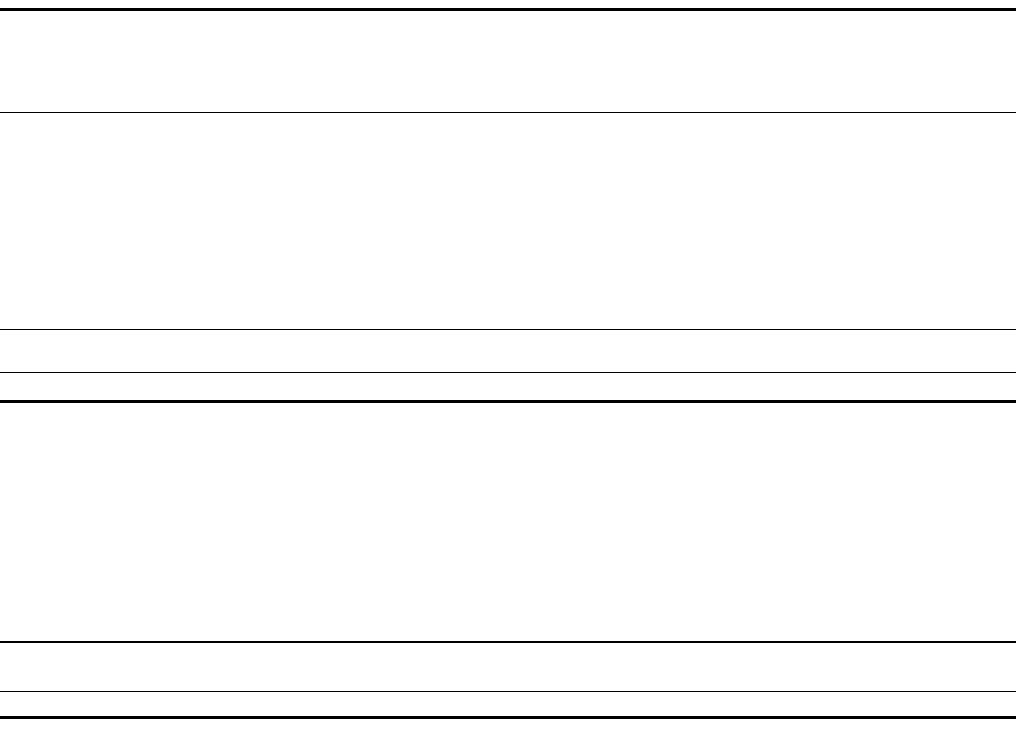

The following table provides the outstanding balances of our consumer portfolio by delinquency status.

Real estate

Real estate

Other

1-4 family

1-4 family

revolving

first

junior lien

Credit

credit and

(in millions)

mortgage

mortgage

card

installment

Total

December 31, 2011

By delinquency status:

Current-29 DPD

$

156,985

83,033

22,125

69,712

331,855

30-59 DPD

4,075

786

211

963

6,035

60-89 DPD

2,012

501

154

275

2,942

90-119 DPD

1,152

382

135

127

1,796

120-179 DPD

1,704

537

211

33

2,485

180+ DPD

6,665

546

-

4

7,215

Government insured/guaranteed loans (1)

26,555

-

-

15,346

41,901

Total consumer loans (excluding PCI)

199,148

85,785

22,836

86,460

394,229

Total consumer PCI loans (carrying value)

29,746

206

-

-

29,952

Total consumer loans

$

228,894

85,991

22,836

86,460

424,181

December 31, 2010 (2)

By delinquency status:

Current-29 DPD

$

164,558

92,512

21,276

67,129

345,475

30-59 DPD

4,516

917

262

1,261

6,956

60-89 DPD

2,173

608

207

376

3,364

90-119 DPD

1,399

476

190

171

2,236

120-179 DPD

2,080

764

324

58

3,226

180+ DPD

6,750

622

1

117

7,490

Government insured/guaranteed loans (1)

15,514

-

-

17,453

32,967

Total consumer loans (excluding PCI)

196,990

95,899

22,260

86,565

401,714

Total consumer PCI loans (carrying value)

33,245

250

-

-

33,495

Total consumer loans

$

230,235

96,149

22,260

86,565

435,209

(1) Represents loans whose repayments are insured by the FHA or guaranteed by the VA and student loans whose repayments are predominantly guaranteed by agencies on

behalf of the U.S. Department of Education under the Federal Family Education Loan Program (FFELP). In 2011, we consolidated $5.6 billion of previously sold FHA insured

real estate 1-4 family reverse mortgages.

(2) Amounts at December 31, 2010, have been revised to conform to the current separate presentation of government insured/guaranteed loans.

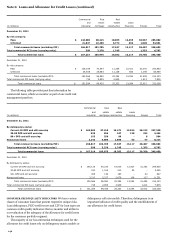

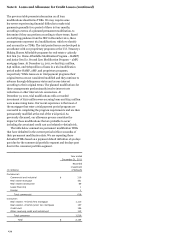

Of the $11.5 billion of loans that are 90 days or more past due

at December 31, 2011, $1.5 billion was accruing, compared with

$13.0 billion past due and $2.0 billion accruing at

December 31, 2010.

Real estate 1-4 family first mortgage loans 180 days or more

past due totaled $6.7 billion, or 3.3%, of total first mortgages

(excluding PCI), at December 31, 2011, compared with

$6.8 billion, or 3.4%, at December 31, 2010. The aging of the

delinquent real estate 1-4 family first mortgage loans is a result

of the prolonged foreclosure process and our effort to help

customers stay in their homes through various loan modification

programs, as loans continue to age until these processes are

complete.

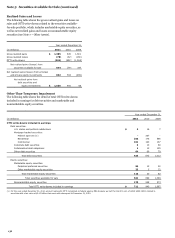

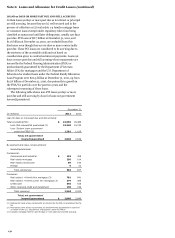

The following table provides a breakdown of our consumer

portfolio by updated FICO. We obtain FICO scores at loan

origination and the scores are updated at least quarterly. FICO is

not available for certain loan types. In addition, FICO may not be

obtained if we deem it unnecessary due to strong collateral and

other borrower attributes, primarily securities-based margin

loans of $5.0 billion and $4.1 billion at December 31, 2011 and

2010, respectively. The majority of our portfolio is underwritten

with a FICO score of 680 and above.

147