Wells Fargo 2011 Annual Report Download - page 194

Download and view the complete annual report

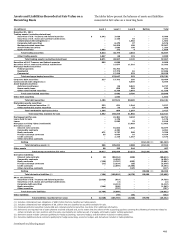

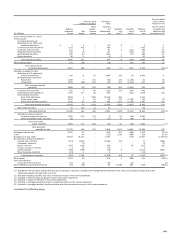

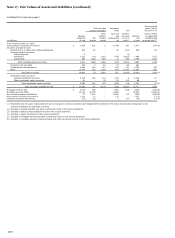

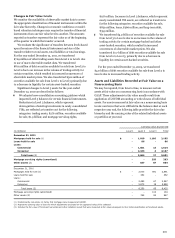

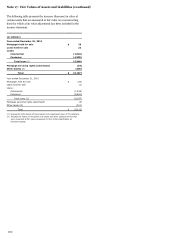

Please find page 194 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 17: Fair Values of Assets and Liabilities (continued)

municipal bonds, U.S. government and agency MBS, and

corporate debt securities.

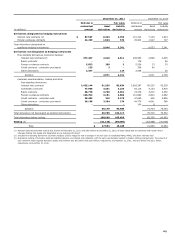

Security fair value measurements using significant inputs

that are unobservable in the market due to limited activity or a

less liquid market are classified as Level 3 in the fair value

hierarchy. Such measurements include securities valued using

internal models or a combination of multiple valuation

techniques such as weighting of internal models and vendor or

broker pricing, where the unobservable inputs are significant to

the overall fair value measurement. Securities classified as Level

3 include certain residential and commercial MBS, asset-backed

securities collateralized by auto leases or loans and cash

reserves, CDOs and CLOs, and certain residual and retained

interests in residential mortgage loan securitizations. CDOs are

valued using the prices of similar instruments, the pricing of

completed or pending third party transactions or the pricing of

the underlying collateral within the CDO. Where vendor or

broker prices are not readily available, management's best

estimate is used.

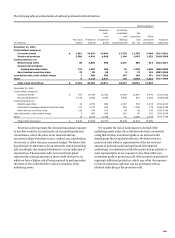

MORTGAGES HELD FOR SALE (MHFS)

We carry substantially all

of our residential MHFS portfolio at fair value. Fair value is

based on independent quoted market prices, where available, or

the prices for other mortgage whole loans with similar

characteristics. As necessary, these prices are adjusted for typical

securitization activities, including servicing value, portfolio

composition, market conditions and liquidity. Most of our MHFS

are classified as Level 2. For the portion where market pricing

data is not available, we use a discounted cash flow model to

estimate fair value and, accordingly, classify as Level 3.

LOANS HELD FOR SALE (LHFS)

LHFS are carried at the lower of

cost or market value, or at fair value. The fair value of LHFS is

based on what secondary markets are currently offering for

portfolios with similar characteristics. As such, we classify those

loans subjected to nonrecurring fair value adjustments as

Level 2.

LOANS

For the carrying value of loans, including PCI loans, see

Note 1. Although most loans are not recorded at fair value on a

recurring basis, reverse mortgages, which were previously sold

under a GNMA securitization program and were consolidated

during fourth quarter 2011, are held at fair value on a recurring

basis. In addition, we record nonrecurring fair value adjustments

to loans to reflect partial write-downs that are based on the

observable market price of the loan or current appraised value of

the collateral.

We provide fair value estimates in this disclosure for loans

that are not recorded at fair value on a recurring or nonrecurring

basis. Those estimates differentiate loans based on their

financial characteristics, such as product classification, loan

category, pricing features and remaining maturity. Prepayment

and credit loss estimates are evaluated by product and loan rate.

The fair value of commercial loans is calculated by

discounting contractual cash flows, adjusted for credit loss

estimates, using discount rates that reflect our current pricing

for loans with similar characteristics and remaining maturity.

For real estate 1-4 family first and junior lien mortgages, fair

value is calculated by discounting contractual cash flows,

adjusted for prepayment and credit loss estimates, using

discount rates based on current industry pricing (where readily

available) or our own estimate of an appropriate risk-adjusted

discount rate for loans of similar size, type, remaining maturity

and repricing characteristics.

The carrying value of credit card loans, which is adjusted for

estimates of credit losses inherent in the portfolio at the balance

sheet date, is reported as a reasonable estimate of fair value.

For all other consumer loans, the fair value is generally

calculated by discounting the contractual cash flows, adjusted

for prepayment and credit loss estimates, based on the current

rates we offer for loans with similar characteristics.

Loan commitments, standby letters of credit and commercial

and similar letters of credit generate ongoing fees at our current

pricing levels, which are recognized over the term of the

commitment period. In situations where the credit quality of the

counterparty to a commitment has declined, we record an

allowance. A reasonable estimate of the fair value of these

instruments is the carrying value of deferred fees plus the related

allowance. Certain letters of credit that are hedged with

derivative instruments are carried at fair value in trading assets

or liabilities. For those letters of credit fair value is calculated

based on readily quotable credit default spreads, using a market

risk credit default swap model.

DERIVATIVES

Quoted market prices are available and used for

our exchange-traded derivatives, such as certain interest rate

futures and option contracts, which we classify as Level 1.

However, substantially all of our derivatives are traded in over-

the-counter (OTC) markets where quoted market prices are not

always readily available. Therefore we value most OTC

derivatives using internal valuation techniques. Valuation

techniques and inputs to internally-developed models depend on

the type of derivative and nature of the underlying rate, price or

index upon which the derivative's value is based. Key inputs can

include yield curves, credit curves, foreign-exchange rates,

prepayment rates, volatility measurements and correlation of

such inputs. Where model inputs can be observed in a liquid

market and the model does not require significant judgment,

such derivatives are typically classified as Level 2 of the fair

value hierarchy. Examples of derivatives classified as Level 2

include generic interest rate swaps, foreign currency swaps,

commodity swaps, and certain option and forward contracts.

When instruments are traded in less liquid markets and

significant inputs are unobservable, such derivatives are

classified as Level 3. Examples of derivatives classified as Level 3

include complex and highly structured derivatives, certain credit

default swaps, interest rate lock commitments written for our

residential mortgage loans that we intend to sell and long dated

equity options where volatility is not observable. Additionally,

significant judgments are required when classifying financial

instruments within the fair value hierarchy, particularly between

Level 2 and 3, as is the case for certain derivatives.

192