Wells Fargo 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

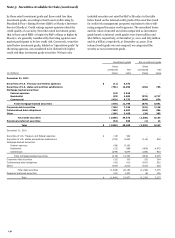

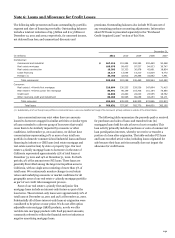

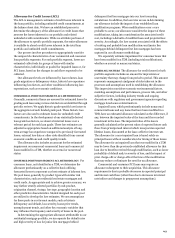

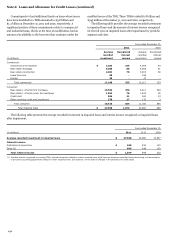

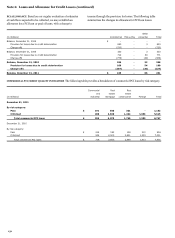

Note 6: Loans and Allowance for Credit Losses (continued)

Commercial

Real

Real

and

estate

estate

Lease

(in millions)

industrial

mortgage

construction

financing

Foreign

Total

December 31, 2011

By risk category:

Pass

$

144,980

80,215

10,865

12,455

36,567

285,082

Criticized

21,837

22,490

6,772

662

1,840

53,601

Total commercial loans (excluding PCI)

166,817

102,705

17,637

13,117

38,407

338,683

Total commercial PCI loans (carrying value)

399

3,270

1,745

-

1,353

6,767

Total commercial loans

$

167,216

105,975

19,382

13,117

39,760

345,450

December 31, 2010

By risk category:

Pass

$

126,058

70,597

11,256

12,411

30,341

250,663

Criticized

24,508

25,983

11,128

683

1,158

63,460

Total commercial loans (excluding PCI)

150,566

96,580

22,384

13,094

31,499

314,123

Total commercial PCI loans (carrying value)

718

2,855

2,949

-

1,413

7,935

Total commercial loans

$

151,284

99,435

25,333

13,094

32,912

322,058

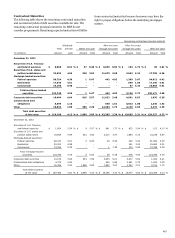

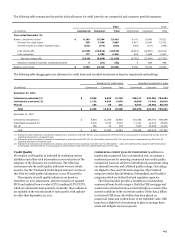

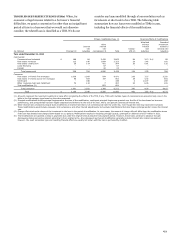

The following table provides past due information for

commercial loans, which we monitor as part of our credit risk

management practices.

Commercial

Real

Real

and

estate

estate

Lease

(in millions)

industrial

mortgage

construction

financing

Foreign

Total

December 31, 2011

By delinquency status:

Current-29 DPD and still accruing

$

163,583

97,410

15,471

12,934

38,122

327,520

30-89 DPD and still accruing

939

954

187

130

232

2,442

90+ DPD and still accruing

153

256

89

-

6

504

Nonaccrual loans

2,142

4,085

1,890

53

47

8,217

Total commercial loans (excluding PCI)

166,817

102,705

17,637

13,117

38,407

338,683

Total commercial PCI loans (carrying value)

399

3,270

1,745

-

1,353

6,767

Total commercial loans

$

167,216

105,975

19,382

13,117

39,760

345,450

December 31, 2010

By delinquency status:

Current-29 DPD and still accruing

$

146,135

90,233

19,005

12,927

31,350

299,650

30-89 DPD and still accruing

910

1,016

510

59

-

2,495

90+ DPD and still accruing

308

104

193

-

22

627

Nonaccrual loans

3,213

5,227

2,676

108

127

11,351

Total commercial loans (excluding PCI)

150,566

96,580

22,384

13,094

31,499

314,123

Total commercial PCI loans (carrying value)

718

2,855

2,949

-

1,413

7,935

Total commercial loans

$

151,284

99,435

25,333

13,094

32,912

322,058

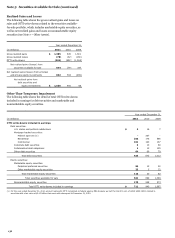

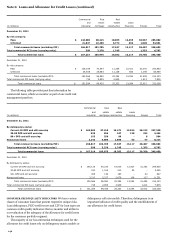

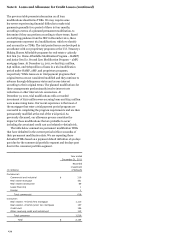

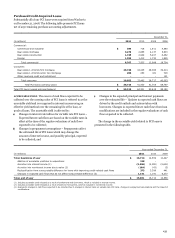

CONSUMER CREDIT QUALITY INDICATORS

We have various

classes of consumer loans that present respective unique risks.

Loan delinquency, FICO credit scores and LTV for loan types are

common credit quality indicators that we monitor and utilize in

our evaluation of the adequacy of the allowance for credit losses

for the consumer portfolio segment.

The majority of our loss estimation techniques used for the

allowance for credit losses rely on delinquency matrix models or

delinquency roll rate models. Therefore, delinquency is an

important indicator of credit quality and the establishment of

our allowance for credit losses.

146