Wells Fargo 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

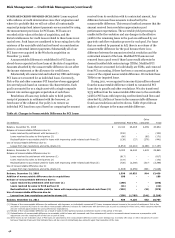

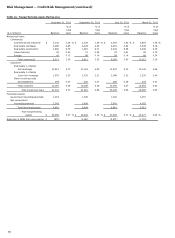

COMMERCIAL AND INDUSTRIAL LOANS AND LEASE

FINANCING

For purposes of portfolio risk management, we

aggregate commercial and industrial loans and lease financing

according to market segmentation and standard industry

codes. Table 21 summarizes commercial and industrial loans and

lease financing by industry with the related nonaccrual totals.

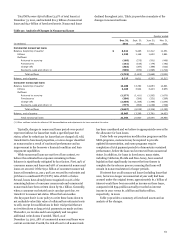

Across our non-PCI commercial loans and leases, the

commercial and industrial loans and lease financing portfolio

generally experienced better credit improvement than our CRE

portfolios in 2011. Of the total commercial and industrial loans

and lease financing non-PCI portfolio, 0.09% was 90 days or

more past due and still accruing, 1.22% was nonaccruing and

12.5% was criticized. In comparison, of the total non-PCI CRE

portfolio, 0.29% was 90 days or more past due and still accruing,

4.97% was nonaccruing and 24.3% was criticized. Also, the net

charge-off rate for both portfolios declined in 2011 from 2010.

We believe the commercial and industrial loans and lease

financing portfolio is well underwritten and is diverse in its risk

with relatively level concentrations across several industries. Our

credit risk management process for this portfolio primarily

focuses on a customer’s ability to repay the loan through their

cash flow.

A majority of our commercial and industrial loans and lease

financing portfolio is secured by short-term liquid assets, such as

accounts receivable, inventory and securities, as well as long-

lived assets, such as equipment and other business assets.

Generally, the collateral securing this portfolio represents a

secondary source of repayment. See Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report for more analysis and credit metric information.

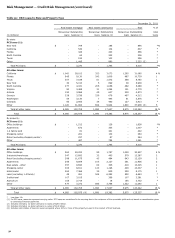

Table 21: Commercial and Industrial Loans and Lease

Financing by Industry

December 31, 2011

% of

Nonaccrual

Outstanding

total

(in millions)

loans

balance (1)

loans

PCI loans (1):

Technology

$

-

65

*

%

Investors

-

49

*

Healthcare

-

39

*

Insurance

-

38

*

Aerospace and defense

-

36

*

Residential construction

-

26

*

Other

-

146

(2)

*

Total PCI loans

$

-

399

*

%

All other loans:

Financial institutions

$

146

13,597

2

%

Cyclical retailers

41

10,364

1

Oil and gas

89

10,198

1

Food and beverage

36

10,150

1

Healthcare

78

8,419

1

Investors

2

8,407

1

Industrial equipment

97

7,365

*

Technology

66

6,404

*

Business services

42

6,377

*

Transportation

17

6,260

*

Real estate lessor

44

6,067

*

Utilities

1

5,357

*

Other

1,536

80,969

(3)

11

Total all other loans

$

2,195

179,934

23

%

Total

$

2,195

180,333

23

%

* Less than 1%.

(1) For PCI loans, amounts represent carrying value. PCI loans are considered to be

accruing due to the existence of the accretable yield and not based on

consideration given to contractual interest payments.

(2) No other single category had loans in excess of $24 million.

(3) No other single category had loans in excess of $4.9 billion.

51