Wells Fargo 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Performance (continued)

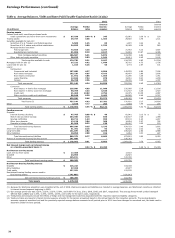

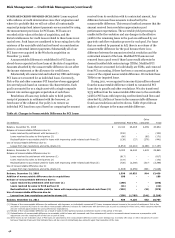

Net gains on mortgage loan origination/sales activities

include the cost of any additions to the mortgage repurchase

liability. Mortgage loans are repurchased from third parties

based on standard representations and warranties, and early

payment default clauses in mortgage sale contracts. Additions to

the mortgage repurchase liability that were charged against net

gains on mortgage loan origination/sales activities during 2011

totaled $1.3 billion (compared with $1.6 billion for 2010), of

which $1.2 billion ($1.5 billion for 2010) was for subsequent

increases in estimated losses on prior year’s loan sales. For

additional information about mortgage loan repurchases, see the

“Risk Management – Credit Risk Management – Liability for

Mortgage Loan Repurchase Losses” section and Note 9

(Mortgage Banking Activities) to Financial Statements in this

Report.

Net gains from trading activities, which reflect unrealized

changes in fair value of our trading positions and realized gains

and losses, were $1.0 billion in 2011 and $1.6 billion in 2010.

The year-over-year decrease was driven by challenging market

conditions, including sovereign debt concerns, which pressured

credit spreads, reduced prices on financial assets and limited

new issue origination and trading opportunities. The decline also

reflects a loss of $377 million in 2011 relating to our resolution of

a legacy Wachovia position. Net gains from trading activities do

not include interest income and other fees earned from related

activities. Those amounts are reported within interest income

from trading assets and other noninterest income, respectively,

in the income statement. Net gains from trading activities are

primarily from trading conducted on behalf of or driven by the

needs of our customers (customer accommodation trading) and

also include the results of certain economic hedging and

proprietary trading activity. Net gains (losses) from proprietary

trading were a $14 million net loss in 2011 and a $22 million net

gain in 2010. Proprietary trading results also included interest

and fees reported in their corresponding income statement line

items. Proprietary trading activities are not significant to our

client-focused business model. Our trading activities, customer

accommodation, economic hedging and proprietary trading are

further discussed in the “Asset/Liability Management – Market

Risk – Trading Activities” section in this Report.

Net gains on debt and equity securities totaled $1.5 billion for

2011 and $455 million for 2010, after other-than-temporary

impairment (OTTI) write downs of $711 million for 2011 and

$940 million for 2010. Included in net gains on debt and equity

securities for 2011 was a $271 million gain related to a legacy

Wachovia position, due to redemption of our interest in an

investment fund. Other income in 2011 also included a

$153 million gain on the sale of our H.D. Vest Financial Services

business.

38