Wells Fargo 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

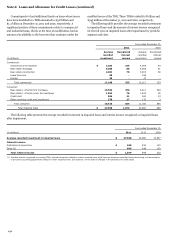

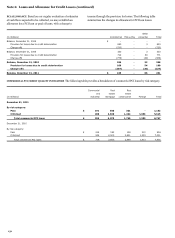

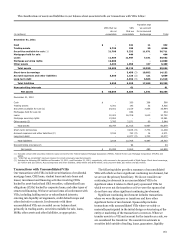

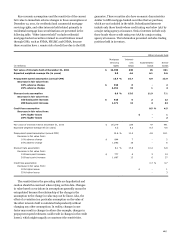

The classifications of assets and liabilities in our balance sheet associated with our transactions with VIEs follow:

Transfers that

VIEs that we

VIEs

we account

do not

that we

for as secured

(in millions)

consolidate

consolidate

borrowings

Total

December 31, 2011

Cash

$

-

321

11

332

Trading assets

3,723

293

30

4,046

Securities available for sale (1)

21,708

3,332

11,671

36,711

Mortgages held for sale

-

444

-

444

Loans

11,404

11,967

7,181

30,552

Mortgage servicing rights

12,080

-

-

12,080

Other assets

4,494

1,858

137

6,489

Total assets

53,409

18,215

19,030

90,654

Short-term borrowings

-

3,450

(3)

10,682

14,132

Accrued expenses and other liabilities

3,350

1,138

(3)

121

4,609

Long-term debt

-

4,932

(3)

6,686

11,618

Total liabilities

3,350

9,520

17,489

30,359

Noncontrolling interests

-

61

-

61

Net assets

$

50,059

8,634

1,541

60,234

December 31, 2010

Cash

$

-

200

398

598

Trading assets

5,351

143

32

5,526

Securities available for sale (1)

24,001

2,159

7,834

33,994

Mortgages held for sale (2)

-

634

-

634

Loans

12,401

16,708

1,613

30,722

Mortgage servicing rights

13,261

-

-

13,261

Other assets (2)

3,783

2,071

90

5,944

Total assets

58,797

21,915

9,967

90,679

Short-term borrowings

-

3,636

(3)

7,773

11,409

Accrued expenses and other liabilities (2)

3,514

743

(3)

14

4,271

Long-term debt

-

8,377

(3)

1,700

10,077

Total liabilities

3,514

12,756

9,487

25,757

Noncontrolling interests (2)

-

94

-

94

Net assets

$

55,283

9,065

480

64,828

(1) Excludes certain debt securities related to loans serviced for the Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC) and

GNMA.

(2) “VIEs that we consolidate” has been revised to correct previously reported amounts.

(3) Includes the following VIE liabilities at December 31, 2011, and December 31, 2010, respectively, with recourse to the general credit of Wells Fargo: Short-term borrowings,

$3.4 billion and $3.6 billion; Accrued expenses and other liabilities, $963 million and $645 million; and Long-term debt, $30 million and $53 million.

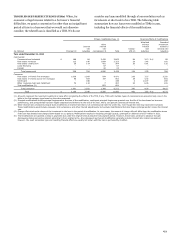

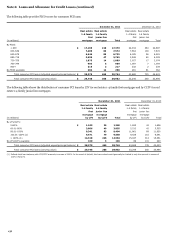

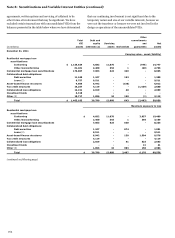

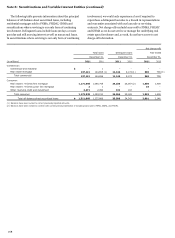

Transactions with Unconsolidated VIEs

Our transactions with VIEs include securitizations of residential

mortgage loans, CRE loans, student loans and auto loans and

leases; investment and financing activities involving CDOs

backed by asset-backed and CRE securities, collateralized loan

obligations (CLOs) backed by corporate loans, and other types of

structured financing. We have various forms of involvement with

VIEs, including holding senior or subordinated interests,

entering into liquidity arrangements, credit default swaps and

other derivative contracts. Involvements with these

unconsolidated VIEs are recorded on our balance sheet

primarily in trading assets, securities available for sale, loans,

MSRs, other assets and other liabilities, as appropriate.

The following tables provide a summary of unconsolidated

VIEs with which we have significant continuing involvement, but

we are not the primary beneficiary. We do not consider our

continuing involvement in an unconsolidated VIE to be

significant when it relates to third-party sponsored VIEs for

which we were not the transferor or if we were the sponsor but

do not have any other significant continuing involvement.

Significant continuing involvement includes transactions

where we were the sponsor or transferor and have other

significant forms of involvement. Sponsorship includes

transactions with unconsolidated VIEs where we solely or

materially participated in the initial design or structuring of the

entity or marketing of the transaction to investors. When we

transfer assets to a VIE and account for the transfer as a sale, we

are considered the transferor. We consider investments in

securities held outside of trading, loans, guarantees, liquidity

161