Wells Fargo 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

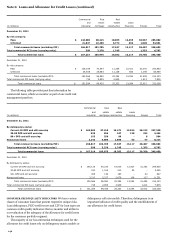

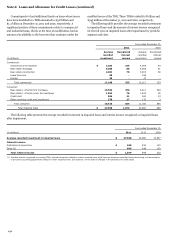

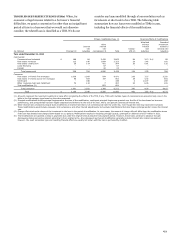

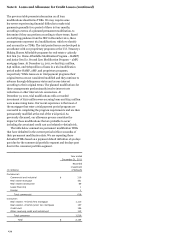

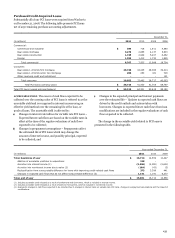

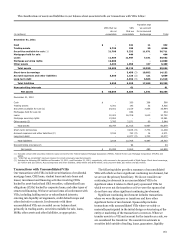

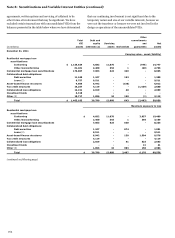

Note 6: Loans and Allowance for Credit Losses (continued)

Commitments to lend additional funds on loans whose terms

have been modified in a TDR amounted to $3.8 billion and

$1.2 billion at December 31, 2011 and 2010, respectively. A

significant portion of these commitments relate to commercial

and industrial loans, which, at the time of modification, had an

amount of availability to the borrower that continues under the

modified terms of the TDR. These TDRs totaled $1.8 billion and

$345 million at December 31, 2011 and 2010, respectively.

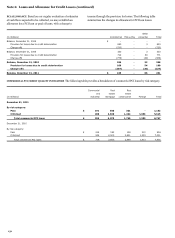

The following table provides the average recorded investment

in impaired loans and the amount of interest income recognized

for the full year on impaired loans after impairment by portfolio

segment and class.

Year ended December 31,

2011

2010

Average

Recognized

Average

Recognized

recorded

interest

recorded

interest

(in millions)

investment

income

investment

income

Commercial:

Commercial and industrial

$

3,282

105

4,098

64

Real estate mortgage

5,308

80

4,598

41

Real estate construction

2,481

70

3,203

28

Lease financing

80

-

166

-

Foreign

29

-

47

-

Total commercial

11,180

255

12,112

133

Consumer:

Real estate 1-4 family first mortgage

13,592

700

9,221

494

Real estate 1-4 family junior lien mortgage

1,962

76

1,443

55

Credit card

594

21

360

13

Other revolving credit and installment

270

27

132

3

Total consumer

16,418

824

11,156

565

Total impaired loans

$

27,598

1,079

23,268

698

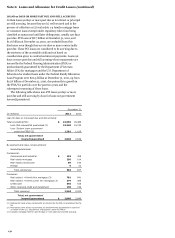

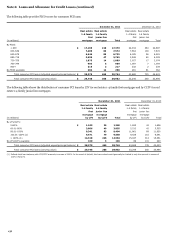

The following table presents the average recorded investment in impaired loans and interest income recognized on impaired loans

after impairment.

Year ended December 31,

(in millions)

2011

2010

2009

Average recorded investment in impaired loans

$

27,598

23,268

10,557

Interest income:

Cash basis of accounting

$

180

250

130

Other (1)

899

448

102

Total interest income

$

1,079

698

232

(1) Includes interest recognized on accruing TDRs, interest recognized related to certain impaired loans which have an allowance calculated using discounting, and amortization

of purchase accounting adjustments related to certain impaired loans. See footnote 1 to the table of changes in the allowance for credit losses.

152