Wells Fargo 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

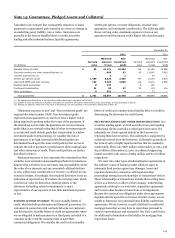

Note 15: Legal Actions (continued)

Wells Fargo and the plaintiffs agreed to settle the In re

Wachovia Preferred Securities and Bond/Notes Litigation for

$590 million. The proposed settlement was preliminarily

approved by the Court on August 9, 2011. The hearing on final

approval was held on November 14, 2011, and a judgment

approving class action settlements was filed on January 3, 2012.

There are a number of other similar actions filed in state

courts in North Carolina and South Carolina by individual

shareholders. Two of the individual shareholder actions in South

Carolina have been dismissed and the shareholders have

appealed. On December 22, 2011, the dismissal of the Rivers v.

Wachovia Corporation, et al. case, one of the two South

Carolina actions, was affirmed by the U.S. Court of Appeals for

the Fourth Circuit.

OUTLOOK

When establishing a liability for contingent litigation

losses, the Company determines a range of potential losses for

each matter that is both probable and estimable, and records the

amount it considers to be the best estimate within the range.

The high end of the range of reasonably possible potential

litigation losses in excess of the Company’s liability for probable

and estimable losses was $1.2 billion as of December 31, 2011.

For these matters and others where an unfavorable outcome is

reasonably possible but not probable, there may be a range of

possible losses in excess of the established liability that cannot

be estimated. Based on information currently available, advice of

counsel, available insurance coverage and established reserves,

Wells Fargo believes that the eventual outcome of the actions

against Wells Fargo and/or its subsidiaries, including the

matters described above, will not, individually or in the

aggregate, have a material adverse effect on Wells Fargo’s

consolidated financial position. However, in the event of

unexpected future developments, it is possible that the ultimate

resolution of those matters, if unfavorable, may be material to

Wells Fargo’s results of operations for any particular period.

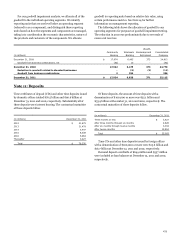

Note 16: Derivatives

We use derivatives to manage exposure to market risk, interest

rate risk, credit risk and foreign currency risk, to generate profits

from proprietary trading and to assist customers with their risk

management objectives. Derivative transactions are measured in

terms of the notional amount, but this amount is not recorded

on the balance sheet and is not, when viewed in isolation, a

meaningful measure of the risk profile of the instruments. The

notional amount is generally not exchanged, but is used only as

the basis on which interest and other payments are determined.

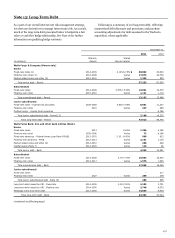

Our asset/liability management approach to interest rate,

foreign currency and certain other risks includes the use of

derivatives. Such derivatives are typically designated as fair

value or cash flow hedges, or economic hedge derivatives for

those that do not qualify for hedge accounting. This helps

minimize significant, unplanned fluctuations in earnings, fair

values of assets and liabilities, and cash flows caused by interest

rate, foreign currency and other market value volatility. This

approach involves modifying the repricing characteristics of

certain assets and liabilities so that changes in interest rates,

foreign currency and other exposures do not have a significantly

adverse effect on the net interest margin, cash flows and

earnings. As a result of fluctuations in these exposures, hedged

assets and liabilities will gain or lose market value. In a fair value

or economic hedge, the effect of this unrealized gain or loss will

generally be offset by the gain or loss on the derivatives linked to

the hedged assets and liabilities. In a cash flow hedge, where we

manage the variability of cash payments due to interest rate

fluctuations by the effective use of derivatives linked to hedged

assets and liabilities, the unrealized gain or loss on the

derivatives or the hedged asset or liability is generally not

reflected in earnings.

We also offer various derivatives, including interest rate,

commodity, equity, credit and foreign exchange contracts, to our

customers but usually offset our exposure from such contracts by

purchasing other financial contracts. The customer

accommodations and any offsetting financial contracts are

treated as free-standing derivatives. Free-standing derivatives

also include derivatives we enter into for risk management that

do not otherwise qualify for hedge accounting, including

economic hedge derivatives. To a lesser extent, we take positions

based on market expectations or to benefit from price

differentials between financial instruments and markets.

Additionally, free-standing derivatives include embedded

derivatives that are required to be accounted for separately from

their host contracts.

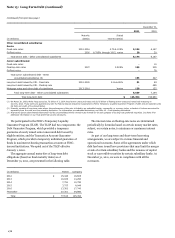

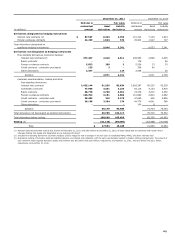

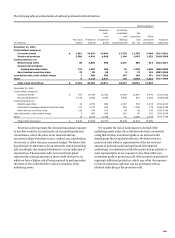

The following table presents the total notional or contractual

amounts and fair values for derivatives designated as qualifying

hedge contracts, which are used as asset/liability management

hedges, and free-standing derivatives (economic hedges) not

designated as hedging instruments that are recorded on the

balance sheet in other assets or other liabilities. Customer

accommodation, trading and other free-standing derivatives are

recorded on the balance sheet at fair value in trading assets or

other liabilities.

184