Wells Fargo 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

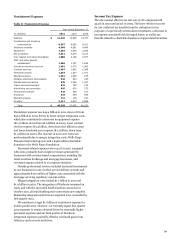

Earnings Performance (continued)

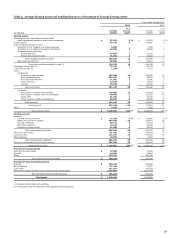

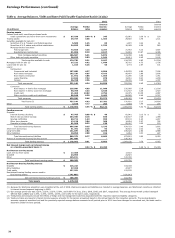

Table 5: Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) (1)(2)(3)

2011

2010

Interest

Interest

Average

Yields/

income/

Average

Yields/

income/

(in millions)

balance

rates

expense

balance

rates

expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments

$

87,186

0.40

%

$

345

62,961

0.36

%

$

230

Trading assets

39,737

3.68

1,463

29,920

3.75

1,121

Securities available for sale (4):

Securities of U.S. Treasury and federal agencies

5,503

1.25

69

1,870

3.24

61

Securities of U.S. states and political subdivisions

24,035

5.09

1,223

16,089

6.09

980

Mortgage-backed securities:

Federal agencies

74,665

4.36

3,257

71,953

5.14

3,697

Residential and commercial

31,902

8.20

2,617

31,815

10.67

3,396

Total mortgage-backed securities

106,567

5.51

5,874

103,768

6.84

7,093

Other debt and equity securities

38,625

5.03

1,941

32,611

6.45

2,102

Total securities available for sale

174,730

5.21

9,107

154,338

6.63

10,236

Mortgages held for sale (5)

37,232

4.42

1,644

36,716

4.73

1,736

Loans held for sale (5)

1,104

5.25

58

3,773

2.67

101

Loans:

Commercial:

Commercial and industrial

157,608

4.37

6,894

149,576

4.80

7,186

Real estate mortgage

102,236

4.07

4,163

98,497

3.89

3,836

Real estate construction

21,592

4.88

1,055

31,286

3.36

1,051

Lease financing

12,944

7.54

976

13,451

9.21

1,239

Foreign

36,768

2.56

941

29,726

3.49

1,037

Total commercial

331,148

4.24

14,029

322,536

4.45

14,349

Consumer:

Real estate 1-4 family first mortgage

226,980

4.89

11,090

235,568

5.18

12,206

Real estate 1-4 family junior lien mortgage

90,705

4.33

3,926

101,537

4.45

4,519

Credit card

21,463

13.02

2,794

22,375

13.35

2,987

Other revolving credit and installment

86,848

6.29

5,463

88,585

6.49

5,747

Total consumer

425,996

5.46

23,273

448,065

5.68

25,459

Total loans (5)

757,144

4.93

37,302

770,601

5.17

39,808

Other

4,929

4.12

203

5,849

3.56

207

Total earning assets

$

1,102,062

4.55

%

$

50,122

1,064,158

5.02

%

$

53,439

Funding sources

Deposits:

Interest-bearing checking

$

47,705

0.08

%

$

40

60,941

0.12

%

$

72

Market rate and other savings

464,450

0.18

836

416,877

0.26

1,088

Savings certificates

69,711

1.43

995

87,133

1.43

1,247

Other time deposits

13,126

2.04

268

14,654

2.07

302

Deposits in foreign offices

61,566

0.22

136

55,097

0.22

123

Total interest-bearing deposits

656,558

0.35

2,275

634,702

0.45

2,832

Short-term borrowings

51,781

0.18

94

46,824

0.22

106

Long-term debt

141,079

2.82

3,978

185,426

2.64

4,888

Other liabilities

10,955

2.88

316

6,863

3.31

227

Total interest-bearing liabilities

860,373

0.77

6,663

873,815

0.92

8,053

Portion of noninterest-bearing funding sources

241,689

-

-

190,343

-

-

Total funding sources

$

1,102,062

0.61

6,663

1,064,158

0.76

8,053

Net interest margin and net interest income

on a taxable-equivalent basis (6)

3.94

%

$

43,459

4.26

%

$

45,386

Noninterest-earning assets

Cash and due from banks

$

17,388

17,618

Goodwill

24,904

24,824

Other

125,911

120,338

Total noninterest-earning assets

$

168,203

162,780

Noninterest-bearing funding sources

Deposits

$

215,242

183,008

Other liabilities

57,399

47,877

Total equity

137,251

122,238

Noninterest-bearing funding sources used to

fund earning assets

(241,689)

(190,343)

Net noninterest-bearing funding sources

$

168,203

162,780

Total assets

$

1,270,265

1,226,938

(1) Because the Wachovia acquisition was completed at the end of 2008, Wachovia's assets and liabilities are included in average balances, and Wachovia's results are reflected

in interest income/expense beginning in 2009.

(2) Our average prime rate was 3.25%, 3.25%, 3.25%, 5.09%, and 8.05% for 2011, 2010, 2009, 2008, and 2007, respectively. The average three-month London Interbank

Offered Rate (LIBOR) was 0.34%, 0.34%, 0.69%, 2.93%, and 5.30% for the same years, respectively.

(3) Yields/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(4) Yields and rates are based on interest income/expense amounts for the period, annualized based on the accrual basis for the respective accounts. The average balance

amounts represent amortized cost and the previously reported average balance amounts for all periods prior to 2011 have been changed to amortized cost, the basis used to

determine yields for those periods.

34