Wells Fargo 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

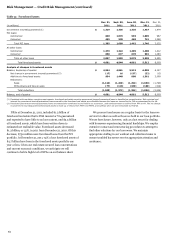

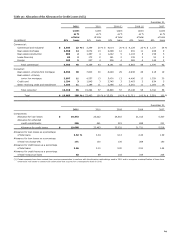

Risk Management — Credit Risk Management (continued)

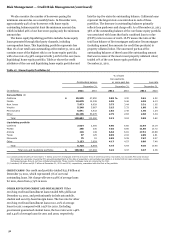

Table 31: Foreclosed Assets

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

(in millions)

2011

2011

2011

2011

2010

Government insured/guaranteed (1)

$

1,319

1,336

1,320

1,457

1,479

PCI loans:

Commercial

840

1,079

993

1,005

967

Consumer

465

530

469

741

1,068

Total PCI loans

1,305

1,609

1,462

1,746

2,035

All other loans:

Commercial

1,379

1,322

1,409

1,408

1,412

Consumer

658

677

670

901

1,083

Total all other loans

2,037

1,999

2,079

2,309

2,495

Total foreclosed assets

$

4,661

4,944

4,861

5,512

6,009

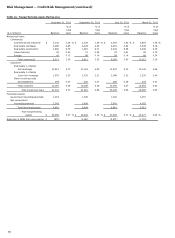

Analysis of changes in foreclosed assets

Balance, beginning of quarter

$

4,944

4,861

5,512

6,009

6,127

Net change in government insured/guaranteed (2)

(17)

16

(137)

(22)

(13)

Additions to foreclosed assets

934

1,440

880

1,361

2,099

Reductions:

Sales

(1,123)

(1,260)

(1,294)

(1,656)

(1,790)

Write-downs and loss on sales

(77)

(113)

(100)

(180)

(414)

Total reductions

(1,200)

(1,373)

(1,394)

(1,836)

(2,204)

Balance, end of quarter

$

4,661

4,944

4,861

5,512

6,009

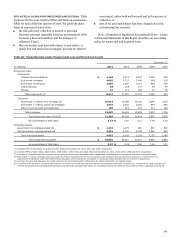

(1)

Consistent with regulatory reporting requirements, foreclosed real estate securing government insured/guaranteed loans is classified as nonperforming. Both principal and

interest for government insured/guaranteed loans secured by the foreclosed real estate are collectible because the loans are insured by the FHA or guaranteed by the VA.

(2)

Foreclosed government insured/guaranteed loans are temporarily transferred to and held by us as servicer, until reimbursement is received from FHA or VA. The net change

in government insured/guaranteed foreclosed assets is made up of inflows from MHFI and MHFS, and outflows when we are reimbursed by FHA/VA.

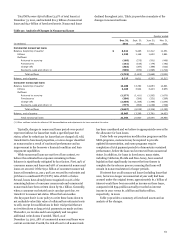

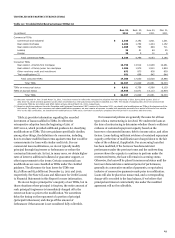

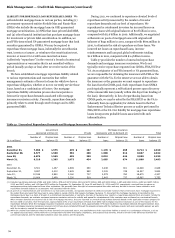

NPAs at December 31, 2011, included $1.3 billion of

foreclosed real estate that is FHA insured or VA guaranteed

and expected to have little to no loss content, and $3.3 billion

of foreclosed assets, which have been written down to

estimated net realizable value. Foreclosed assets decreased

$1.3 billion, or 22%, in 2011 from December 31, 2010. Of this

decrease, $730 million were foreclosed loans from the PCI

portfolio. At December 31, 2011, 74% of our foreclosed assets of

$4.7 billion have been in the foreclosed assets portfolio one

year or less. Given our real estate-secured loan concentrations

and current economic conditions, we anticipate we will

continue to hold a high level of NPAs on our balance sheet.

We process foreclosures on a regular basis for the loans we

service for others as well as those we hold in our loan portfolio.

We use foreclosure, however, only as a last resort for dealing

with borrowers experiencing financial hardships. We employ

extensive contact and restructuring procedures to attempt to

find other solutions for our borrowers. We maintain

appropriate staffing in our workout and collection teams to

ensure troubled borrowers receive appropriate attention and

assistance.

62