Wells Fargo 2011 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

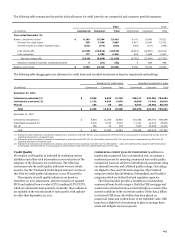

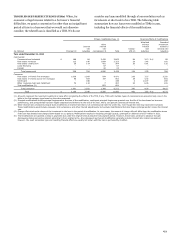

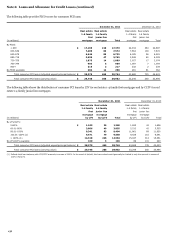

Purchased Credit-Impaired Loans

Substantially all of our PCI loans were acquired from Wachovia

on December 31, 2008. The following table presents PCI loans

net of any remaining purchase accounting adjustments.

December 31,

(in millions)

2011

2010

2009

2008

Commercial:

Commercial and industrial

$

399

718

1,911

4,580

Real estate mortgage

3,270

2,855

4,137

5,803

Real estate construction

1,745

2,949

5,207

6,462

Foreign

1,353

1,413

1,733

1,859

Total commercial

6,767

7,935

12,988

18,704

Consumer:

Real estate 1-4 family first mortgage

29,746

33,245

38,386

39,214

Real estate 1-4 family junior lien mortgage

206

250

331

728

Other revolving credit and installment

-

-

-

151

Total consumer

29,952

33,495

38,717

40,093

Total PCI loans (carrying value)

$

36,719

41,430

51,705

58,797

Total PCI loans (unpaid principal balance)

$

55,312

64,331

83,615

98,182

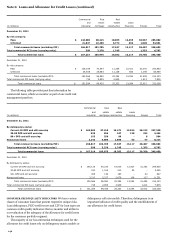

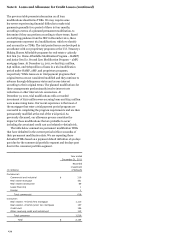

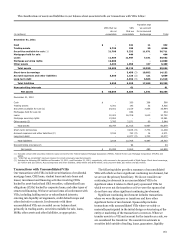

ACCRETABLE YIELD

The excess of cash flows expected to be

collected over the carrying value of PCI loans is referred to as the

accretable yield and is recognized in interest income using an

effective yield method over the remaining life of the loan, or

pools of loans. The accretable yield is affected by:

Changes in interest rate indices for variable rate PCI loans –

Expected future cash flows are based on the variable rates in

effect at the time of the regular evaluations of cash flows

expected to be collected;

Changes in prepayment assumptions – Prepayments affect

the estimated life of PCI loans which may change the

amount of interest income, and possibly principal, expected

to be collected; and

Changes in the expected principal and interest payments

over the estimated life – Updates to expected cash flows are

driven by the credit outlook and actions taken with

borrowers. Changes in expected future cash flows from loan

modifications are included in the regular evaluations of cash

flows expected to be collected.

The change in the accretable yield related to PCI loans is

presented in the following table.

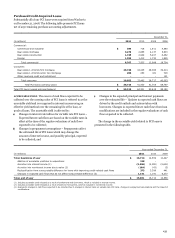

Year ended December 31,

(in millions)

2011

2010

2009

Total, beginning of year

$

16,714

14,559

10,447

Addition of accretable yield due to acquisitions

128

-

-

Accretion into interest income (1)

(2,206)

(2,392)

(2,601)

Accretion into noninterest income due to sales (2)

(189)

(43)

(5)

Reclassification from nonaccretable difference for loans with improving credit-related cash flows

373

3,399

441

Changes in expected cash flows that do not affect nonaccretable difference (3)

1,141

1,191

6,277

Total, end of year

$

15,961

16,714

14,559

(1) Includes accretable yield released as a result of settlements with borrowers, which is included in interest income.

(2) Includes accretable yield released as a result of sales to third parties, which is included in noninterest income.

(3) Represents changes in cash flows expected to be collected due to changes in interest rates on variable rate PCI loans, changes in prepayment assumptions and the impact of

modifications.

155