Wells Fargo 2011 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

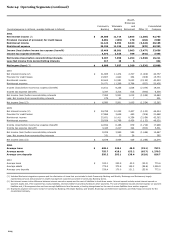

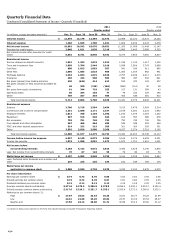

Note 26: Regulatory and Agency Capital Requirements

The Company and each of its subsidiary banks are subject to

regulatory capital adequacy requirements promulgated by

federal regulatory agencies. The Federal Reserve establishes

capital requirements, including well capitalized standards, for

the consolidated financial holding company, and the OCC has

similar requirements for the Company’s national banks,

including Wells Fargo Bank, N.A.

We do not consolidate our wholly-owned trust (the Trust)

formed solely to issue trust preferred and preferred purchase

securities (the Securities). Securities issued by the Trust

includable in Tier 1 capital were $7.5 billion at

December 31, 2011. Since December 31, 2010, we have called

$9.2 billion of trust preferred securities, and also issued

$2.5 billion in Series I Preferred Stock, replacing certain

preferred purchase securities reflected in the amount of

Securities issued by the Trust includable in Tier 1 capital at

December 31, 2010. The Series I Preferred Stock was included in

preferred stock (Note 18), as a separate component of Tier 1

capital. The junior subordinated debentures held by the Trust

were included in the Company’s long-term debt.

Certain subsidiaries of the Company are approved

seller/servicers, and are therefore required to maintain

minimum levels of shareholders’ equity, as specified by various

agencies, including the United States Department of Housing

and Urban Development, GNMA, FHLMC and FNMA. At

December 31, 2011, each seller/servicer met these requirements.

Certain broker-dealer subsidiaries of the Company are subject to

SEC Rule 15c3-1 (the Net Capital Rule), which requires that we

maintain minimum levels of net capital, as defined. At

December 31, 2011, each of these subsidiaries met these

requirements.

The following table presents regulatory capital information

for Wells Fargo & Company and Wells Fargo Bank, N.A.

Wells Fargo & Company

Wells Fargo Bank, N.A.

Well-

Minimum

December 31,

capitalized

capital

(in billions, except ratios)

2011

2010

2011

2010

ratios (1)

ratios (1)

Regulatory capital:

Tier 1

$

114.0

109.4

92.6

90.2

Total

148.5

147.1

117.9

117.1

Assets:

Risk-weighted

$

1,005.6

980.0

923.2

895.2

Adjusted average (2)

1,262.6

1,189.5

1,115.4

1,057.7

Capital ratios:

Tier 1 capital

11.33

%

11.16

10.03

10.07

6.00

4.00

Total capital

14.76

15.01

12.77

13.09

10.00

8.00

Tier 1 leverage (2)

9.03

9.19

8.30

8.52

5.00

4.00

(1) As defined by the regulations issued by the Federal Reserve, OCC and FDIC.

(2) The leverage ratio consists of Tier 1 capital divided by quarterly average total assets, excluding goodwill and certain other items. The minimum leverage ratio guideline is

3% for banking organizations that do not anticipate significant growth and that have well-diversified risk, excellent asset quality, high liquidity, good earnings, effective

management and monitoring of market risk and, in general, are considered top-rated, strong banking organizations.

230