Wells Fargo 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 1: Summary of Significant Accounting Policies (continued)

measurement. These up-front payments received permanent

equity treatment in the quarter paid and thus assured

appropriate repurchase timing, consistent with our 2011 capital

plan which contemplated a fixed dollar amount available per

quarter for share repurchases pursuant to FRB supervisory

guidance. In return, the counterparty agreed to deliver a variable

number of shares based on a per share discount to the volume-

weighted average stock price over the contract period. The

counterparty had the right to accelerate settlement with delivery

of shares prior to the contractual settlement. There were no

scenarios where the contracts would not either physically settle

in shares or allow us to choose the settlement method.

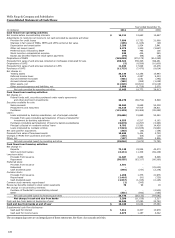

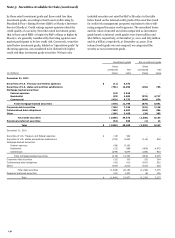

SUPPLEMENTAL CASH FLOW INFORMATION

Noncash activities are presented below, including information on transfers affecting

MHFS, LHFS and MSRs.

Year ended December 31,

(in millions)

2011

2010

2009

Transfers from trading assets to securities available for sale

$

47

-

854

Transfers from (to) loans to (from) securities available for sale

2,822

3,476

(258)

Trading assets retained from securitization of MHFS

61,599

19,815

2,993

Capitalization of MSRs from sale of MHFS

4,089

4,570

6,287

Transfers from MHFS to foreclosed assets

224

262

162

Transfers from (to) loans to (from) MHFS

6,305

230

144

Transfers from (to) loans to (from) LHFS

129

1,313

(111)

Transfers from loans to foreclosed assets

9,315

8,699

7,604

Changes in consolidations of variable interest entities:

Trading assets

-

155

-

Securities available for sale

7

(7,590)

-

Loans

(599)

26,117

-

Other assets

-

212

-

Short-term borrowings

-

5,127

-

Long-term debt

(628)

13,613

-

Accrued expenses and other liabilities

-

(32)

-

Net transfer from additional paid-in capital to noncontrolling interests

-

-

2,299

Decrease in noncontrolling interests due to deconsolidation of subsidiaries

-

440

-

Transfer from noncontrolling interests to long-term debt

-

345

-

Consolidation of reverse mortgages previously sold:

Loans

5,483

-

-

Long-term debt

5,425

-

-

SUBSEQUENT EVENTS

We have evaluated the effects of

subsequent events that have occurred subsequent to period end

December 31, 2011, and there have been no material events that

would require recognition in our 2011 consolidated financial

statements or disclosure in the Notes to the financial statements,

except as discussed in Note 15 (Legal Actions) for the

announcement on February 9, 2012, of an agreement with state

attorneys and federal agencies regarding mortgage servicing,

foreclosures and origination issues.

130