Wells Fargo 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Betting on America

WellsFargo employs one of every 500 working

adults in America, making us the nation’s 12th

largest private employer. Chances are you

know someone who works for WellsFargo,

or someone who knows someone who does.

Thirty-seven percent of our team is racially and

ethnically diverse. This is slightly more than

the U.S. population, which is 36percent diverse.

This diversity should enable us to better

understand and respond to the financial needs

of our customers and communities.

Our reach is global, but at our heart we’re

a hometown American company. Ninety-

seven percent of our assets and 98percent of

our team members are based in the U.S. This

makes us dierent from our large peers. Our

roots are American roots, and we’ve grown as

they’ve spread wide and deep in American soil.

Since 1852, we’ve been betting on America.

We liked our bet then, and we like it even

more now. We’re confident in the ingenuity,

resourcefulness, work ethic, and can-do attitude

of Americans and our WellsFargo team.

Together, we’re focused on the tremendous

opportunities we now have ahead of us and

on the responsibilities we have to help our

customers, communities, and country succeed.

We’re focused on providing you, our

shareholders, with sustainable, long-term

success. We returned more capital to

shareholders in 2011 by increasing our quarterly

common stock dividend by 140percent, to

48cents for the year. We also resumed the

repurchase of our common stock.

Earning trust

The U.S. economy’s recovery remained sluggish

and continued to deliver disappointing

results. Millions of Americans struggled with

unemployment and underemployment despite

slight improvements in the job market. The

lack of jobs led to a decline in first-time home

sales, even with historic low interest rates and

bargain-basement prices. A stagnant housing

market placed a drag on the economy.

Consumers spent less and paid down their

debt, including mortgages, credit cards, and

auto loans. This made sense for consumers

who wanted to regain control of their financial

situation, but less spending didn’t help the

recovery. By year’s end, credit balances and

spending began trending upward again, but

balances were often paid in full each month.

Consumers were not alone. Businesses also

faced significant obstacles. Our quarterly

surveys of small business owners showed their

deep concerns about economic and credit

market outlooks, along with pending regulatory

reforms, and their potential eect on sales and

operating costs.

Many Americans remained frustrated with

the slow, uneven economic recovery and the

lack of job opportunities. As a result, they

have lost faith in many large companies and

institutions. We understand their concerns.

We’re listening to our customers every day

and helping them address their financial

needs in any way we can. We’re contributing

to communities across the country, helping

them find local solutions for local problems.

We’re also at the table in Washington,D.C.,

discussing the merits of proposed reforms for

the financial services industry. We want to be

a partner for thoughtful change, and we share

our government’s desire to do what’s right for

consumers and businesses.

We don’t take trust for granted. We know we

have to earn it every day in our conversations

and actions with our customers. Here’s how we

try to do that.

Helping our mortgage customers

First, no financial product is more important

to Americans, more interwoven with their

financial security, than their home mortgage.

Other financial services companies are backing

away from this business because of what they

perceive to be its high costs and its risks. Not

WellsFargo. Here’s why: Two-thirds of all

Americans are in the mortgage business. They

have mortgages on their homes. We want to be

there to satisfy not just their mortgage needs,

but all their other financial needs that connect

to their mortgage. We believe we have the right

products to oer mortgage customers and

the right underwriting principles to make sure

their loans are good loans. As a result, more

than 92percent of our mortgage customers

were current on their payments and fewer

than 2percent of our owner-occupied home

mortgages proceeded to a foreclosure sale.

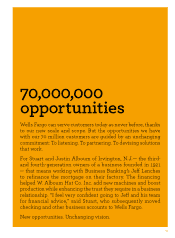

1 in 500

WellsFargo employs more than

270,000 team members. That’s

1in500 working adults — making

us the 12th largest private

employer in the U.S.

No. 1

Our company had the highest

market capitalization in the

U.S. banking industry.

1 in 3

WellsFargo serves one in three

households in the U.S.