Wells Fargo 2011 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

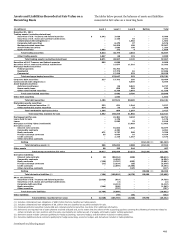

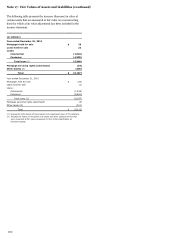

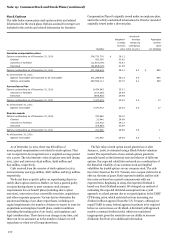

Note 17: Fair Values of Assets and Liabilities (continued)

December 31, 2011

December 31, 2010

Fair value

Fair value

carrying

carrying

amount

amount

less

less

Fair value

Aggregate

aggregate

Fair value

Aggregate

aggregate

carrying

unpaid

unpaid

carrying

unpaid

unpaid

(in millions)

amount

principal

principal

amount

principal

principal

Mortgages held for sale:

Total loans

$

44,791

43,687

1,104

(1)

47,531

47,818

(287)

(1)

Nonaccrual loans

265

584

(319)

325

662

(337)

Loans 90 days or more past due and still accruing

44

56

(12)

38

47

(9)

Loans held for sale:

Total loans

1,176

1,216

(40)

873

897

(24)

Nonaccrual loans

25

39

(14)

1

7

(6)

Loans:

Total loans

5,916

5,441

475

309

348

(39)

Nonaccrual loans

32

32

-

13

16

(3)

Loans 90 days or more past due and still accruing

-

-

-

2

2

-

Long-term debt

-

-

-

306

353

(47)

(1) The difference between fair value carrying amount and aggregate unpaid principal includes changes in fair value recorded at and subsequent to funding, gains and losses on

the related loan commitment prior to funding, and premiums on acquired loans.

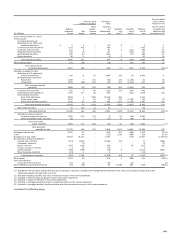

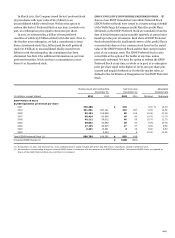

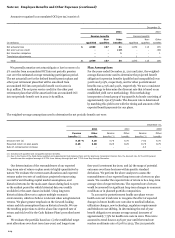

The assets accounted for under the fair value option are initially

measured at fair value. Gains and losses from initial

measurement and subsequent changes in fair value are

recognized in earnings. The changes in fair value related to

initial measurement and subsequent changes in fair value

included in earnings for these assets measured at fair value are

shown, by income statement line item, below.

2011

2010

2009

Net gains

Net gains

Net gains

Mortgage

(losses)

Mortgage

(losses)

Mortgage

(losses)

banking

from

Other

banking

from

Other

banking

from

Other

noninterest

trading

noninterest

noninterest

trading

noninterest

noninterest

trading

noninterest

(in millions)

income

activities

income

income

activities

income

income

activities

income

Year ended December 31,

Mortgages held for sale

$

6,084

-

-

6,512

-

-

4,891

-

-

Loans held for sale

-

-

32

-

-

24

-

-

99

Loans

13

-

80

55

-

-

-

-

-

Long-term debt

(11)

-

-

(48)

-

-

-

-

-

Other interests held

-

(25)

-

-

(13)

-

-

117

-

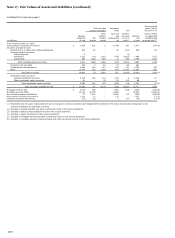

The following table shows the estimated gains and losses

from earnings attributable to instrument-specific credit risk

related to assets accounted for under the fair value option.

Year ended Dec. 31,

(in millions)

2011

2010

2009

Gains (losses) attributable to

instrument-specific credit risk:

Mortgages held for sale

$

(144)

(28)

(277)

Loans held for sale

32

24

63

Total

$

(112)

(4)

(214)

For performing loans, instrument-specific credit risk gains or

losses were derived principally by determining the change in fair

value of the loans due to changes in the observable or implied

credit spread. Credit spread is the market yield on the loans less

the relevant risk-free benchmark interest rate. In recent years

spreads have been significantly affected by the lack of liquidity in

the secondary market for mortgage loans. For nonperforming

loans, we attribute all changes in fair value to instrument-

specific credit risk.

204