Wells Fargo 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

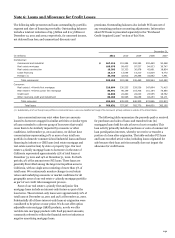

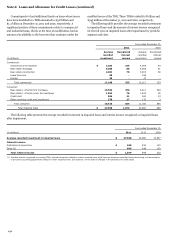

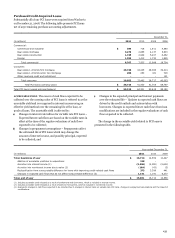

|

|

December 31, 2011

December 31, 2010 (1)

Real estate

Real estate

Real estate

Real estate

1-4 family

1-4 family

1-4 family

1-4 family

first

junior lien

first

junior lien

mortgage

mortgage

mortgage

mortgage

(in millions)

by LTV

by CLTV

Total

by LTV

by CLTV

Total

By LTV/CLTV:

0-60%

$

46,476

12,694

59,170

47,808

14,814

62,622

60.01-80%

46,831

15,722

62,553

42,542

17,744

60,286

80.01-100%

36,764

20,290

57,054

39,497

24,255

63,752

100.01-120% (2)

21,116

15,829

36,945

24,147

17,887

42,034

> 120% (2)

18,608

18,626

37,234

24,243

18,628

42,871

No LTV/CLTV available

2,798

2,624

5,422

3,239

2,571

5,810

Government insured/guaranteed loans (3)

26,555

-

26,555

15,514

-

15,514

Total consumer loans (excluding PCI)

199,148

85,785

284,933

196,990

95,899

292,889

Total consumer PCI loans (carrying value)

29,746

206

29,952

33,245

250

33,495

Total consumer loans

$

228,894

85,991

314,885

230,235

96,149

326,384

(1) Amounts at December 31, 2010, have been revised to conform to the current separate presentation of government insured/guaranteed loans.

(2) Reflects total loan balances with LTV/CLTV amounts in excess of 100%. In the event of default, the loss content would generally be limited to only the amount in excess of

100% LTV/CLTV.

(3) Represents loans whose repayments are insured by the FHA or guaranteed by the VA. In 2011, we consolidated $5.6 billion of previously sold FHA insured real estate 1-4

family reverse mortgages.

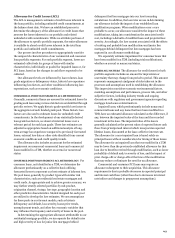

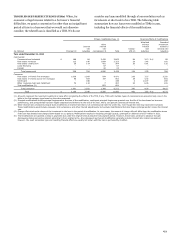

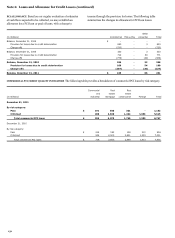

NONACCRUAL LOANS

The following table provides loans on

nonaccrual status. PCI loans are excluded from this table due to

the existence of the accretable yield.

December 31,

(in millions)

2011

2010

Commercial:

Commercial and industrial

$

2,142

3,213

Real estate mortgage

4,085

5,227

Real estate construction

1,890

2,676

Lease financing

53

108

Foreign

47

127

Total commercial (1)

8,217

11,351

Consumer:

Real estate 1-4 family first mortgage (2)

10,913

12,289

Real estate 1-4 family junior lien mortgage

1,975

2,302

Other revolving credit and installment

199

300

Total consumer

13,087

14,891

Total nonaccrual loans

(excluding PCI)

$

21,304

26,242

(1) Includes LHFS of $25 million and $3 million at December 31, 2011 and 2010,

respectively.

(2) Includes MHFS of $301 million and $426 million at December 31, 2011 and

2010, respectively.

149