Wells Fargo 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking

statements, which may include forecasts of our financial results and condition, expectations for our operations and business, and our

assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ

materially from our forward-looking statements due to several factors. Factors that could cause our actual results to differ materially

from our forward-looking statements are described in this Report, including in the “Forward-Looking Statements” and “Risk Factors”

sections in this Report, and the “Regulation and Supervision” section of our Annual Report on Form 10-K for the year ended

December 31, 2011 (2011 Form 10-K).

When we refer to “Wells Fargo,” “the Company,” “we,” “our” or “us” in this Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean Wells Fargo & Company. When we refer to “legacy Wells Fargo,” we mean

Wells Fargo excluding Wachovia Corporation (Wachovia). See the Glossary of Acronyms at the end of this Report for terms used

throughout this Report.

Financial Review

Overview

Wells Fargo & Company is a diversified financial services

company with $1.3 trillion in assets. Founded in 1852 and

headquartered in San Francisco, we provide banking, insurance,

trust and investments, mortgage banking, investment banking,

retail banking, brokerage services and consumer and commercial

finance through more than 9,000 stores, 12,000 ATMs, the

internet and other distribution channels to individuals,

businesses and institutions across North America and

internationally. With approximately 264,000 active, full-time

equivalent team members, we serve one in three households in

America and ranked No. 23 on Fortune’s 2011 rankings of

America’s largest corporations. We ranked fourth in assets and

first in the market value of our common stock among all U.S.

banks at December 31, 2011.

Our vision is to satisfy all our customers’ financial needs,

help them succeed financially, be recognized as the premier

financial services company in our markets and be one of

America’s great companies. Our primary strategy to achieve this

vision is to increase the number of products our customers

utilize and to offer them all of the financial products that fulfill

their needs. Our cross-sell strategy, diversified business model

and the breadth of our geographic reach facilitate growth in both

strong and weak economic cycles, as we can grow by expanding

the number of products our current customers have with us, gain

new customers in our extended markets, and increase market

share in many businesses. Our retail bank household cross-sell

increased each quarter during 2011 to 5.92 products per

household in fourth quarter 2011, up from 5.70 in fourth quarter

2010. We believe there is more opportunity for cross-sell as we

continue to earn more business from our customers. Our goal is

eight products per customer, which is approximately half of our

estimate of potential demand for an average U.S. household.

Currently, one of every four of our retail banking households has

eight or more products.

Our pursuit of growth and earnings performance is

influenced by our belief that it is important to maintain a well

controlled operating environment. We manage our credit risk by

establishing what we believe are sound credit policies for

underwriting new business, while monitoring and reviewing the

performance of our loan portfolio. We manage the interest rate

and market risks inherent in our asset and liability balances

within established ranges, while ensuring adequate liquidity and

funding. We maintain strong capital levels to facilitate future

growth.

Expense management is also important to us, but we

approach this in a manner intended to help ensure our revenue

is not adversely affected. Our current company-wide expense

management initiative is focused on removing unnecessary

complexity and eliminating duplication as a way to improve the

customer experience and the work process of our team members.

With this initiative and the completion of Wachovia merger

integration activities, we are targeting fourth quarter 2012

noninterest expense of $11 billion. We expect first quarter 2012

noninterest expense to remain elevated because of seasonally

higher personnel expenses and our final quarter of Wachovia

integration expenses, partially offset by continued gains from

efficiency and cost save initiatives. We expect quarterly total

expenses to decline over the rest of 2012, driven by the benefit

from ongoing efficiency initiatives and the conclusion of

integration activities. However, quarterly expenses may vary due

to cyclical or seasonal factors, among others. In addition, we will

continue to invest in our businesses and add team members

where appropriate.

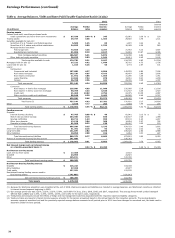

Financial Performance

Our 2011 results were strong despite continued economic

volatility during the year, with improved credit quality and lower

expenses as well as solid growth in deposits and capital, which

funded growth in loans and investment securities. Regulatory

reform and related initiatives also created a difficult

environment in which to achieve strong financial performance.

For example, changes mandated by Regulation E and related

overdraft policy changes implemented in third quarter 2010

decreased our service charges on deposit accounts. Also,

implementation of the Durbin Amendment to the Dodd-Frank

Act in fourth quarter 2011 reduced debit interchange fees and

the mortgage servicing regulatory consent orders that we

entered into with our regulators in April 2011 and other

regulatory activities contributed to lowered residential mortgage

26